BTC Dips Below $64K Amid Historic Sell-Off: Analysts Debate Where Support Lies

As Bitcoin falls beneath the $64,000 threshold amid unprecedented selling pressure, market experts caution that further downside may be ahead. Can onchain metrics validate forecasts pointing to prices below $60,000?

Over the course of four days, Bitcoin (BTC) experienced a substantial 13% decline, dropping from $79,300 to reach $63,844. The cryptocurrency is now changing hands beneath the $69,000 mark, which represented the peak of the 2021 bull cycle and is widely considered an important support threshold.

This price decline coincided with a significant reduction in derivatives market participation, as open interest for BTC futures contracts decreased by over $10 billion during the preceding seven-day period.

Market observers are currently examining long-term technical parameters and blockchain-based metrics that could indicate a significant inflection point for BTC.

Key takeaways:

- A 13% four-day decline has pushed Bitcoin beneath the previous cycle's peak around $69,000 following a significant deleveraging event.

- Analysis points to a critical Bitcoin accumulation area spanning $58,000 to $69,000, backed by substantial transaction volume and the 200-week moving average.

- Technical and sentiment readings showing oversold conditions indicate selling pressure could be approaching exhaustion for BTC, regardless of whether a bounce materializes soon.

The significance of the $69,000 threshold for Bitcoin

The $69,000 price point marks where Bitcoin reached its highest level during the 2021 bull run. Throughout Bitcoin's history, previous cycle peaks have typically functioned as areas of support when markets turned bearish. During the most recent downturn, Bitcoin found its low near the 2017 peak of $19,600 before experiencing a brief descent to approximately $16,000 during November 2022.

The present decline beneath $69,000 could be replicating this historical behavior. That said, examination of previous market cycles reveals that prices have the potential to breach former peaks before establishing a definitive low. This reality maintains the possibility of additional downside for BTC.

André Dragosch, Bitwise European Head of Research, observed that a substantial portion of recent trading activity has taken place within the $58,000 to $69,000 corridor. This price band also corresponds with the 200-weekly moving average positioned near $58,000, strengthening its status as a critical area of demand.

At the same time, cryptocurrency analyst exitpump pointed out that substantial BTC buy orders are present in exchange order books within the $68,000 to $65,000 range, indicating accumulation interest during price declines.

Bitcoin displays unprecedented oversold conditions

Market analyst Subu indicated that the weekly relative strength index (RSI) for Bitcoin has dropped below the 30 threshold. This oversold level has been reached on just four previous occasions, and following each instance, BTC experienced an average price increase of 16% during the subsequent four-day window.

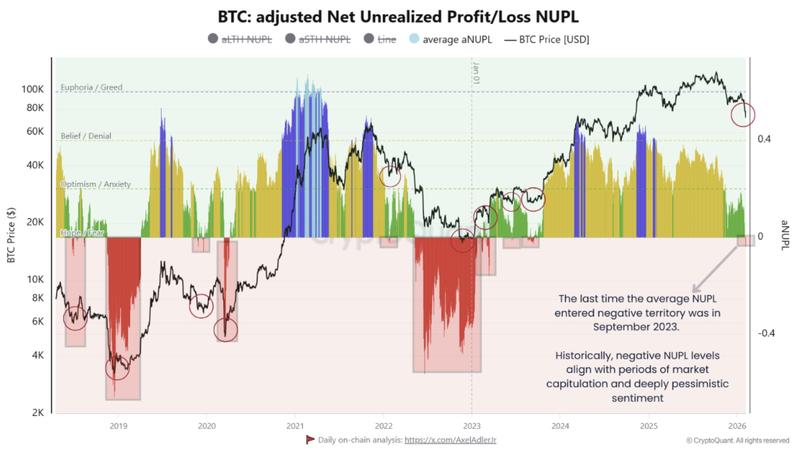

Additionally, crypto analyst I. Moreno highlighted that the adjusted net unrealized profit/loss (aNUPL) indicator has crossed into negative territory for the first time since 2023. This development indicates that the typical Bitcoin holder is currently experiencing unrealized losses. Comparable market conditions during 2018–2019, 2020, and 2022–2023 each preceded price recoveries for BTC.

Even though a short-term relief rally may not materialize right away, Moreno emphasized that the present "speed of sentiment deterioration" is considerably faster compared to what occurred in previous market cycles. The analyst added,

"This rapid transition suggests an acute sentiment reset rather than a gradual decline, potentially shortening the capitulation phase."