BTC Drops Below $73K Amid US Equity Market Turbulence: Expert Claims Price Movement Remains 'Within Normal Parameters'

Bitcoin's value dropped beneath the $73,000 threshold as liquidations in futures markets surged and concerns about upcoming US corporate earnings reports sparked a broader equity market downturn. The question remains: will market participants seize the opportunity to purchase BTC at these reduced levels?

On Tuesday, Bitcoin (BTC) descended to a fresh 2026 low, reaching $72,945 as bullish market participants were unable to defend the $80,000 threshold as a support level. Looking at performance since the beginning of the year, Bitcoin is currently showing a 15% deficit and continues to trade approximately 45% below its record high of $126,267, sparking concerns among market participants that the cyclical upward trend for BTC might have concluded.

Turbulent market conditions in United States equity markets are being cited as a potential catalyst behind the widespread selling pressure across cryptocurrency markets. Starting from the conclusion of the fourth quarter of 2025, market participants began raising questions about the sustainability of expenses tied to artificial intelligence infrastructure development, alongside the elevated fundraising rounds and company valuations that accompanied them.

Market participants harbor concerns that actual product demand and revenue generation could fail to meet industry forecasts, and this deteriorating market sentiment is evident in the performance of the Magnificent 7 technology stocks, in addition to the S&P 500, DOW and NASDAQ indices, which are presently experiencing declines ranging from 0.70% to 1.77%.

Leading artificial intelligence companies, NVIDIA and Microsoft experienced respective declines of 3.4% and 2.7% throughout the trading session, while Amazon experienced a 2.67% decrease. With over 100 companies within the S&P 500 index scheduled to release their quarterly earnings reports during the current week, the volatility observed early in the week could be interpreted either as a reflection of investor apprehension or as an indication of developments that may materialize after earnings figures are disclosed.

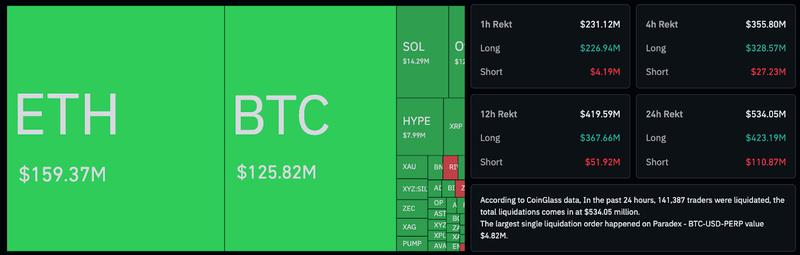

Looking at the cryptocurrency market specifically, forced liquidations of leveraged trading positions are contributing additional downward pressure to the selling momentum, with long positions in BTC experiencing $127.25 million in forced closures and ETH long positions registering $159.1 million in liquidations.

Despite numerous market analysts proposing that Bitcoin is currently valued at a substantial discount, visible buying activity from retail market participants and institutional investors such as Strategy has proven insufficient to halt the continued selling pressure. According to Joe Burnett, who serves as Strive's vice president of Bitcoin strategy, the current "price action is still sitting within historical norms at $74,000."

Burnett provided further context by noting that the "45% Bitcoin drawdown aligns closely with historical volatility," while emphasizing that the "volatility of this magnitude remains a symptom of a rapidly monetizing asset."

Should the selling pressure persist, current orderbook data for Bitcoin (BTC/USDT, Binance) sourced from TRDR.io indicates accumulating buy orders spanning from $71,800 down to $63,000. The crucial unknown factor is whether traders will actually execute purchases within that price range, and there is strong likelihood that macroeconomic factors not specific to cryptocurrencies and developments connected to traditional stock markets will remain the primary forces influencing Bitcoin's price trajectory.