Bitcoin ETFs See $562M Recovery Following Last Week's $1.5B Exodus Amid Persistent Challenges

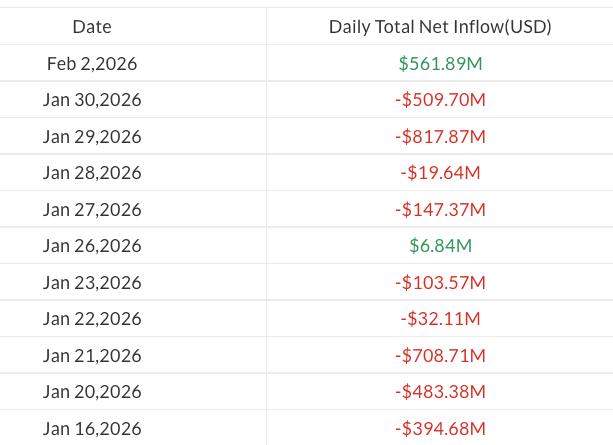

US-listed spot Bitcoin ETFs recorded $562 million in net inflows on Monday, providing partial relief from the prior week's $1.5 billion in outflows, though Ether ETFs continued experiencing withdrawals.

Exchange-traded funds tracking Bitcoin (ETF) witnessed yet another rally on Monday despite a turbulent market landscape for BTC and the wider cryptocurrency sector.

US-listed spot Bitcoin (BTC) ETFs attracted approximately $562 million in net capital on Monday, ending a consecutive four-day period of outflows. Last week saw withdrawals totaling $1.5 billion, based on information from SoSoValue data.

However, despite this positive momentum, market analysts issued warnings that ETFs and the wider financial markets are expected to encounter ongoing headwinds stemming from institutional asset liquidation and macroeconomic ambiguity, with short-term price floors potentially holding around the ETF cost basis threshold of $84,000.

Monday's capital influx occurred as Bitcoin staged a comeback following a brief drop beneath the $75,000 mark during the weekend, climbing to a session peak exceeding $79,000, based on CoinGecko data.

Bitcoin ETFs at $1 billion outflows year-to-date

Monday's incoming capital of $562 million represents a significant portion of the year-to-date net outflows from spot Bitcoin ETFs, which totaled $1 billion through Tuesday.

Year-to-date figures show aggregate outflows have climbed to $4.6 billion, which have been partially counterbalanced by $3.6 billion in incoming capital, per SoSoValue data.

Meanwhile, Ether (ETH) ETFs failed to attract any positive flows on Monday, instead recording modest outflows totaling $2.9 million.

ETF flow cost basis now underwater, says Galaxy Digital's Alex Thorn

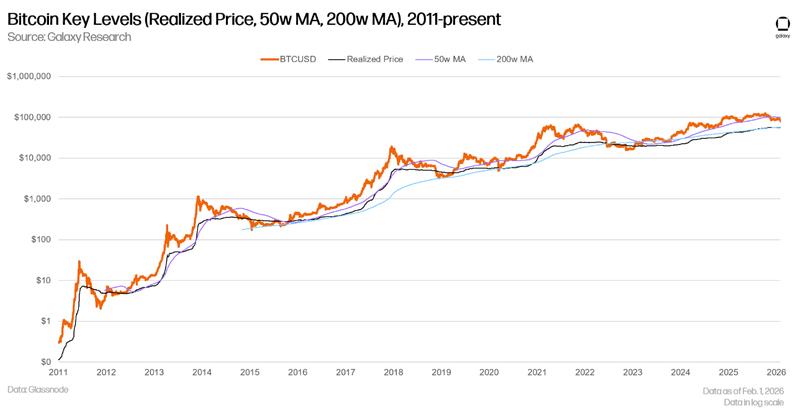

Beyond the capital exodus, Bitcoin's market price has dropped beneath the ETF flow cost basis level, according to Alex Thorn, Galaxy Digital's head of research, who shared insights in a market commentary on X on Monday.

"BTC is currently trading 7.3% lower than the average ETF create cost basis ($84k), though it traded as low as 10% below that level on Saturday, Jan. 31," Thorn observed, further stating:

"BTC hasn't traded below the average ETF create cost basis since summer and early fall 2024, when it reached as low as -9.9%. It's reasonable to expect this level to serve as near-term support."

Thorn additionally highlighted Bitcoin's realized price sitting at $56,000, observing that BTC has traditionally discovered price support "around or slightly below" this threshold preceding a bull market.

CoinShares head of research James Butterfill indicated that markets are confronting disadvantageous capital movement patterns, Bitcoin's divergence from worldwide money supply patterns, geopolitical friction and ambiguity surrounding US monetary policy following Kevin Warsh's appointment as Federal Reserve Chair.

"In the long term, however, the outlook remains constructive, as structural concerns about currency depreciation persist and the current lag behind liquidity trends signals potential for catch-up," Butterfill added.

CoinShares disclosed on Monday that cryptocurrency exchange-traded products experienced an additional $1.7 billion in withdrawals throughout last week, representing a twofold increase in outflows compared to the preceding week.