Ethereum's Buterin distinguishes 'authentic DeFi' from yield-bearing centralized stablecoins

Ethereum's co-creator presented alternative stablecoin frameworks that he believes better embody DeFi's fundamental vision of decentralized risk distribution.

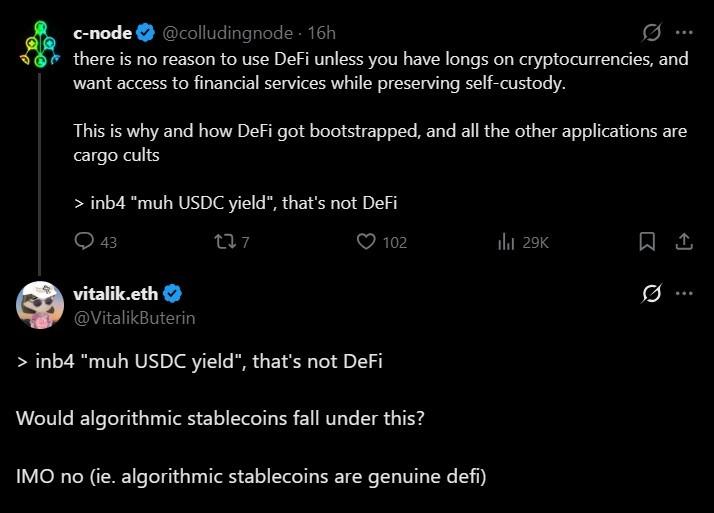

Vitalik Buterin, the co-creator of Ethereum, established a distinct demarcation around his definition of "authentic" decentralized finance (DeFi), challenging yield-focused stablecoin approaches that he argues do not effectively transform risk distribution.

During a conversation on X, Buterin emphasized that the true worth of DeFi stems from its ability to reshape the allocation and oversight of risk, rather than merely producing yield through centralized asset holdings.

The remarks from Buterin arrive at a time when DeFi's primary use cases face heightened examination, especially regarding lending platforms constructed around fiat-pegged stablecoins such as USDC.

Though he refrained from identifying particular protocols by name, Buterin criticized what he characterized as "USDC yield" offerings, asserting they rely substantially on centralized entities while providing minimal reduction in issuer-related or counterparty risks.

Dual stablecoin approaches presented

Buterin presented two approaches that he views as more compatible with the foundational principles of DeFi: an algorithmic stablecoin backed by Ether (ETH) and an algorithmic stablecoin supported by real-world assets (RWA) that maintains overcollateralization.

Regarding an ETH-backed algorithmic stablecoin model, he explained that even when the majority of a stablecoin's liquidity originates from users who create the token by taking loans against cryptocurrency collateral, the fundamental breakthrough lies in the capability to transfer risk to markets instead of concentrating it with a solitary issuer.

The fact that you have the ability to punt the counterparty risk on the dollars to a market maker is still a big feature.

Buterin noted that stablecoins supported by RWAs could still deliver enhanced risk outcomes provided they follow conservative structural principles.

He explained that when such a stablecoin maintains adequate overcollateralization and diversification such that the collapse of any individual backing asset would not compromise the peg, the risk exposure for token holders would be substantially diminished.

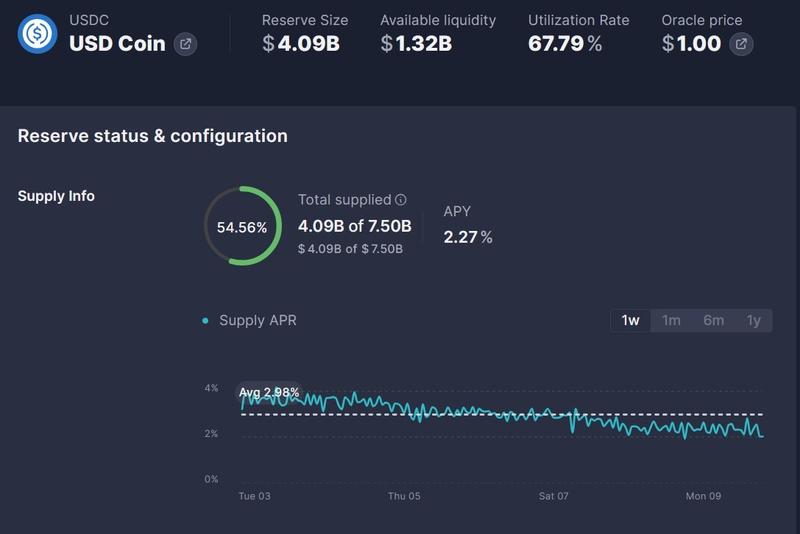

USDC's dominance in DeFi lending markets

Buterin's statements emerge as lending platforms throughout Ethereum continue to concentrate heavily on USDC.

Within Aave's primary Ethereum implementation, over $4.1 billion in USDC is presently supplied from an overall market size of approximately $36.4 billion, with around $2.77 billion in outstanding borrows, based on data from the protocol dashboard.

A comparable trend is visible on Morpho, which enhances lending efficiency across Aave and Compound-based platforms.

Within Morpho's borrowing markets, three among the five largest markets measured by size are denominated in USDC, generally supported by collateral such as wrapped Bitcoin or Ether. The leading borrowing market provides USDC lending and features a market size of $510 million.

On Compound, USDC continues to be among the protocol's most actively utilized assets, featuring approximately $382 million in assets generating yield and $281 million in borrowed funds. This activity is underpinned by roughly $536 million in collateral backing.

Buterin's advocacy for decentralized stablecoin solutions

Buterin's criticism does not dismiss stablecoins entirely but instead challenges whether the prevailing lending frameworks today truly deliver the risk decentralization that DeFi fundamentally promises.

The statements also expand upon previous criticisms he has articulated regarding the architecture of the contemporary stablecoin marketplace.

On Jan. 12, he contended that Ethereum requires more robust decentralized stablecoins, cautioning against designs that depend excessively on centralized issuers and a singular fiat currency.

During that discussion, he stated stablecoins must be capable of withstanding long-term macroeconomic risks, including currency volatility and nation-state level failures, while simultaneously maintaining resistance to oracle manipulation and protocol vulnerabilities.