CME Group Explores Launch of Proprietary Digital Token, CEO Duffy Reveals

During the company's recent earnings call, Terry Duffy, CEO of CME Group, revealed plans to investigate the development of a proprietary token while simultaneously testing tokenized cash systems in partnership with Google.

The Chicago-headquartered derivatives marketplace CME Group is considering the introduction of a proprietary digital token while examining potential use cases for tokenized assets serving as collateral throughout financial markets, based on statements made by CEO Terry Duffy.

During a corporate earnings conference call, Duffy revealed that CME is examining various collateral formats, including tokenized cash and a CME-branded token capable of functioning on a decentralized network. He stated:

Not only are we looking at tokenized cash […] we're looking at different initiatives with our own coin that we could potentially put on a decentralized network for other of our industry participants to use.

He further noted that collateral provided by a "systemically important financial institution" could deliver enhanced confidence to market participants compared to tokens created by a "third or fourth-tier bank trying to issue a token for margin."

Duffy's mention of tokenized cash relates to a partnership with Google that was revealed in March, where CME Group and Google Cloud announced they had commenced piloting blockchain-powered infrastructure designed for wholesale payments and asset tokenization utilizing Google Cloud's Universal Ledger.

The prospective CME-branded token would represent a distinct initiative, and the exchange has not provided specifics regarding its operational framework.

CME Group functions as a derivatives marketplace that oversees futures and options trading across rates, equities, commodities and cryptocurrencies.

In January, CME announced intentions to broaden its regulated crypto product lineup by introducing futures contracts linked to Cardano (ADA), Chainlink (LINK) and Stellar (XLM). In a separate move, it reached an agreement with Nasdaq to consolidate its crypto index products under the Nasdaq-CME Crypto Index.

The marketplace also recently announced plans to launch 24/7 trading capabilities for cryptocurrency futures and options starting in early 2026, subject to regulatory approval.

Banks expand stablecoin and payment token efforts amid regulatory debate

Although CME Group has not released concrete details regarding its potential proprietary token, Duffy's statements position the derivatives marketplace within a wider movement by traditional financial institutions, especially banks, to investigate blockchain-powered tokens for payments and settlement operations.

In July, Bank of America announced it was examining stablecoins as a way to modernize its payments infrastructure, with CEO Brian Moynihan characterizing them as a potential transactional tool for moving US dollar and euro-denominated funds through the bank's global payment systems.

JPMorgan introduced JPM Coin in November, launching a blockchain-powered token that represents US dollar deposits maintained at the bank. The token is accessible to institutional clients and can be utilized to transfer funds on Base, a blockchain developed by Coinbase, enabling onchain payments and settlement.

Fidelity Investments announced it soon plans to launch a US dollar–backed stablecoin called the Fidelity Digital Dollar (FIDD), extending its digital-asset push after receiving conditional approval to operate a national trust bank.

Nevertheless, as US banks advance with stablecoin and token initiatives, they are concurrently resisting yield-bearing stablecoins, driving an active policy clash with the crypto industry under the CLARITY Act, which is being debated in Congress.

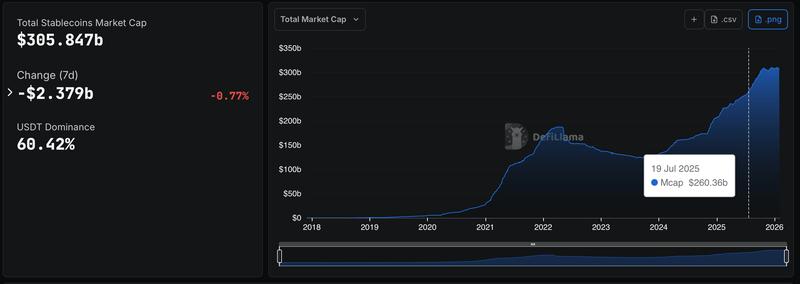

Since the passage of the GENIUS Act in July 2025, the stablecoin market has grown considerably. It has a market capitalization of around $305.8 billion, up from around $260 billion when the law was passed, according to DefiLlama data.