Gemini Withdraws from European and Australian Markets, Cuts Quarter of Staff

The cryptocurrency exchange Gemini, established in 2015 and headquartered in the US, plans to concentrate its expansion efforts domestically, leveraging America's robust capital markets infrastructure.

On Thursday, cryptocurrency trading platform Gemini revealed plans to withdraw operations from the United Kingdom, European Union and Australian territories, while simultaneously reducing its employee headcount by 25%.

The exchange pointed to advances in artificial intelligence that have automated labor processes and enhanced engineer productivity by a factor of "100x," alongside increasingly difficult operating conditions across UK, EU and Australian jurisdictions, as key factors driving the withdrawal decision, as stated in Thursday's public announcement:

"These foreign markets have proven hard to win in for various reasons, and we find ourselves stretched thin with a level of organizational and operational complexity that drives our cost structure up and slows us down."

"We don't have the demand in these regions to justify them. The reality is that America has the world's greatest capital markets," the announcement said.

Rather than maintaining international operations, the organization will concentrate available resources on advancing its prediction market offering, Gemini Predictions, which debuted in December 2025, while simultaneously expanding its presence across the US market.

This development arrives during a particularly turbulent period for the cryptocurrency sector, as digital currency valuations have experienced sustained decline throughout a widespread market downturn that originated with a rapid crash in October and continued with the legislative stagnation of the CLARITY Act, a highly anticipated US cryptocurrency market structure bill.

Gemini shifts focus to prediction markets as the sector grows

Thursday's statement from Gemini underscored the increasingly central position that prediction markets occupy within its corporate strategy, noting these platforms will become "more front-and-center" across its service offerings.

"Our thesis is that prediction markets will be as big or bigger than today's capital markets," the announcement said.

According to the firm, Gemini Predictions has attracted more than 10,000 users and generated $24 millon in trading volume since its initial launch.

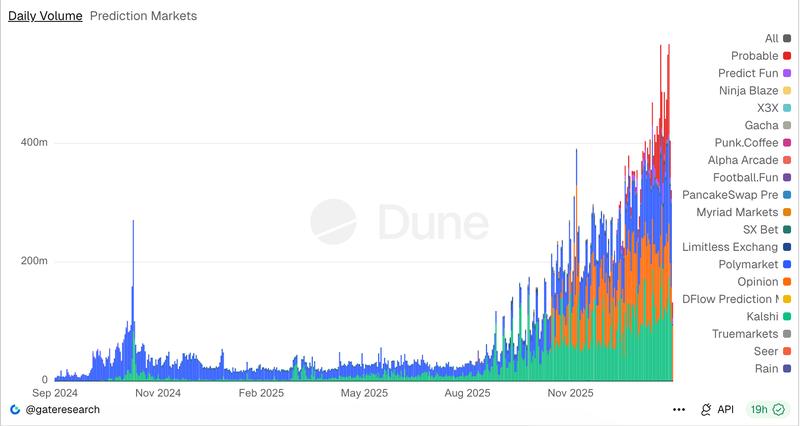

The third quarter of 2024 witnessed a dramatic surge in prediction market activity coinciding with the US presidential election cycle, with total trading volume climbing 565.4% compared to the previous quarter, ultimately reaching approximately $3.1 billion.

Throughout January 2026, prediction market platforms recorded daily trading volumes fluctuating between approximately $277 million and roughly $550 million, based on analytics from Dune.

Industry dominance continues to rest with Polymarket and Kalshi, as Polymarket captures more than 37% of aggregate prediction market 24-hour trading volume while Kalshi maintains control of over 26%, according to Dune.