Current Bitcoin Bull Market Shows Unique Long-Term Holder Selling Patterns, Analysis Reveals

A fresh examination of the ongoing bull market reveals that Bitcoin holders maintaining positions for two years or longer achieved unprecedented selling records throughout 2024 and 2025.

While Bitcoin (BTC) is experiencing unprecedented selling volumes from veteran holders, analysis shows this distribution trend initiated at price points significantly lower than today's valuations.

Key points:

- Long-term Bitcoin holders have established new records through their distribution activity spanning the previous two years.

- The selling patterns observed during this bull cycle distinguish it from earlier market cycles.

- An ongoing price cycle accompanied by an investor "transition" is currently taking place.

CryptoQuant: Previously dormant BTC supply "stands out"

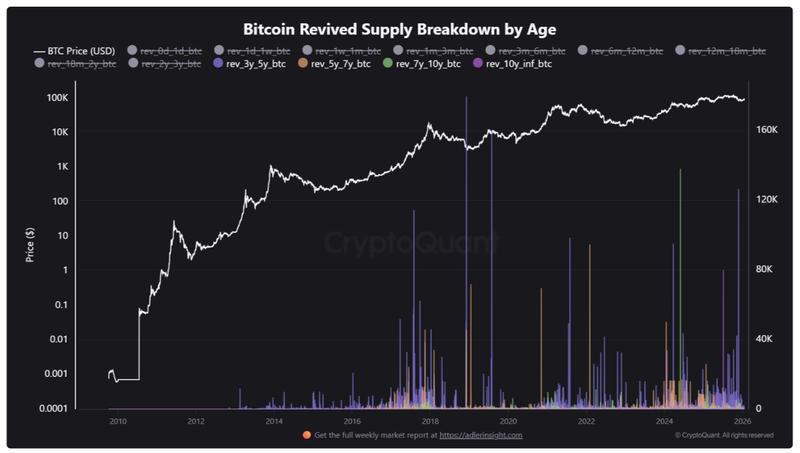

Fresh analysis from blockchain analytics firm CryptoQuant has verified continuous distribution of "significantly older coins" throughout this bull market.

Transaction outputs that had remained unspent (UTXOs) containing BTC that was previously inactive for a minimum of two years have experienced sharp increases beginning in 2024.

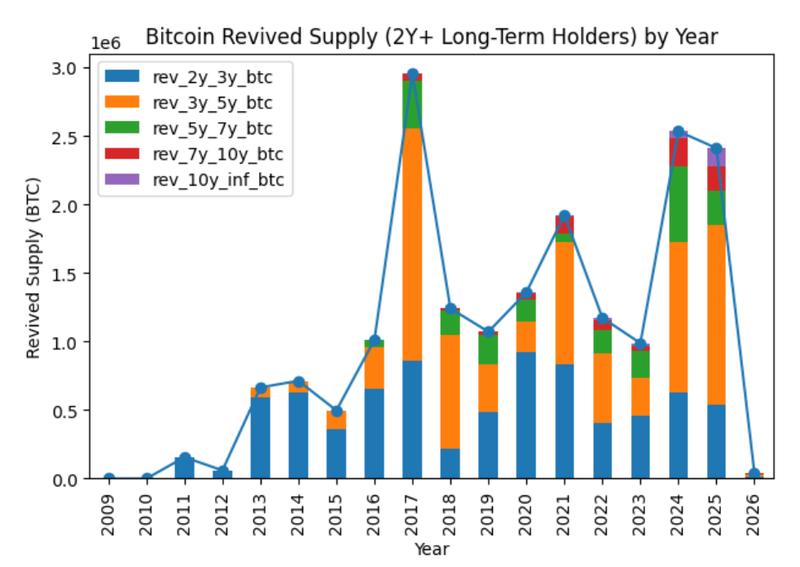

"What stands out is that 2024 and 2025 record the highest annual revived supply from long-term holders in Bitcoin's history," contributor Kripto Mevsimi commented alongside an explanatory chart.

The information shows that both 2024 and 2025 are matching the selling activity observed during the conclusion of an earlier bull market in 2017, which concluded when BTC/USD reached its peak of $20,000.

"This is not just a repeat of 2017 or 2021," Kripto Mevsimi stressed.

"While those cycles saw revived supply rise alongside strong price momentum and speculative inflows, the current revival is happening with lower overall market noise but significantly older coins."

According to CryptoQuant's assessment, Bitcoin's long-term holders are currently "reassessing exposure" to the marketplace, with this behavior evident since prices surpassed the $40,000 threshold.

"Early 2026 data does not yet show a full reversal of this trend, but revived long-term supply has moderated compared to the peaks of 2024–2025," Kripto Mevsimi said about the latest phase of the trend.

"Whether this represents temporary exhaustion or the start of a new accumulation phase will become clearer as the year progresses."

Bitcoin is experiencing a "transition"

The phenomenon of long-term holders reactivating extensively dormant coins for market distribution has emerged as a significant discussion point in recent months.

The underperformance of Bitcoin relative to other prominent asset classes starting from Q4 2025 has, consequently, prompted inquiries regarding how the upcoming year could potentially deviate from historical price cycles.

It's worth noting that 2026 is expected to represent a bear market year according to traditional patterns, with multiple projections anticipating a decline to price levels substantially below the present $90,000 mark.

The continued validity of the four-year price cycle pattern itself has also become a subject of considerable discussion among market participants.

"Bitcoin is not only undergoing a price cycle, but potentially a transition in who holds it and why—and long-term holder supply behavior is one of the clearest on-chain signals of that shift," CryptoQuant concluded.