Cryptocurrency Political Action Committees Amass Substantial Funding Before Midterm Elections

Political action committees backed by the cryptocurrency sector are accumulating tens of millions in contributions aimed at supporting legislative candidates favorable to their regulatory agenda.

Political action committees serving the cryptocurrency sector's interests have amassed substantial financial resources in the months leading up to the upcoming midterm electoral cycle in the United States.

Super PACs represent the unlimited-contribution, ultra-wealthy equivalents of traditional crypto PACs, operating without disclosure requirements. During the previous year, the cryptocurrency sector allocated no less than $245 million toward campaign financing.

Fairshake, the primary super PAC receiving cryptocurrency industry backing, accumulated approximately $133 million throughout 2025, pushing its available funds beyond $190 million. The venture capital entity a16z provided $24 million in initial funding, with both Coinbase and Ripple contributing $25 million each.

This substantial capital injection has raised concerns among activist organizations and electoral reform advocates. Speaking to Cointelegraph, Saurav Ghosh, who serves as director at the Campaign Legal Center — an organization dedicated to voting rights protection, equitable redistricting, and campaign finance oversight — stated:

This kind of influence buying ultimately undermines the democratic process by marginalizing everyday Americans, ensuring that their voices and interests take a backseat to the crypto industry's deregulatory desires.

Bipartisan support ensures crypto lobby's success

The cryptocurrency sector in America has prioritized passage of comprehensive framework legislation, specifically the CLARITY Act, which successfully cleared the House of Representatives during the summer months before advancing to the Senate. However, the legislation has yet to meet the expectations of the cryptocurrency industry, especially Coinbase, while also failing to address the ethical and oversight reservations held by Democratic senators.

Currently, the CLARITY Act remains stalled, as Congressional focus transitions toward the 2026 midterm electoral contests. Historically, spanning nearly eight decades, the incumbent president's political party has consistently suffered losses during midterm elections, which occur during the off-year between presidential contests. This pattern carries particular significance for the cryptocurrency sector, given its stronger support base within the Republican Party. As evidence, consider the Senate's GENIUS Act vote tallies: Democratic opposition votes nearly doubled those cast in favor.

Certain cryptocurrency advocates have interpreted this dynamic as requiring partisan alignment. The Winklevoss twins, Cameron and Tyler, who established the Gemini cryptocurrency exchange, have invested millions into the conservative-oriented Digital Freedom Fund PAC, designed to elevate pro-cryptocurrency and pro-Trump political candidates.

Alternative voices have emphasized maintaining bipartisan backing, cautioning that exclusive support for one party will inevitably prove problematic when opposing parties assume control.

Speaking to Politico during October 2025, Representative Sam Liccardo, a Democrat supportive of cryptocurrency interests, remarked, "I don't think anybody in this town would recommend that an industry put their eggs in one party's basket."

Fairshake, a prominent lobbying organization, has demonstrated clear willingness to back Democratic candidates, provided they maintain sufficiently pro-cryptocurrency positions. According to data from Open Secrets, the Super PAC actually allocated greater financial resources supporting Democrats compared to Republicans during the 2023 to 2024 period.

Whether targeting Republicans or Democrats, the cryptocurrency industry's political approach has undergone substantial transformation regarding both expenditure volumes and allocation strategies.

How did we get here?

The cryptocurrency sector generated significant media attention throughout 2024 by contributing nearly a quarter-billion dollars across various political campaigns and super PACs — representing the single largest contribution from any individual industry sector.

However, this wasn't the cryptocurrency sector's initial foray into political involvement. Throughout the 2020-2021 cryptocurrency market upswing, crypto companies executed extensive advertising campaigns. High-profile celebrities including Matt Damon promoted cryptocurrency investment platforms. Sam Bankman-Fried, later convicted of fraud, branded his subsequently defunct cryptocurrency exchange, FTX, onto the Miami Heat basketball team's arena.

Concurrently, cryptocurrency entities intensified their Washington lobbying activities. Major platforms such as Coinbase and financial technology developers like Ripple expanded their budgets as industry prominence increased.

Coinbase expanded its spending from $1.5 million during 2020 to $3.9 million throughout 2021. Ripple more than tripled its lobbying expenditures across the identical timeframe, allocating $330,000 during 2020 and exceeding $1.1 million throughout 2021.

Bankman-Fried emerged as a significant cryptocurrency sector contributor. He provided over $100 million in political campaign financing during the 2022 midterm elections. "He leveraged this influence, in turn, to lobby Congress and regulatory agencies to support legislation and regulation he believed would make it easier for FTX to continue to accept customer deposits and grow," federal prosecutors stated in a subsequent indictment.

According to Bankman-Fried's own statements, he funded campaigns across both political parties, though he considered Republicans "far more reasonable" regarding cryptocurrency matters.

The cryptocurrency market subsequently collapsed. FTX declared bankruptcy, the Terra stablecoin ecosystem failed, and the Securities and Exchange Commission (SEC), America's principal financial regulatory body under then-Chair Gary Gensler, initiated enforcement proceedings against numerous cryptocurrency companies conducting US operations.

During 2023, the presidential electoral cycle commenced. Trump competed against former Vice President Kamala Harris. Cryptocurrency emerged as a presidential platform issue for the first time. Trump appeared at a Bitcoin (BTC) conference and pledged to eliminate "regulation by enforcement."

