BitMine accumulates 40,613 ETH amid market downturn while treasury approach encounters significant losses

BitMine, supported by Tom Lee, purchased more than 40,000 ETH throughout the previous week's market downturn, reinforcing its Ether accumulation approach even as unrealized losses reach billions of dollars.

BitMine Immersion Technologies, an Ether-focused treasury firm, substantially expanded its ETH reserves throughout the market correction that occurred last week, demonstrating persistent confidence in its extended-horizon approach even as paper losses continue to accumulate.

The firm made public on Monday its purchase of 40,613 Ether (ETH) throughout the preceding week, pushing its aggregate reserves beyond 4.326 million ETH, which carries an approximate valuation of $8.8 billion based on prevailing market rates.

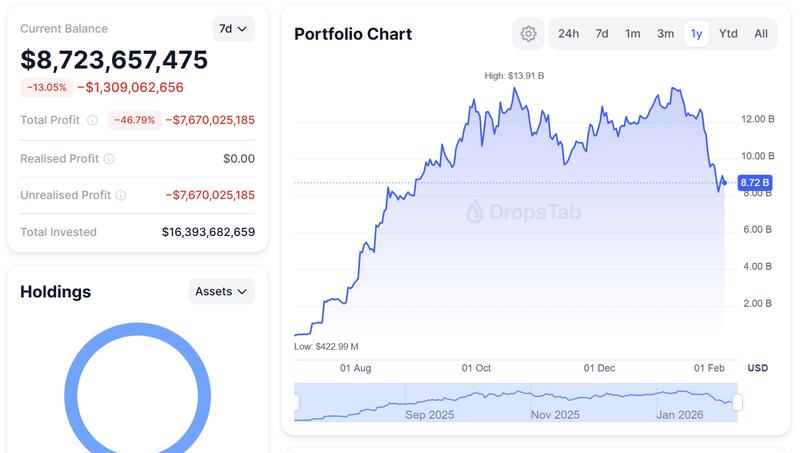

Notwithstanding this continued accumulation, BitMine currently finds itself substantially below breakeven on its Ether holdings, based on information from DropsTab data.

A substantial share of these reserves, specifically 2,873,459 ETH, has been staked within the Ethereum network. ETH that is staked becomes locked in order to contribute to blockchain security, and earns staking rewards distributed as supplementary Ether in exchange, supplying the firm with an income stream derived from yield generation.

The firm announced on Monday that its combined cryptocurrency holdings, total cash reserves and "moonshots" carry a valuation of $10.0 billion. The company concluded the November 2025 quarter holding digital assets worth $10.6 billion, based on regulatory filing documentation.

While BitMine's approach to treasury management has attracted detractors, the firm maintains positive operating cash flow derived from Ethereum staking rewards as well as from its established immersion-cooled data center business operations, which deliver infrastructure support for high-performance computing applications.

Tom Lee, BitMine chairman and co-founder along with chief investment officer of Fundstrat Global Advisors, has stood behind the approach, maintaining that the firm is fundamentally structured to mirror the valuation trajectory of Ether. Consequently, both its portfolio metrics and equity performance are anticipated to decline throughout wider market corrections and rebound in tandem with ETH price recoveries.

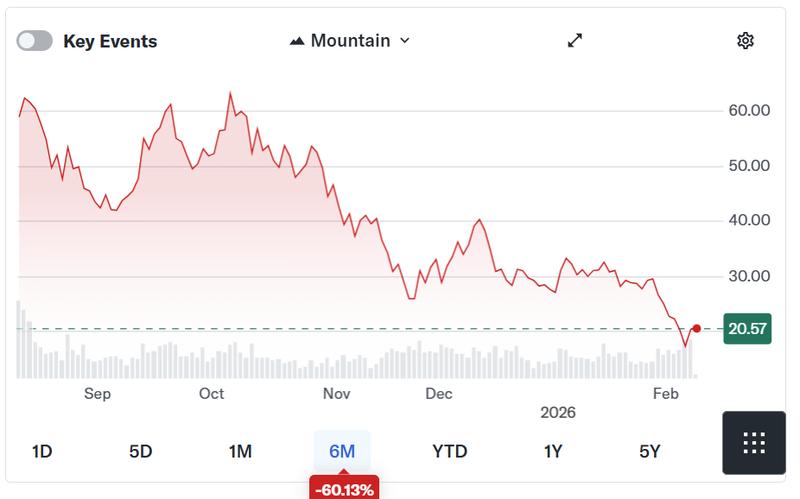

This price fluctuation has manifested clearly in BitMine's equity performance. The company's shares have declined by more than 31% throughout the most recent month and approximately 60% across the preceding six months.

Forced liquidations escalate, yet Ether treasury firms refrain from selling

The price of Ether, together with the wider cryptocurrency marketplace, has experienced severe pressure from substantial liquidations following an October flash crash that catalyzed approximately $19 billion in forced liquidation events. Market valuations have persisted in a continuous downward trajectory from that point forward, with intensified selling pressure materializing in successive waves extending through November and resurfacing in late January.

As previously documented by Cointelegraph, the extended period of market turbulence led Ether-centered investment firm Trend Research to materially decrease its ETH allocation as an element of a comprehensive risk-mitigation approach.

Nevertheless, the majority of Ether treasury enterprises have thus far declined to liquidate positions during market weakness. Sector data demonstrates that although no enterprise besides BitMine Immersion Technologies has expanded its Ether reserves throughout the past 30 days, the more than two dozen corporations maintaining ETH on their financial statements have predominantly preserved their existing positions.

The solitary outlier was Quantum Solutions, which disposed of approximately 600 ETH throughout the identical timeframe, based on CoinGecko data.