BitGo shares tumble beneath IPO pricing following initial trading surge

The cryptocurrency custody platform experienced a turbulent market entrance, highlighting evolving market attitudes and increased examination of fresh stock offerings amid challenging conditions in digital asset markets.

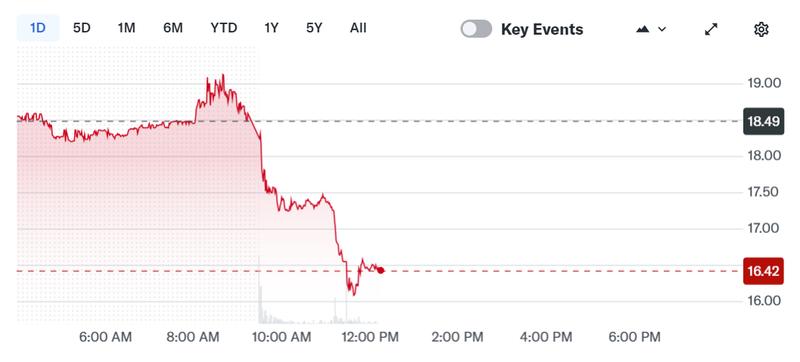

Stock in cryptocurrency custody provider BitGo Holdings (BTG) has experienced dramatic fluctuations following the firm's Thursday debut on the New York Stock Exchange, as early trading gains rapidly dissipated when initial public offering excitement waned and market participants sought to secure their returns.

The company set its initial public offering price at $18 per share, and the stock surged approximately 25% during its inaugural trading session, demonstrating robust initial investor appetite. Although BitGo's shares closed with only a slight increase following the first complete trading day, this upward movement was fleeting.

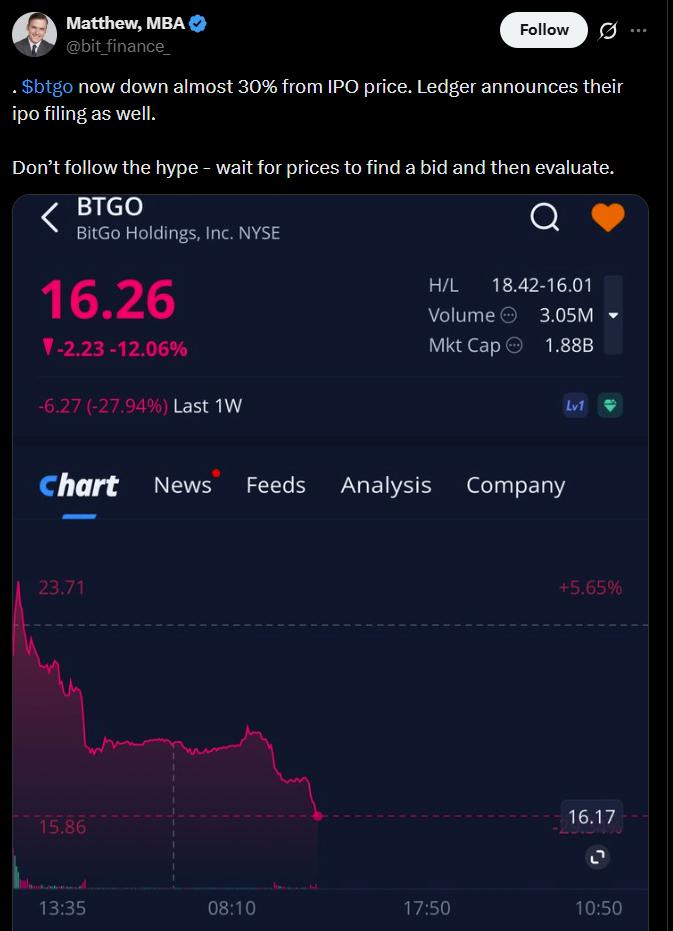

The stock has subsequently dropped beneath the IPO offering price, sliding as much as 13.4% during Friday's trading session, based on information from Yahoo Finance.

This market turbulence seems to stem from investors capturing gains after the opening day's spike, the comparatively small public float characteristic of recently debuted companies, and wider concerns about cryptocurrency-linked stocks, which have demonstrated susceptibility to dramatic price swings as market participant attitudes continue to evolve.

BitGo received a $2 billion valuation at its IPO price point.

According to earlier coverage from Cointelegraph, BitGo initially announced its plans to pursue a public listing in September 2025, following the submission of required regulatory documentation to the US Securities and Exchange Commission. The company, which specializes in providing digital asset custody and infrastructure solutions, maintains custody of more than $90 billion in assets through its platform.

Crypto IPO momentum continues despite market pressure

Multiple prominent cryptocurrency firms are purportedly evaluating public market debuts notwithstanding ongoing market challenges, demonstrating sustained optimism regarding long-term investor appetite.

This week, the Financial Times disclosed that Ledger, a manufacturer of hardware wallets, is evaluating a potential US initial public offering that could achieve a valuation surpassing $4 billion.

Concurrently, cryptocurrency trading platform Kraken has recently secured $800 million in funding at a $20 billion company valuation, generating fresh conjecture regarding a possible IPO. The exchange's co-CEO Arjun Sethi has indicated the organization is not accelerating toward a public market debut.

Nevertheless, recent initial public offering results have been mixed. According to data compiled by Bloomberg, equity shares of firms that completed public listings in 2025 have delivered returns below the S&P 500 benchmark, with medium-sized public offerings facing the greatest difficulties.

"The biggest takeaway is that we're firmly back in a fundamentals-driven market. Investors have become far more selective, and companies must enter the market with a sharper story and stronger operational direction."

Mike Bellin, IPO expert at PwC