BTC Plunges Below $73K to Fresh 15-Month Depths as $800M in Crypto Positions Get Wiped Out

BTC dropped to price levels not witnessed since November 2024, surpassing its earlier low point, as market attention turns toward the $70,000 support zone and potential further decline.

Bitcoin (BTC) experienced its second descent beneath the $73,000 threshold following Wednesday's opening bell on Wall Street as American market participants resumed selling pressure.

Key points:

- Bitcoin continues declining into price ranges unseen since the final months of 2024, breaching Tuesday's previous low point.

- Broader market assets lose momentum as gold and silver surrender their recent upward movements.

- Market participants anticipate potentially deeper long-term Bitcoin price floors in the coming period.

Bitcoin follows precious metals downward after failed recovery attempt

Information from TradingView revealed typical BTC price vulnerability throughout the American trading hours, with bottoms reaching below $72,500 recorded on the Bitstamp exchange.

This performance exceeded the 15-month depths recorded just one day earlier, and an attempted recovery rally pushing above $76,000 proved to be fleeting.

Broader market instruments displayed weakness on all fronts, with the yellow metal unable to hold $5,000 as a floor and American equity indices trending downward at market opening.

BREAKING: Silver prices post a massive reversal, falling nearly -$9/oz in under 3 hours. Gold prices also fall -$220/oz in under 3 hours.

— The Kobeissi Letter (@KobeissiLetter) February 4, 2026

"Crypto remains volatile," trading company QCP Capital wrote in its latest "Asia Color" market update.

According to QCP, the United States government successfully sidestepping another fresh shutdown temporarily was "easing near-term headline risk" for markets.

"In macro, the shutdown overhang has faded, but the key takeaway is how quickly fiscal standoffs can return. Homeland Security funding was only extended through 13 February, keeping another deadline risk in play," it added.

BTC is seeing "bear market price action"

Bitcoin market participants therefore stayed anxious as market uncertainty dominated prevailing sentiment. According to Cointelegraph's reporting, the zone surrounding $50,000 had emerged as a widely anticipated target.

"Ugly interim weekly candle for bulls. IF we close sub 74k - its safe to say 50k area is next," trader Roman wrote in his latest analysis on X.

Notice how volume is high every time price moves down. That tells us when volume comes in - its selling AKA bear market price action!

Market analyst CJ positioned himself for the spot market price to decline by an additional $10,000 or potentially more, contingent upon whether a temporary relief rebound materializes beforehand.

Not sure if it will be a straight shot or we bounce first. But 59-65k is the next major downside level of interest for me. $BTC

— CJ (@CJ900X) February 4, 2026

Previously, Cointelegraph had highlighted a possible safeguard represented by the 200-week exponential moving average (EMA), which is presently positioned near the $68,000 level.

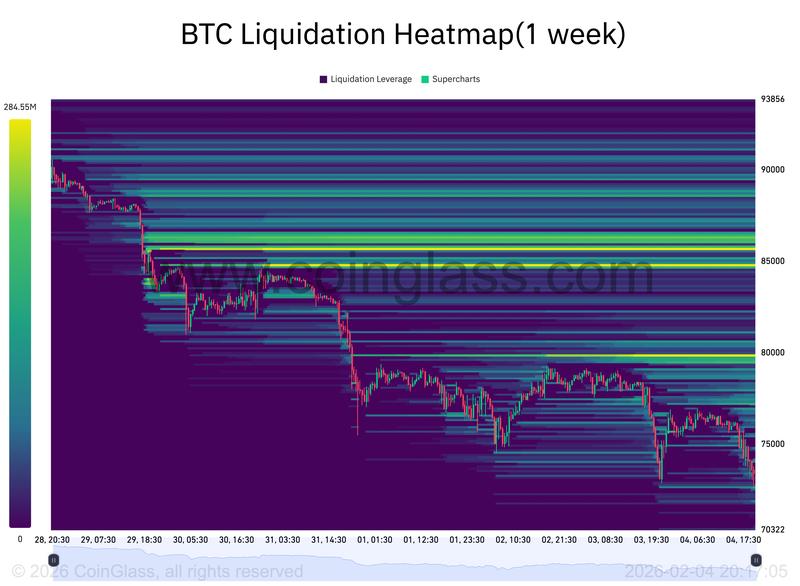

Statistics from tracking platform CoinGlass indicated futures long liquidations accumulating above the $72,000 mark, while aggregate 24-hour cryptocurrency liquidations reached in excess of $800 million.