Bitcoin's Recent Downturn Represents 'Weakest Bear Case' Ever, Bernstein Maintains $150K Price Forecast for 2026

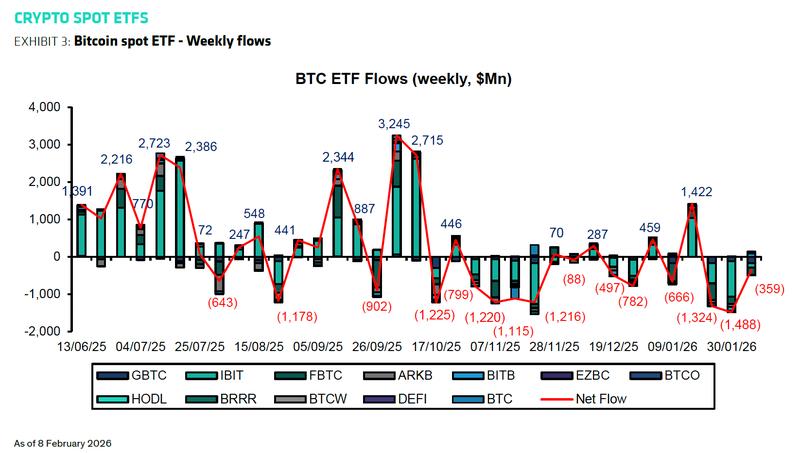

Research firm points to constrained liquidity and macroeconomic headwinds as primary factors behind Bitcoin's decline, observing that spot Bitcoin ETFs have experienced only moderate outflows.

Research analysts at Bernstein stood by their $150,000 price projection for Bitcoin (BTC) on Monday, despite the recent downturn that they characterized as stemming from diminished investor sentiment rather than fundamental market weaknesses.

Describing this correction as the "weakest bear case" in the digital asset's entire history, the research note distributed to investors highlighted that no significant failures have materialized within Bitcoin's underlying market infrastructure, and emphasized that spot Bitcoin ETFs have experienced only modest net outflows of approximately 7% despite BTC experiencing a roughly 50% price decline.

"The current Bitcoin price action is a mere crisis of confidence. Nothing broke, no skeletons will show up," analysts led by Gautam Chhugani said.

According to Bernstein, Bitcoin's recent lag in performance when compared to gold demonstrates its ongoing categorization as a risk asset sensitive to liquidity conditions rather than as a store of value for the long term. The research team noted that restrictive monetary conditions and higher interest rates have created favorable conditions for equities connected to artificial intelligence and precious metals, constraining Bitcoin's potential for near-term gains despite increasing mainstream acceptance.

The analysis also challenged a number of the emerging bearish narratives, including worries that artificial intelligence is redirecting investment capital away from cryptocurrency or that quantum computing represents an immediate existential risk to Bitcoin. Bernstein wrote:

Framing quantum computing as a Bitcoin-killer ignores the timeline, the upgrade path and the fact that the entire digital world shares the same vulnerability and will migrate together.

With respect to leverage positions held by prominent corporate Bitcoin holders like Michael Saylor's Strategy, Bernstein noted that the firm depends primarily on long-duration perpetual preferred equity instruments and retains sufficient cash reserves to satisfy dividend obligations without facing immediate refinancing pressure.

Additionally, the research team anticipates Bitcoin miners will face capitulation and begin selling as the asset's price drops beneath their cost of production.

Following their examination of the current bearish narratives in circulation, Bernstein forecasted that Bitcoin will probably climb back to new record highs once liquidity conditions begin to ease. The firm reaffirmed its $150,000 Bitcoin price projection for 2026.

Institutional Players See Bitcoin Decline as Buying Opportunity While Traders Signal Potential for Additional Losses

Last Friday, Bitwise CEO Hunter Horsley indicated that Bitcoin's drop beneath $70,000 is generating divergent reactions throughout the marketplace, with veteran holders exercising caution while institutional market participants interpret the correction as a fresh opportunity to enter positions.

During an appearance on CNBC, Horsley explained that institutional investors are reconsidering price points they had previously assumed were no longer accessible. He characterized the downturn as resulting from wider macroeconomic stress rather than cryptocurrency-specific challenges, noting Bitcoin is moving in tandem with other liquid assets as market participants "sell everything that is liquid."

Although Horsley presented the sell-off as a macro-influenced repositioning event, short-term market participants continue to express skepticism regarding Bitcoin's immediate price direction.

This past Sunday, independent market analysts Filbfilb and Tony Severino drew attention to technical indicators they believe continue to suggest additional downward movement, while other market participants contended that an "authentic bottom" might not materialize until Bitcoin descends below $50,000.

Bitcoin achieved an unprecedented peak exceeding $126,000 on Oct. 6, but has subsequently declined to approximately $70,000 at the time of this writing, based on CoinGecko data.