Crypto 'Winter' Nearing Its End, BitWise CIO Claims as Gold Eyes $5K Milestone

Bitcoin struggled to breach the $80,000 barrier while gold made attempts to reclaim $5,000, amid claims that the current 'crypto winter' commenced in early 2025.

On Tuesday, Bitcoin (BTC) reverted to trading within a confined range while gold approached the critical $5,000 threshold once more.

Key points:

- Bitcoin moves laterally while gold and silver make efforts to recover previous losses.

- Market observers remain divided on the future trajectory of the Bitcoin-gold dynamic.

- Bitwise's Chief Investment Officer suggests the current "crypto winter" is nearing its conclusion.

Bitcoin's $80,000 price level remains elusive

According to data sourced from TradingView, BTC's price movement avoided retesting the $80,000 level, which is currently serving as a resistance point.

The BTC/USD pair exhibited characteristic uncertainty throughout the trading day, once more creating a stark contrast with precious metals, which were vigorously working to recover substantial portions of their significant recent losses.

The XAU/USD pair climbed back to $4,971, representing an increase of more than $500 from the local lows recorded on Monday.

Meanwhile, silver, which had plummeted to approximately $71 following the close of January's monthly candle, was experiencing gains exceeding 11% at the time of publication.

Equity markets in the United States remained reactive to corporate earnings announcements, with PayPal's disappointing results triggering a nearly 20% decline in its stock valuation.

When evaluating the current market conditions, those forecasting BTC price movements expressed optimism for the continuation of historical patterns observed during bullish gold market phases.

"$BTC and $GOLD historically have taken turns to run, with Gold running the show for the past 14 months or so. It's usually right around that time that the digital gold narrative takes over," trader Jelle wrote in one of his latest X posts.

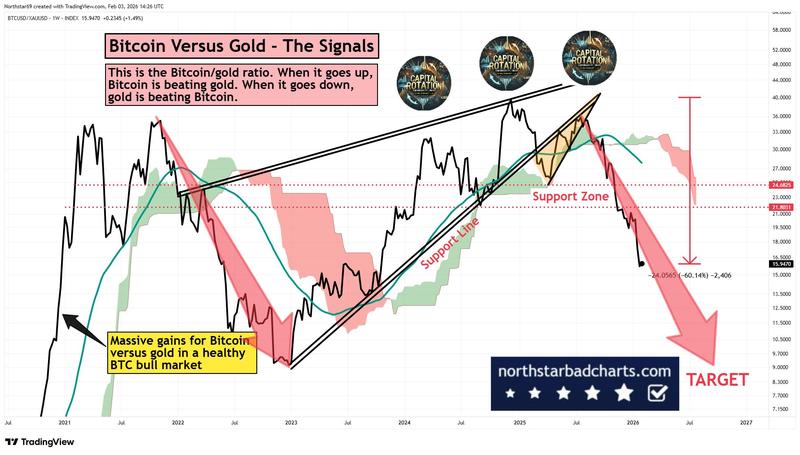

However, other market participants remained deeply skeptical, including trader and analyst Northstar, who projected that Bitcoin would eventually surrender 80% of its value when measured against gold.

"Note, this was the first cycle where Bitcoin DID NOT make big new highs against gold. Worse may be to come due to capital rotation," they told X followers.

Bitwise CIO: Crypto spring "closer than you think"

Through his own X article published on Tuesday, Matt Hougan, chief investment officer of crypto asset manager Bitwise, also suggested that the prevailing "crypto winter" has a finite duration.

"Here's the good news: We're closer than you think," he summarized.

According to Hougan's assessment, the most recent bearish trend actually began at the start of 2025, and the introduction of US spot Bitcoin exchange-traded funds (ETFs) was responsible for creating the illusion of a bull market throughout much of the previous year.

"As a veteran of multiple crypto winters, I can tell you that the end of those crypto winters feel a lot like now: despair, desperation, and malaise. But there is nothing about the current market pullback that's changed anything fundamental about crypto," he concluded.

"I think we're going to come roaring back sooner rather than later. Heck, it's been winter since January 2025. Spring is surely coming soon."