Circle and Polymarket Join Forces for Native USDC Integration

The prediction market platform Polymarket is transitioning away from bridged USDC on Polygon toward native USDC issued by Circle, minimizing dependence on cross-chain bridge technology amid sector growth.

Polymarket has formed a strategic partnership with Circle Internet Group to overhaul the prediction platform's settlement framework by adopting native USDC, moving away from the bridged stablecoin collateral currently employed for trades on the marketplace.

Per Thursday's official announcement, the platform presently utilizes bridged USDC (USDC.e) operating on Polygon for its trading collateral and intends to complete the transition to Circle-issued native USDC (USDC) throughout the coming months. Native USDC represents stablecoins directly issued through Circle's regulated corporate entities and maintains one-to-one redemption capability for US dollars, providing a more "capital-efficient" and expandable solution that eliminates dependence on cross-chain bridge infrastructure.

Cross-chain bridge protocols facilitate token movement across different blockchains through a mechanism that locks digital assets on one network while creating equivalent representations on a separate chain. Nevertheless, establishing secure cross-chain connectivity necessitates certain compromises regarding security parameters, trust requirements or operational flexibility that single-blockchain environments do not encounter.

This infrastructure upgrade will transition Polymarket's collateral system to utilize a stablecoin directly issued and redeemable through Circle, eliminating the need for bridged token representations.

Shayne Coplan, founder and CEO of Polymarket, said using USDC will support "a consistent, dollar-denominated settlement standard that enhances market integrity and reliability as participation on the platform continues to grow."

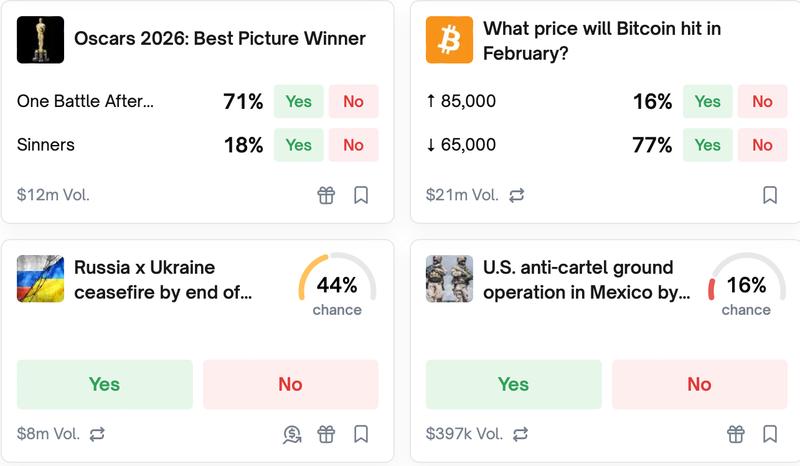

As an onchain prediction marketplace, Polymarket enables participants to trade contractual instruments linked to real-world event outcomes utilizing stablecoins for collateral purposes, encompassing markets focused on cryptocurrency valuations, electoral results and various other occurrences.

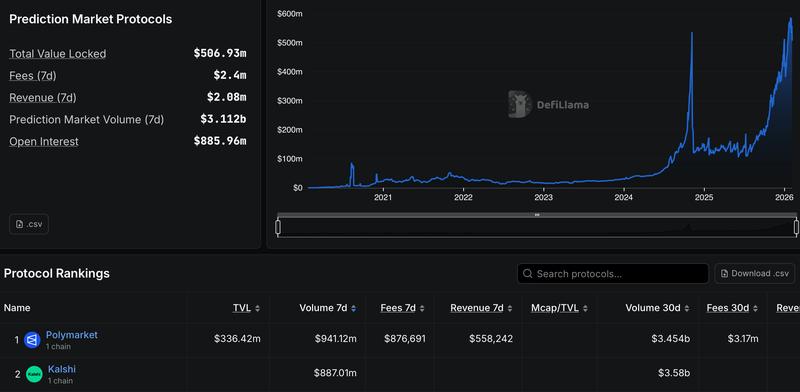

According to data from Defillama, USDC presently holds the position as the second-largest stablecoin in the market behind Tether's USDt (USDT), maintaining a market capitalization of approximately $70.77 billion.

Crypto exchanges push deeper into prediction markets

Although Polymarket and Kalshi continue to dominate as the foremost prediction market platforms, numerous prominent cryptocurrency exchanges have recently made their entrance into this sector.

During mid-December, Gemini unveiled its proprietary prediction market platform, Gemini Predictions, bringing event-based trading capabilities to users across all 50 US states after obtaining regulatory authorization, while Coinbase revealed its own prediction market initiative in collaboration with Kalshi just one day afterward.

This past Tuesday, Crypto.com introduced its prediction markets offering as an independent platform called OG, managed by Crypto.com Derivatives North America and accessible exclusively to users based in the United States.

Retail investment platform Robinhood and sports wagering company DraftKings similarly introduced prediction market offerings throughout 2025, adding further competition to a market segment that initially gained substantial traction during the 2024 US presidential election cycle.

Notwithstanding the expanding appeal of prediction markets, certain market analysts have expressed concerns regarding potential vulnerability to insider trading activities, pointing to cases where traders seemingly generated profits through access to confidential information or by manipulating data sources utilized for establishing market valuations.

State-level authorities in the US have similarly presented regulatory obstacles, with Kalshi encountering legal examination from gaming oversight agencies in Massachusetts, New York and multiple other jurisdictions regarding questions of whether its event-based contracts should be classified as gambling activities.