ING Germany Broadens Digital Asset Investment Options Through Bitwise and VanEck Partnership

German banking division of ING Group introduces new cryptocurrency investment products from Bitwise and VanEck, offering exposure to Bitcoin, Ether, Solana, XRP and additional leading cryptocurrencies.

The German retail banking division of the Dutch multinational banking institution ING Group is broadening its cryptocurrency investment offerings by establishing new collaborative agreements with American asset management firms Bitwise and VanEck.

On Monday, both companies made separate announcements regarding the German bank's introduction of cryptocurrency exchange-traded products (ETPs) provided by Bitwise alongside crypto exchange-traded notes (ETNs) offered by VanEck.

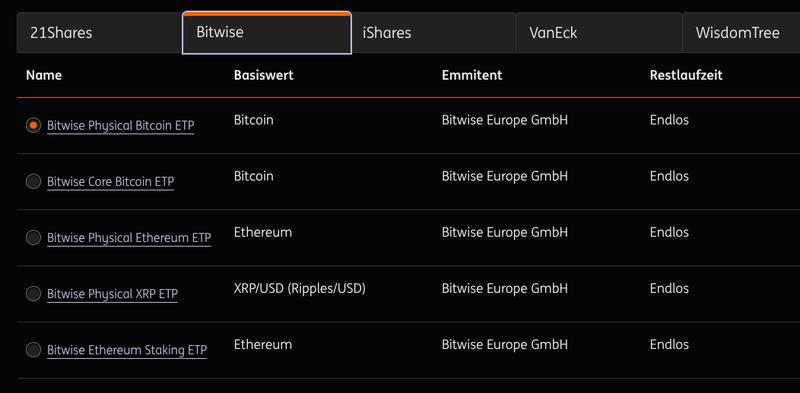

These latest product offerings will complement the existing ING-listed investment instruments from providers including 21Shares, WisdomTree and BlackRock's iShares division.

These product launches arrive during a period of cryptocurrency market challenges, with Bitcoin (BTC) experiencing a 10% decline year-to-date, demonstrating traditional financial institution adoption despite ongoing market volatility.

Latest Product Lineup Encompasses Bitcoin, Ether, Solana, XRP and Additional Assets

Beginning in February, customers of ING Germany will gain access to trade Bitwise cryptocurrency ETPs with minimum order quantities of 1,000 euros ($1,180) without incurring execution fees, whereas orders below this threshold will incur a commission of 3.90 euros ($4.60), Bitwise stated.

"These products are additionally available for savings plan utilization without execution fees," the company stated, emphasizing that this partnership demonstrates both organizations' sustained dedication to digital asset investment opportunities.

Although this promotional initiative encompasses the complete Bitwise product portfolio available on the Deutsche Börse Group's Xetra trading platform, the offering emphasizes three primary products: the Bitwise Core Bitcoin ETP (BTC1), the Bitwise MSCI Digital Assets Select 20 ETP (DA20) and the Bitwise Physical Ethereum ETP (ZETH).

The cryptocurrency ETNs from VanEck that are now listed on ING comprise 10 securities providing exposure to Bitcoin, Ether (ETH), Algorand (ALGO), Avalanche (AVAX), Chainlink (LINK), Polkadot (DOT), Polygon (POL), Solana (SOL), in addition to two basket ETNs.

Exchange-traded products represent a comprehensive category of securities that track underlying assets, whereas exchange-traded notes constitute a particular variety of ETP designed as unsecured debt securities. Similar to exchange-traded funds (ETFs), ETPs maintain holdings of physical assets, while ETNs do not possess such holdings, instead providing returns that correspond to an index.

Cryptocurrency ETPs worldwide have experienced a challenging beginning to 2026, recording losses of $3.43 billion throughout the previous two weeks and registering $1 billion in year-to-date outflows, based on data from CoinShares. Following the recent market downturn, Bitcoin ETFs experienced a Monday rebound, capturing $562 million in inflows, as reported by SoSoValue.