ARK Invest Offloads $17M Worth of Coinbase Holdings Amid 37% Stock Decline This Year

Cathie Wood's ARK Invest divested $17.4 million worth of Coinbase stock while simultaneously acquiring $17.8 million in Bullish shares, marking a significant strategic pivot amid turbulent cryptocurrency markets.

The investment firm ARK Invest, headed by well-known Bitcoin advocate Cathie Wood, has reversed course from accumulating to divesting Coinbase stock, amid a 13% decline in the shares that pushed them to their lowest levels in several months.

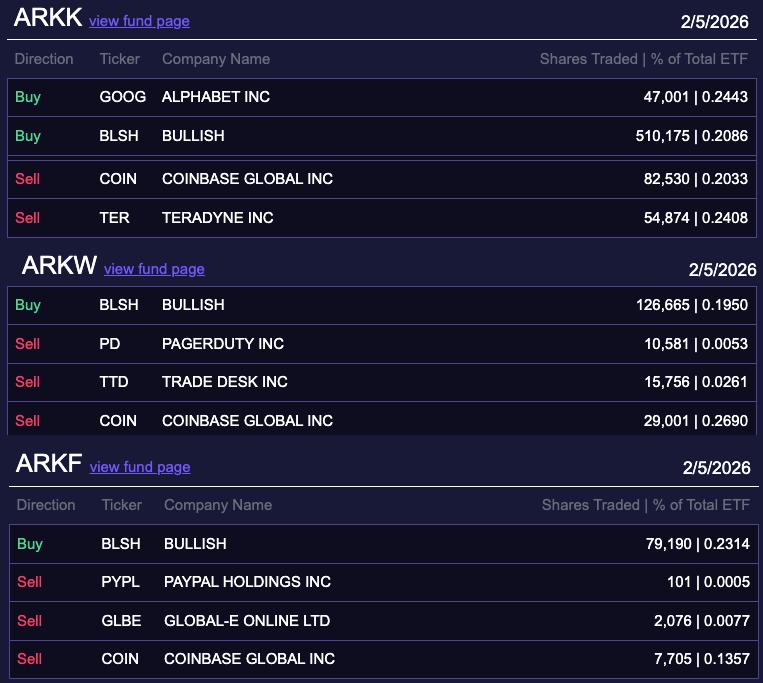

During Thursday's trading session, ARK disposed of 119,236 shares of Coinbase (COIN) stock, representing approximately $17.4 million in value, based on trade documentation reviewed by Cointelegraph.

The divestment occurred merely one day following a small purchase of 3,510 shares (worth $630,000) on Tuesday, which came after a sequence of acquisitions at elevated price points during the early part of 2026.

The transaction represents ARK's initial Coinbase divestment in 2026 and marks the first sale since August 2025, indicating a change in the firm's trading approach. The digital currency exchange's stock has declined approximately 37% year-to-date, based on Nasdaq trading data.

ARK divested Coinbase holdings and acquired Bullish stock

ARK deployed nearly an identical sum to what it divested from Coinbase holdings to purchase 716,030 shares (worth $17.8 million) of Bullish (BLSH), a digital asset platform designed for institutional investors that began trading on the New York Stock Exchange in August 2025.

Following its trading debut, Bullish stock had declined more than 60% to reach $24.9 at Thursday's market close, based on NYSE trading data.

ARK ranked among the most significant purchasers during Bullish's initial public offering, sharing that distinction with asset management titan BlackRock.

ARK maintains $312 million position in Coinbase stock

ARK's most recent Coinbase divestment occurs during a pronounced cryptocurrency market downturn, with Bitcoin (BTC) falling beneath the $70,000 threshold on Thursday before momentarily dropping to $60,000 on Friday.

For ARK, which has been a substantial supporter of Coinbase throughout challenging market periods, this action represents a significant change in direction.

Currently, ARK continues to maintain $312 million worth of Coinbase stock distributed among its three investment funds — the ARK Innovation ETF (ARKK), ARK Next Generation Internet ETF (ARKW) and ARK Fintech Innovation ETF (ARKF), with COIN accounting for 3.7%, 3.4%, and 4.95% of each respective fund.

From its April 2021 initial trading launch, Coinbase shares have decreased roughly 60%, falling from an initial opening price of $381, according to Nasdaq trading data.