Bitcoin Miner Cango Secures $75.5M in Strategic Shift Toward AI Infrastructure

The capital injection comes after the company divested $305 million worth of Bitcoin holdings and grants a major investor nearly 50% voting control as Cango reorganizes its financial structure during market turbulence.

Cryptocurrency mining firm Cango announced the completion of a previously disclosed $10.5 million equity investment from Enduring Wealth Capital Limited, while also securing commitments for an additional $65 million in equity funding from entities controlled by company chairman Xin Jin and director Chang-Wei Chiu.

The Thursday announcement revealed that the $10.5 million capital infusion was finalized via the distribution of seven million Class B shares at a unit price of $1.50. These shares possess 20 votes apiece, elevating Enduring Wealth Capital's voting influence to 49.7% from its previous 36.7%, though the firm's economic stake stays under 5% of total outstanding shares.

The supplementary $65 million in capital will be secured through the distribution of approximately 49 million Class A shares, each carrying a single vote, priced at $1.32 per share. These investments originate from entities under full ownership of Jin and Chiu and are contingent upon standard closing requirements, including clearance from the New York Stock Exchange. Cango stated it anticipates finalizing these transactions within the current month.

Upon completion of the deal, Chiu is expected to control roughly 12% of all outstanding shares and approximately 6.7% of total voting power, whereas Jin would possess around 4.7% of shares and 2.6% of voting authority.

This capital raise comes on the heels of Cango's Feb. 9 divestiture of 4,451 Bitcoin (BTC) for approximately $305 million, with the proceeds allocated to partially settle a Bitcoin-collateralized loan and decrease financial leverage.

According to the company, this divestment represents part of a comprehensive strategic transition toward artificial intelligence and high-performance computing, with intentions to repurpose its worldwide, grid-connected mining facilities to deliver distributed computational capacity for the artificial intelligence sector.

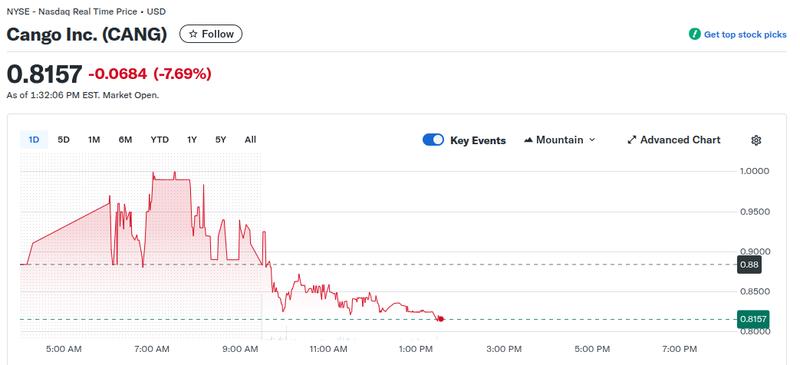

At the time of publication, Cango's share price had decreased approximately 7.7%, based on Yahoo Finance data. The sector-tracking CoinShares Bitcoin Mining ETF experienced a 3.8% decline.

Earnings misses and BTC volatility pressure mining sector

The capital raising effort by Cango arrives after substantial drops in publicly listed Bitcoin mining companies during the previous week. CleanSpark experienced approximately 19% losses during standard trading hours on Feb. 5 and suffered an additional 8.6% decline in after-hours trading following disappointing quarterly results, while IREN tumbled roughly 11.5% during regular hours and plunged another 18.5% after hours subsequent to reporting revenues beneath analyst projections and posting a quarterly net deficit.

Meanwhile, RIOT Platforms and MARA Holdings experienced declines of approximately 15% and 19%, respectively.

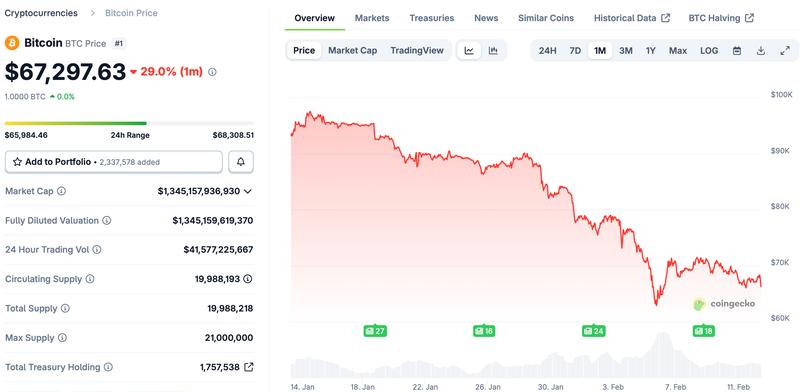

The widespread selling in mining equities occurred alongside a significant downturn in Bitcoin's valuation, which plummeted roughly 12% on the identical day, falling from approximately $71,426 to $62,822, according to data from CoinGecko.

Substantial Bitcoin movements were also observed during this timeframe. On Feb. 5, wallets associated with mining operations transferred 28,605 BTC, valued at roughly $1.8 billion, representing one of the most significant single-day withdrawals since November 2024, based on CryptoQuant data. An additional 20,169 BTC was moved the subsequent day.

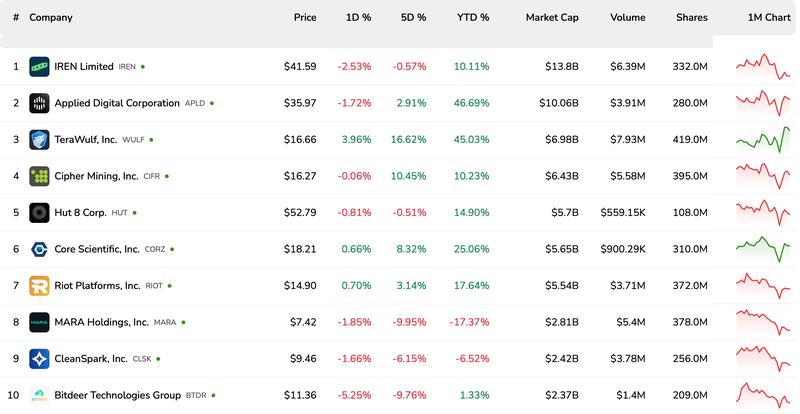

Despite numerous Bitcoin mining companies experiencing significant losses during the previous week, a considerable number of these stocks have posted gains for the year. IREN, which leads Bitcoin miners by market capitalization, has advanced approximately 10% year-to-date.

The best-performing stocks include Applied Digital and TeraWulf, which have each surged roughly 45% year-to-date, while Core Scientific has climbed about 25% and Riot Platforms has advanced approximately 17%. Hut 8 has appreciated nearly 15% during the identical timeframe.

Among the top 10 Bitcoin mining equities ranked by market capitalization, only MARA Holdings and CleanSpark are currently posting negative returns year-to-date. MARA has declined roughly 17% for the year, while CleanSpark has fallen about 6.5%, based on data provided by BitcoinMiningStock.io.