Ethereum ETF Investors Face Deeper Losses Compared to Bitcoin ETF Counterparts During Market Correction

Investors in Bitcoin and Ether spot exchange-traded funds are experiencing significant losses while markets search for a floor, though Bloomberg data indicates that holders from both groups are maintaining their positions without widespread selling.

The cryptocurrency market continues its search for price equilibrium, with Bitcoin (BTC) and Ethereum's native cryptocurrency, Ether (ETH), hitting intraday lows of $66,171 and $1,912 respectively during Thursday's trading session.

While this ongoing price discovery unfolds, Bloomberg analysts have released fresh research examining the current state of spot BTC and ETF investors as they navigate persistent price declines and diminishing inflows into exchange-traded funds (ETFs).

Key takeaways:

- Spot Bitcoin ETF assets experienced a decline in net value to $85.76 billion from a peak of $170 billion reached in October 2025, accompanied by approximately -$2 billion in net flows for 2026.

- Spot Ether ETF assets saw their value plummet to $11.27 billion from $30.5 billion, while ETH trades around $2,000 compared to an average $3,500 cost basis.

- Approximately 6% of Bitcoin ETF holdings were liquidated during the latest market decline, pointing to minimal capitulation among investors.

Asset Values for Bitcoin and Ether ETFs Shrink Amid Stalling Inflows

According to Bloomberg analyst James Seyffart, investors holding Ether ETFs find themselves "sitting in a worse position" compared to those invested in Bitcoin ETF products. Trading below the $2,000 threshold, ETH sits significantly beneath the calculated $3,500 average cost basis—representing the mean price at which spot ETF participants acquired their holdings—resulting in a drawdown surpassing 50% when measured against the recent bottom of $1,736.

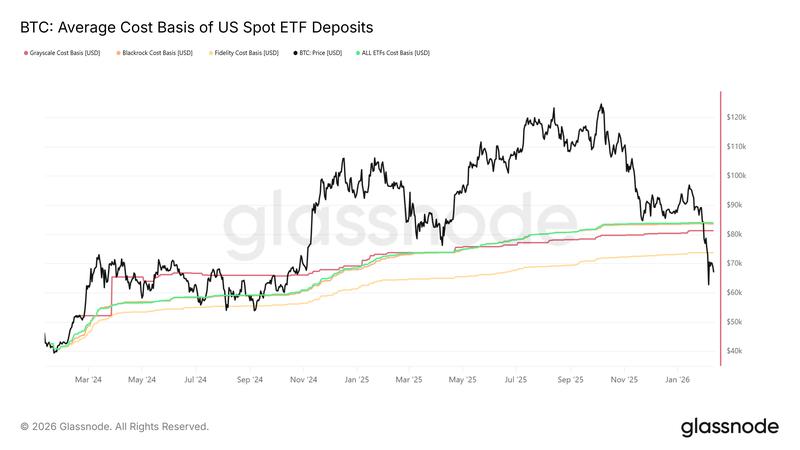

In contrast, Bitcoin's current trading price of $66,171 also falls short of its calculated $84,063 ETF cost basis, yet the percentage drawdown stands considerably lower at 21%.

Seyffart observed that total net inflows to ETH ETFs have contracted by merely $3 billion approximately, indicating that the majority of ETH ETF participants have maintained their holdings throughout the current market correction.

The assets under management in spot Bitcoin ETFs reached their zenith at $170 billion during October 2025 and have since contracted to $85.76 billion. Inflows experienced a dramatic deceleration following the middle of 2025, recording $13.7 billion during the year's first six months, $7.64 billion throughout the latter half, and approximately $2 billion in net outflows on a year-to-date basis. From July 2025 onward, aggregate net flows total $5.64 billion.

During the previous Thursday, Eric Balchunas, senior ETF analyst at Bloomberg, highlighted that merely 6% of aggregate Bitcoin ETF holdings were withdrawn throughout the recent market downturn. While BlackRock's IBIT fund has contracted to $51 billion from a peak valuation of $100 billion, it continues to stand as among the swiftest ETFs to accumulate $60 billion in managed assets.

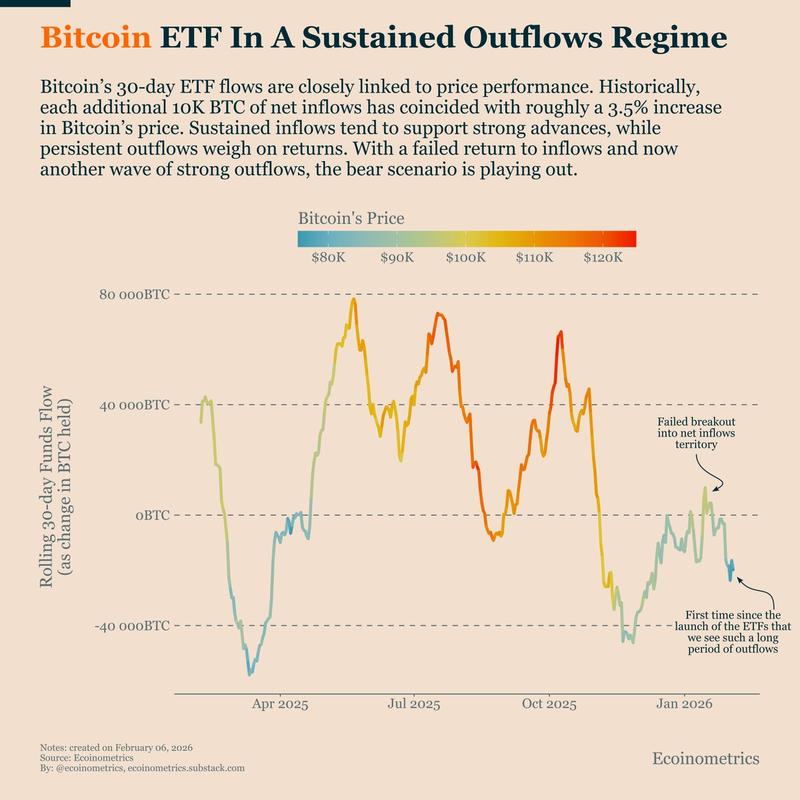

Bitcoin ETF Flows Transition Into Bear-Market Territory

The 30-day rolling window for Bitcoin ETF flows has shifted decisively into negative territory after an unsuccessful effort to regain positive flow status. With the exception of a temporary recovery, this represents the most extended period of continuous outflows recorded since the product launch.

Analysis from Glassnode further indicated that the 30-day simple moving average tracking net flows for both Bitcoin and Ether spot ETF products has persisted in negative territory throughout the majority of the preceding 90-day period. The available data reveals no definitive indication of returning investor demand.