Cathie Wood's ARK Invest makes $15M Coinbase comeback following major selloff

After divesting over $39 million worth of Coinbase shares just days earlier, ARK Invest has reversed its stance by acquiring approximately $15.2 million in stock distributed across three exchange-traded funds.

Following a recent reduction in its holdings, ARK Invest has resumed accumulating Coinbase Global shares, acquiring approximately $15 million in stock distributed among multiple actively managed exchange-traded funds (ETFs) during Friday's trading session.

According to the firm's daily trading disclosure reports, the investment management company headed by Cathie Wood acquired 66,545 shares of Coinbase via the ARK Innovation ETF (ARKK), an additional 16,832 shares using the Next Generation Internet ETF (ARKW), and another 9,477 shares through the Fintech Innovation ETF (ARKF).

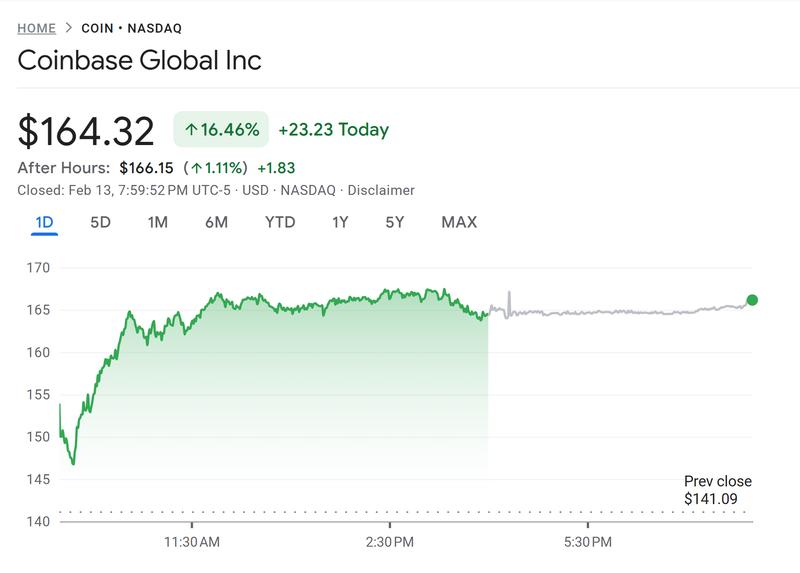

This purchasing activity aligned with a significant upward movement in Coinbase's stock price. The shares concluded the trading day at $164.32, representing an increase of approximately 16.4% during the session, with additional gains appearing in extended-hours trading, based on information from Google Finance. The stock price rally meant the total value of the firm's acquisition reached approximately $15.2 million.

In addition to Coinbase, ARK expanded its holdings in Roblox Corporation, acquiring shares across ARKK, ARKW and ARKF. Roblox finished trading near $63.17 on the New York Stock Exchange during Friday's session.

ARK cuts Coinbase shares across ETFs

During the previous week, ARK Invest decreased its holdings in Coinbase, divesting approximately $17.4 million worth of Coinbase stock on Feb. 5, marking the firm's initial sale this year and the first selloff since August 2025.

Following that transaction, the investment firm proceeded to offload an additional $22 million in Coinbase shares distributed across multiple ETFs on Feb. 6, simultaneously expanding its stake in the digital-asset platform Bullish.

According to Cointelegraph's previous coverage, Coinbase emerged as the primary negative contributor throughout multiple Cathie Wood ARK Invest ETFs during the fourth quarter of 2025, as a widespread cryptocurrency market downturn negatively impacted overall performance. The shares of Coinbase experienced a steeper decline compared to both Bitcoin (BTC) and Ether (ETH) throughout that quarter.

Coinbase posts $667 million Q4 loss

Coinbase disclosed a net loss totaling $667 million during the fourth quarter of 2025, bringing to an end an eight-quarter streak of profitable operations. The company's earnings per share registered at 66 cents, falling short of analyst projections of 92 cents, while total net revenue decreased 21.5% on a year-over-year basis to $1.78 billion. Revenue from transactions declined by nearly 37% to $982.7 million, though revenue from subscription and services segments increased by more than 13% to $727.4 million.

These underwhelming financial results occurred alongside a broader decline in cryptocurrency markets. Coinbase indicated that it produced $420 million in transaction revenue during the early portion of Q1 but anticipates that subscription and services revenue will experience a decline.