Grayscale: Bitcoin Behaves More Like Tech Stocks Than Safe-Haven Gold

Recent Grayscale analysis reveals Bitcoin's market movements are becoming more closely aligned with equity markets, especially software companies, undermining its traditional digital safe-haven status in the near term.

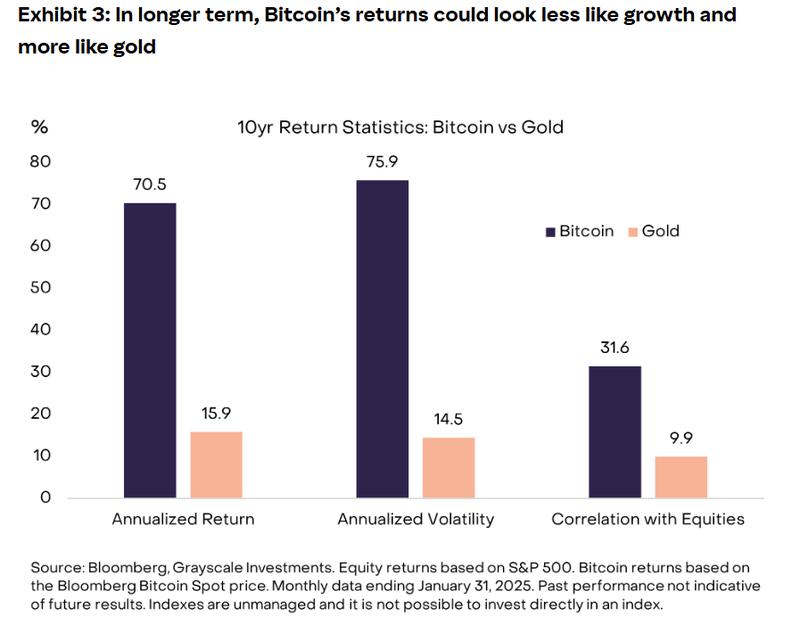

The widely accepted characterization of Bitcoin as "digital gold" faces increasing scrutiny as the cryptocurrency's latest market movements bear greater resemblance to volatile growth equities than to conventional safe-haven assets, new Grayscale research indicates.

In a Tuesday report, author Zach Pandl acknowledged that Grayscale maintains its conviction in Bitcoin (BTC) as a store of value over extended time horizons, citing its capped supply and separation from central bank control, yet current market dynamics tell a different story.

"Bitcoin's short-term price movements have not been tightly correlated with gold or other precious metals," Pandl wrote, pointing to record rallies in bullion and silver prices.

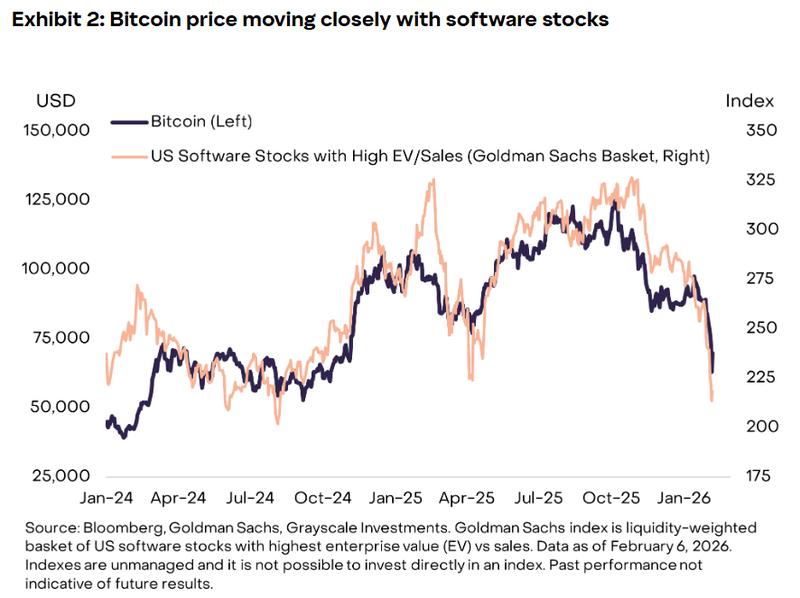

Rather, the research identified a pronounced correlation between Bitcoin and software equities that has strengthened notably from early 2024 onward. This sector has faced substantial downward pressure recently as market participants grapple with concerns surrounding artificial intelligence potentially disrupting or making various software services redundant.

According to the analysis, Bitcoin's increased responsiveness to equity markets and growth-oriented assets signals its more thorough incorporation into mainstream financial systems, propelled partly by institutional investor involvement, exchange-traded fund dynamics and evolving macroeconomic risk perceptions.

This transformation occurs against the backdrop of Bitcoin suffering approximately a 50% decline from its October high exceeding $126,000. The downward trajectory materialized across multiple phases, commencing with an unprecedented October 2025 liquidation episode, continuing through additional selling pressure in late November and resurfacing in late January 2026. Grayscale additionally highlighted "motivated US sellers" during recent periods, referencing ongoing price markdowns observable on Coinbase.

Part of Bitcoin's ongoing evolution

The current disconnect between Bitcoin's performance and its safe-haven narrative shouldn't be interpreted as a failure but instead as a chapter in the digital asset's continuing maturation process, Grayscale suggests.

Pandl said it would have been unrealistic to expect Bitcoin to displace gold as a monetary asset in such a short period.

"Gold has been used as money for thousands of years and served as the backbone of the international monetary system until the early 1970s," Pandl wrote.

Although Bitcoin hasn't yet achieved comparable monetary standing, which remains "central to the investment thesis," he said, the cryptocurrency could progress toward that destination gradually as worldwide economic systems undergo further digitization through artificial intelligence, autonomous agents and tokenized financial markets.

For the immediate future, Bitcoin's potential rebound may hinge on new capital infusions entering the marketplace, whether through revitalized ETF inflows or retail investor reengagement. According to market maker Wintermute, retail trading activity has recently gravitated toward AI-connected equities and growth themes, constraining short-term appetite for cryptocurrency holdings.