CryptoQuant Raises Red Flag as GameStop Transfers Complete $422M Bitcoin Holdings to Coinbase Prime

The video game retail giant has transferred all of its Bitcoin holdings, valued at $422 million, to Coinbase Prime, leading analysts at CryptoQuant to question whether the firm is preparing to abandon its cryptocurrency treasury approach.

The video game retailer GameStop has relocated its complete Bitcoin portfolio to the institutional trading arm of Coinbase, triggering widespread speculation that the company might be preparing to pivot away from its cryptocurrency treasury approach.

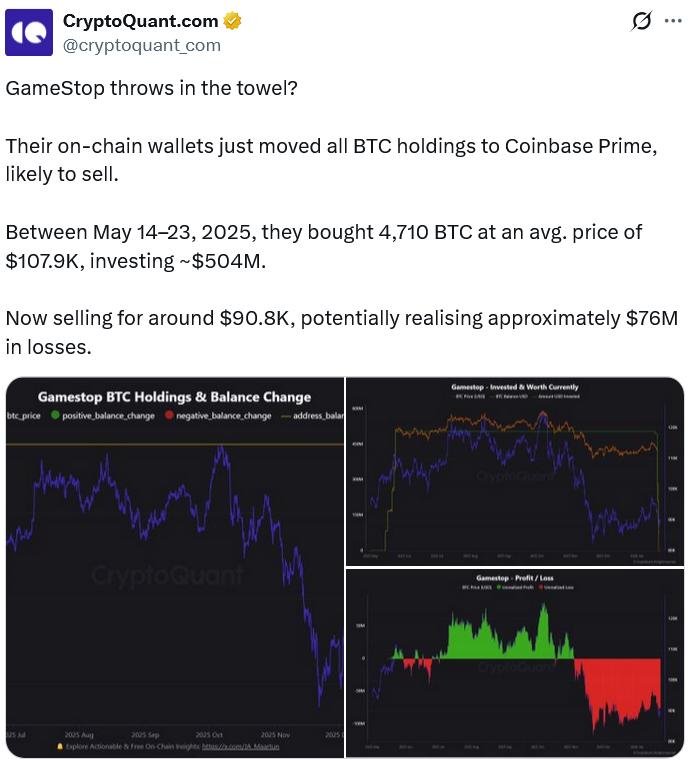

In a post shared on the social media platform X this past Friday, the blockchain analytics firm CryptoQuant questioned whether "GameStop throws in the towel?" following their discovery that the company had transferred all 4,710 Bitcoin (BTC) from its holdings, representing a value exceeding $422 million, to the Coinbase Prime platform.

According to CryptoQuant's analysis, the movement of funds appeared to be "likely to sell" the cryptocurrency assets, with the firm calculating that if GameStop were to liquidate its position at Bitcoin's current trading price of $90,800, the company would be forced to recognize approximately $76 million in unrealized losses from its cryptocurrency investment.

The company's Bitcoin position of 4,710 BTC was built through multiple purchase transactions executed in May, with GameStop paying an average acquisition cost of $107,900 per Bitcoin.

The video game retailer's decision to establish a Bitcoin treasury strategy came after a February meeting between GameStop CEO Ryan Cohen and Strategy chairman Michael Saylor, where the two executives explored optimal approaches for implementing corporate cryptocurrency holdings.

As of now, GameStop has not issued any public statement to confirm or deny the speculation surrounding whether the company has already divested, or is planning to divest, its Bitcoin position.

A request for official comment was sent by Cointelegraph to GameStop's communications team, however, no response had been provided at the time of publication.

The Bitcoin transfer news emerges in the wake of a Wednesday regulatory filing that disclosed GameStop CEO Ryan Cohen's acquisition of an additional 500,000 GME shares valued at more than $10 million, a move that helped propel the company's stock price upward by over 3% during Thursday's trading session.

The adoption of Bitcoin treasury strategies emerged as a widely embraced corporate trend throughout 2024 and into 2025, although numerous companies implementing these approaches experienced significant stock price declines during the latter portion of 2025 amid growing concerns about the long-term viability of such investment frameworks.

Current data indicates that over 190 publicly listed corporations maintain Bitcoin positions on their corporate balance sheets, with numerous additional firms having established treasury holdings in Ether (ETH), Solana (SOL), and various other alternative cryptocurrencies throughout the past 12 months.

MSCI maintains inclusion of crypto treasury firms in market indexes

Companies holding cryptocurrency treasuries, with Strategy being the most prominent example, achieved a significant strategic victory in the early part of this month when Morgan Stanley Capital International made the determination not to remove digital asset treasury enterprises from its market index classifications, at least temporarily.

In its announcement, MSCI indicated that additional time was required to develop proper methodology for differentiating between firms operating primarily as investment vehicles versus corporations that maintain digital asset holdings as an integral component of their operational business models.

Had MSCI proceeded with removing these companies from its indexes, Strategy along with other digital asset treasury firms could have faced the loss of billions of dollars in passive investment flows from index-tracking funds.