BTC Open Interest Plunges to November 2024 Levels: Are Traditional Finance Players Exiting Bitcoin?

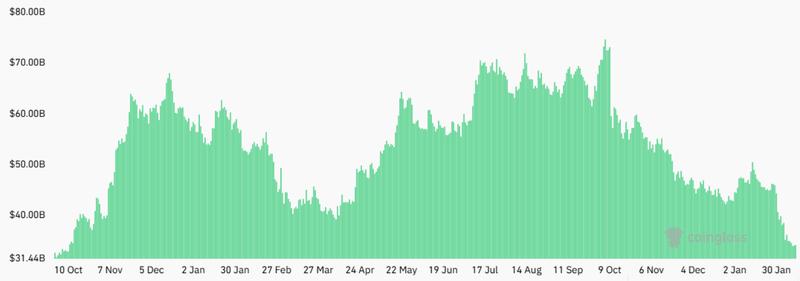

Open interest in Bitcoin derivatives drops to $34 billion amid declining investor appetite and growing focus on concerning macroeconomic indicators from the United States. Are traditional finance institutions withdrawing from BTC?

Key takeaways:

- Open interest in BTC derivatives declines to $34 billion, yet consistent volume measured in Bitcoin terms indicates leverage appetite has not diminished.

- Disappointing employment figures from the US and Bitcoin options positioning point to bearish sentiment, despite gold and equities demonstrating resilience.

The price of Bitcoin (BTC) has failed to maintain momentum above the $72,000 threshold throughout the previous seven days, prompting market participants to wonder if institutional appetite has dried up. Total open interest across Bitcoin futures markets dropped to levels not witnessed since November 2024, intensifying concerns about a potential retracement toward the $60,000 support zone amid mounting uncertainty.

Total open interest across BTC futures contracts reached $34 billion on Thursday, representing a 28% contraction compared to the previous 30-day period. Nevertheless, when evaluated in Bitcoin-denominated terms, this measurement stays essentially unchanged at BTC 502,450, indicating that appetite for leveraged positions has not genuinely weakened. A portion of this reduction can also be traced to forced liquidations, which amounted to $5.2 billion throughout the preceding two-week period.

Weak bullish leverage demand confirms BTC's worrisome market decoupling

Market participants are growing more dismayed by the absence of a definitive trigger for Bitcoin's 28% pullback during the past month, particularly given that gold surpassed the $5,000 psychological barrier and the S&P 500 index traded merely 1% beneath its record peak. Certain market observers contend that this risk-off sentiment originates from developing indications of fragility within the United States employment sector.

According to data released by the US Labor Department on Wednesday, the American economy generated merely 181,000 jobs in 2025, representing a figure below earlier estimates. Nevertheless, the White House has minimized these worries. As reported by the BBC, administration representatives maintain that the deceleration in population expansion resulting from its immigration strategies has diminished the quantity of employment positions the US must generate.

The unprecedented 52% collapse Bitcoin experienced on March 13, 2020, transpired amid the height of COVID-19 pandemic concerns, which foresaw a spike in unemployment claims. Should economic expansion currently face jeopardy, the probability increases that the US Federal Reserve will reduce interest rates earlier than projected. Such action decreases capital expenses for corporations and alleviates borrowing conditions for individual consumers, providing context for the equity market resilience observed throughout 2026.

The absence of conviction in Bitcoin becomes apparent through the insufficient appetite for bullish leverage strategies, rendering the divergence from conventional markets increasingly concerning.

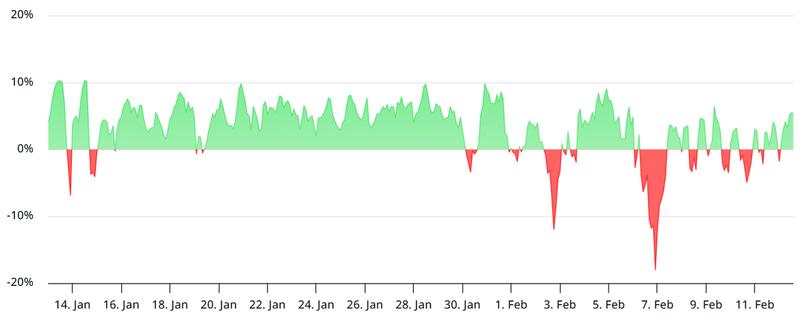

The annualized funding rate across Bitcoin futures positions remained beneath the neutral 12% benchmark throughout the preceding four-month span, indicating trepidation. Consequently, despite the metric's recovery from the negative territory observed during the previous week, bearish traders maintain their advantage. Institutional market participants continue showing reluctance toward accepting downward price risk exposure, as evidenced by Bitcoin options trading activity.

The delta skew for BTC options at Deribit climbed to 22% on Thursday as protective put (sell) contracts commanded elevated premiums. During typical market conditions, this measurement should fluctuate within a -6% to +6% range, demonstrating equilibrium between optimistic and pessimistic risk sentiment. This skew indicator most recently turned bullish during May 2025 when Bitcoin recaptured the $93,000 price point following a test of $75,000 support.

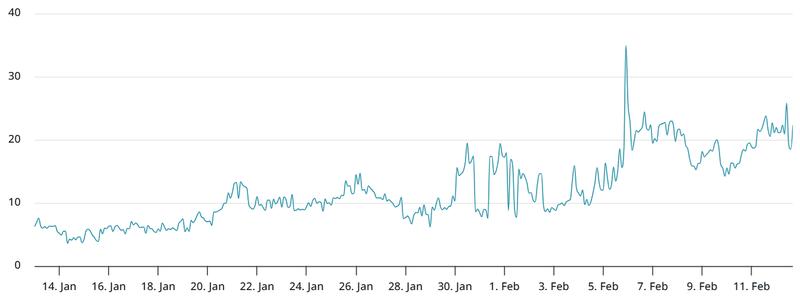

Despite derivative indicators showing fragility, the $5.4 billion mean daily transaction volume across US-listed Bitcoin exchange-traded funds (ETFs) challenges the notion of diminishing institutional participation. Though forecasting the catalyst that will encourage buyers to demonstrate conviction remains impossible, Bitcoin's potential recovery most likely hinges on enhanced clarity regarding labor market dynamics in the United States.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.