Crypto Exchange Coinbase Reports $667M Q4 Deficit Following Market Downturn

The cryptocurrency exchange Coinbase posted a $667 million net deficit in the fourth quarter, marking its first quarterly loss since 2023, driven by declining transaction and subscription income during a broader crypto market downturn.

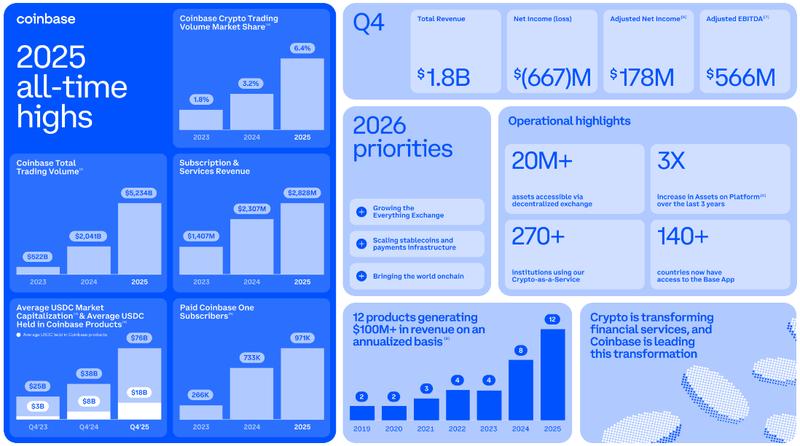

The cryptocurrency exchange Coinbase has disclosed a $667 million net deficit for the fourth quarter of 2025, bringing an end to the platform's two-year run of eight consecutive profitable quarters.

According to the Q4 financial results unveiled on Thursday, Coinbase revealed that its earnings per share came in at 66 cents, representing a shortfall of 26 cents compared to the 92 cents per share that analysts had projected.

The digital asset trading platform indicated that its net revenue experienced a 21.5% decline on a year-over-year basis, reaching $1.78 billion and missing the $1.85 billion target set by market analysts.

Revenue generated from transaction activities plummeted by nearly 37% compared to the same period the previous year, settling at $982.7 million, whereas revenue from subscription and services segments experienced an increase of more than 13% year-over-year, totaling $727.4 million.

This marks the first time Coinbase has posted a net loss since the third quarter of 2023, occurring against the backdrop of a challenging crypto market environment throughout the quarter, during which Bitcoin (BTC) experienced a decline of nearly 30% from its peak of $126,080 in early October to below $88,500 by Dec. 31.

The price of Bitcoin has decreased by 25.6% year-to-date to $65,760, following a recovery from a sharp decline that saw prices drop below $60,000 earlier in the month.

Notwithstanding the disappointing earnings figures, Coinbase (COIN) stock prices climbed 2.9% during after-hours trading sessions on Thursday, reaching $145.18, following a 7.9% downturn during regular trading hours that concluded at $141.1.

The company characterized 2025 as a "strong year" from both operational and financial perspectives, noting that it achieved significant progress toward realizing its vision of becoming an "everything exchange."