Cryptocurrency interests channeled substantial funding into the electoral race via PACs and super PACs. For the 2024 elections, these organizations primarily included:

- Fairshake

- Defend American Jobs (Conservative)

- Protect Progress (Liberal)

Fairshake accumulated an impressive $260 million from 2023 through 2024, with no less than $92 million originating from Coinbase. The organization executed $126 million in independent expenditures and affiliated committee transfers.

Independent expenditures constitute expenditures "for a communication that expressly advocates the election or defeat of a clearly identified candidate and which is not made in coordination with any candidate or their campaign or political party," according to FEC definitions.

According to Follow the Crypto data, the two additional single-issue cryptocurrency PACs maintain affiliations with Fairshake, despite one adopting liberal positions and the other conservative stances. Defend American Jobs executed $57 million in independent expenditures, while Protect Progress completed $34.5 million throughout the identical 2023-2024 timeframe.

This substantial monetary influx into PACs represents a broader transformation in corporate political influence strategies.

"Super PACs are increasingly becoming in vogue for special interests who want to make their presence known in Washington," Michael Beckel, research director of Issue One — a bipartisan political reform organization monitoring big money in politics — explained to Cointelegraph.

Industry-aligned super PACs with huge bank accounts have made a huge splash and helped thwart new regulations on their business interests.

Just several years previously, "corporate influence operations focused more on lobbying and direct campaign contributions," Beckel elaborated. "Now we're seeing sector-specific super PACs with massive bank accounts."

This evolution is fundamentally altering Washington's legislative processes.

Crypto lobby affects policy as Trump seeks to "nationalize" elections

Blockchain industry leaders now maintain regular Washington visits to engage with legislators and provide policymakers with regulatory guidance for the sector.

Issue One vice president of advocacy Alix Fraser commented, "The Trump administration is packed with tech industry insiders who have acted in the interest of their own companies — not the American people — to rig policy for their own profit."

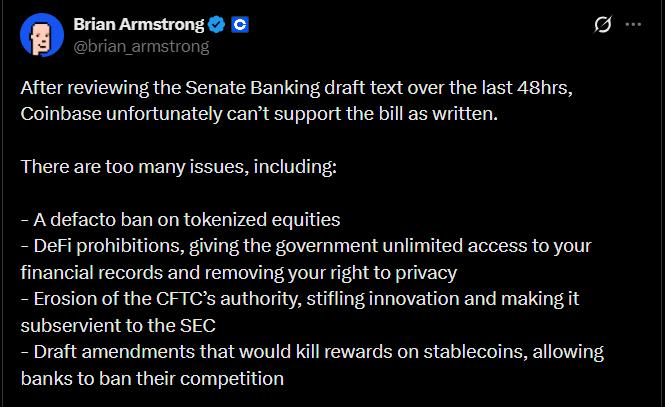

The cryptocurrency industry's legislative process involvement becomes most evident through the market structure legislation currently progressing through the Senate. Legislative work stalled during mid-January following Coinbase's support withdrawal.

The exchange's CEO, Brian Armstrong, posted on X:

The primary dispute centers on a provision prohibiting one of Coinbase's offerings: consumer stablecoin yields. Banking institutions advocate for outlawing this practice, arguing that deposit flights from insured lending institutions could compromise financial stability. The cryptocurrency industry and Coinbase counter that this prohibition suppresses innovation and creates anti-competitive conditions.

During the current week, the White House organized a private summit bringing together cryptocurrency and banking industry leaders to resolve their disagreements, though Reuters reports no agreement was reached.

According to journalist Eleanor Terrett, Senate Democrats characterized the discussions as "constructive" and expressed optimism regarding legislative passage prospects. Journalist Sander Lutz reported that Senate Minority Leader Chuck Schumer appears "desperate" to finalize the legislation, considering Fairshake alone currently possesses $193 million in available funds.

"These payments help explain the crypto industry's success in curtailing efforts to meaningfully regulate their business model, which is consistent with a well-established practice of wealthy corporate special interests using lobbying and political contributions to influence policy decisions," Ghosh informed Cointelegraph.

This kind of influence buying ultimately undermines the democratic process by marginalizing everyday Americans, ensuring that their voices and interests take a backseat to the crypto industry's deregulatory desires.

Rick Claypool, research director at consumer rights advocacy organization Public Citizen, told Cointelegraph that substantial funding from lobbying groups like cryptocurrency interests displaces most voters' priorities from the legislative agenda.

This feeds cynicism — the sense that our elected officials prioritize the interests of wealthy donors over all other constituents — and erodes faith in our democratic institutions.

The expanding influence of financially powerful interests throughout Washington coincides with direct threats to electoral integrity itself. Trump recently suggested Republicans should "nationalize" the midterm electoral process.

"The Republicans should say, 'We want to take over. We should take over the voting, the voting in at least many — 15 places ... the Republicans ought to nationalize the voting,'" he stated.

He further stated he would only recognize results deemed "honest," while asserting widespread voter fraud occurred across numerous American cities. Electoral specialists have disputed these assertions. House Speaker Mike Johnson has acknowledged lacking personal evidence supporting his voter fraud allegations.

Marc Elias, a partner at Elias Law Group, commented that Trump "is not interested in following the Constitution. As we have seen before, he prefers to act by force."

The cryptocurrency sector is positioned to expand its Washington influence while the electoral processes themselves face potential tampering and interference risks from government's highest echelons.