Galaxy Digital Refutes Claims That $9B Bitcoin Transaction Stemmed from Quantum Computing Worries

Financial firm responds to speculation linking a massive $9 billion Bitcoin transaction by a high-net-worth client to concerns about quantum computing threats.

Galaxy Digital has rejected claims that a massive $9 billion Bitcoin transaction executed for one of its clients had any connection to fears surrounding quantum computing threats, addressing widespread speculation that followed the company's recent earnings call.

In the aftermath of the firm's earnings call, members of the cryptocurrency community highlighted a substantial $9 billion Bitcoin (BTC) transaction conducted on behalf of one of Galaxy's high-net-worth clients, with some suggesting the individual was "fairly concerned about BTC quantum resistance."

In a Tuesday post on X, Alex Thorn, who serves as Galaxy's head of research, clarified that the substantial $9 billion transaction carried out for their client had no connection whatsoever to concerns about quantum computing's potential impact on Bitcoin.

According to its quarterly report released on Tuesday, Galaxy disclosed a net loss totaling $482 million during the fourth quarter of 2025, along with an overall loss of $241 million for the entire year of 2025.

Bitcoin faces quantum computing worries

The potential ramifications of a breakthrough in quantum computing technology have represented a persistent concern among cryptographers for years, and have started to surface in asset management decision-making processes more recently.

During January, Christopher Wood, the "Greed & Fear" strategist at investment banking firm Jefferies, purportedly removed his 10% Bitcoin allocation recommendation from his suggested portfolio, pointing to worries about progress being made in quantum computing technology.

Adam Back, the CEO of Blockstream, rejected these concerns and maintained that quantum computing technology would require a minimum of 20 to 40 years before it could present any genuine threat to the Bitcoin network.

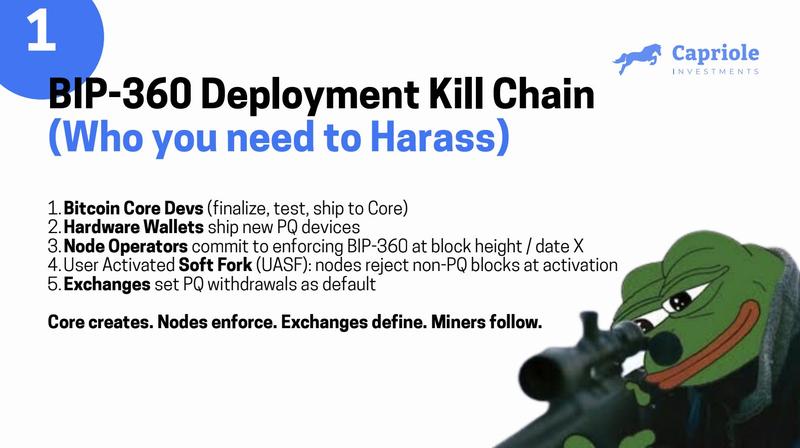

In response to the perceived threat posed by quantum computing advancements, a coalition of Bitcoin supporters and cryptocurrency fund managers began advocating for the Bitcoin Improvement Proposal designated as BIP-360, which would implement a post-quantum signature mechanism for Bitcoin addresses that might be susceptible to future developments in quantum computing capabilities.

Novogratz suggests crypto market bottom approaches with CLARITY Act as potential catalyst

The earnings call from Galaxy Digital and news reports about the substantial crypto whale selling assets emerged as Bitcoin momentarily fell beneath the $74,000 threshold on Tuesday, contributing to growing anxieties about market conditions.

During a separate conversation with Bloomberg, Mike Novogratz, the CEO of Galaxy, suggested that the price declines might be approaching a floor.

I think we're getting close to the bottom, but we'll see. You always know a bottom after you see it.

According to Novogratz, sustained advancement with the US market structure legislation, commonly referred to as the CLARITY Act, has the potential to support the cryptocurrency market's rebound.

Representatives from US President Donald Trump's administration convened with members of the cryptocurrency and banking sectors on Monday to deliberate on approaches for handling stablecoin yield within the forthcoming market structure legislation.

The markup session for the CLARITY Act was delayed by the Senate Banking Committee in January, which identified concerns regarding the draft legislation's handling of tokenized equities, provisions related to decentralized finance, and stablecoin yield rewards.

The objective of the CLARITY Act is to establish a well-defined boundary between the regulatory jurisdictions of the Securities and Exchange Commission and the Commodity Futures Trading Commission with respect to cryptocurrency assets, representing the nation's first comprehensive framework for crypto market structure in the US.