ETH Treasury Holdings Drive BitMine Toward $7B Unrealized Loss Amid Crypto Downturn

Companies holding Ether treasuries face mounting pressure from cryptocurrency market decline, with Trend Research liquidating $77 million in ETH at a deficit while competitors maintain positions despite significant paper losses.

Enterprises maintaining Ether treasury positions are experiencing substantial unrealized losses on their cryptocurrency holdings following the recent market downturn that has pushed numerous firms into negative territory.

As the leading corporate holder of Ether (ETH), BitMine Immersion Technologies is currently experiencing $6.95 billion in paper losses. The company's Ether position reflects an average acquisition price of $3,883 per token, substantially above ETH's present trading value of $2,240.

Positioned as the second-largest corporate Ether treasury holder, SharpLink Gaming is confronting $1.09 billion in unrealized losses after Ether's market value dropped beneath its average purchase price of $3,609, based on data from the company's public dashboard.

These growing unrealized losses could challenge the resolve of companies holding Ether treasuries, creating additional obstacles for capital raising efforts, as the decline in Ether's value is causing a decrease in Market Net Asset Value (MNAV). The mNAV for BitMine dropped to 1, whereas SharpLink's mNAV decreased to 0.92.

Market Net Asset Value ratio serves as a metric comparing a corporation's enterprise value against the worth of its cryptocurrency reserves. When mNAV drops below 1, companies encounter greater difficulty raising capital through new share issuance, potentially constraining their ability to acquire additional cryptocurrency.

This market dynamic could result in a "brutal pruning" throughout the crypto treasury company sector during 2026, where only those firms with the strongest capitalization will endure, according to forecasts from asset management firm Pantera Capital.

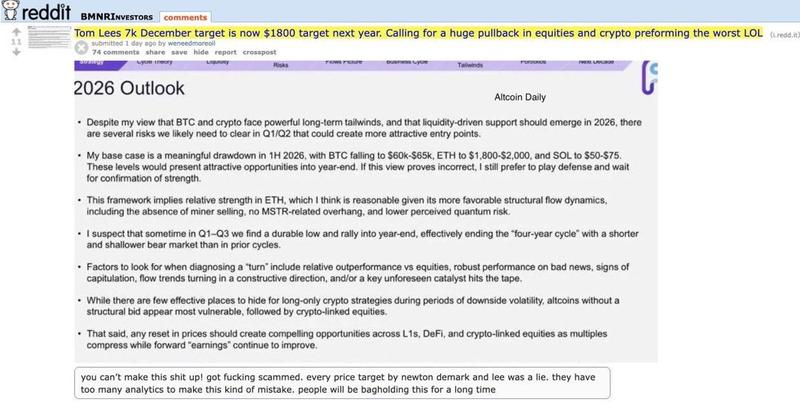

Notwithstanding these worries, the current downturn in Ether's price continues to align with projections from Tom Lee, who serves as BitMine's chairman and holds the position of co-founder at Fundstrat Global Advisors.

According to reporting by Cointelegraph in December, Lee forecasted an Ether decline reaching approximately $1,800 during 2026's first quarter, after which cryptocurrency markets would stabilize and experience a rally through the year's conclusion.

Trend Research sells $79 million Ether at a loss

The recent cryptocurrency market decline has already forced certain treasury companies to begin liquidating their positions.

This past Monday, the Hong Kong-headquartered investment company Trend Research liquidated its leveraged holdings by offloading 33,589 Ether valued at $79 million, realizing a loss on the transaction.

To settle its outstanding loan, Trend Research secured an additional $77.5 million in USDt (USDT) through Binance. According to blockchain analytics shared by EmberCN, the firm reduced its ETH borrowing liquidation threshold from $1,880 down to $1,830.

Despite this sale, Trend Research maintains a long position consisting of 618,000 Ether (currently valued at $1.43 billion,) while experiencing an unrealized deficit exceeding $534 million.

According to Jack Yi, who founded Trend Research, the investment company plans to wait for market conditions to improve while maintaining controlled risk exposure.

After selling out at the top, being too early to go bullish on ETH was indeed a mistake. Because when BTC was around 100k, ETH kept staying at 3000, and we thought it was undervalued.

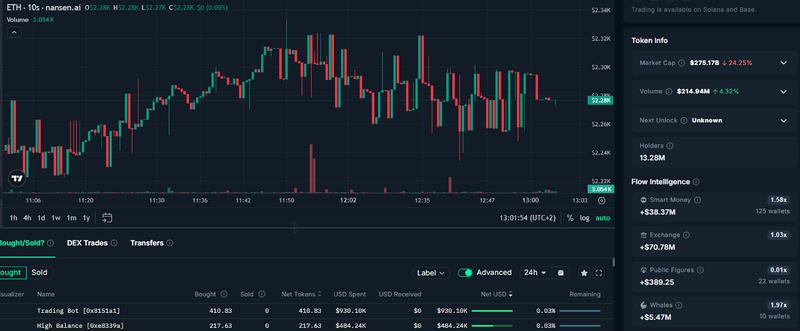

At the same time, top-performing traders in the industry categorized as "smart money," are purchasing spot Ether tokens while the market experiences this downturn.

Over the previous seven days, smart money traders purchased $38.3 million in spot ETH tokens, with whale investors acquiring $5.47 million and newly created wallets purchasing $31 million, per data from crypto intelligence platform Nansen.