Anchorage Digital Secures $100M Strategic Investment from Tether

Tether's equity stake deepens its collaboration with Anchorage Digital as the federally chartered crypto bank pursues significant fundraising in preparation for a possible public market debut.

Anchorage Digital has received a strategic equity injection of $100 million from Tether, solidifying the relationship between the federally regulated cryptocurrency bank based in the US and the leading stablecoin issuer.

In a Thursday announcement from Tether, the company revealed that the financial commitment strengthens the ongoing partnership between the two firms, which already encompasses Anchorage Digital's function as the issuing entity behind USAt, a stablecoin that went live on Jan. 27.

The USAt stablecoin maintains a peg to the US dollar and was created specifically to function within the United States in compliance with the federal payment stablecoin regulatory framework put in place through the GENIUS Act in July 2025.

Established in 2017 and headquartered in San Francisco, Anchorage Digital Bank holds the distinction of being the first digital asset bank in the United States to receive a federal charter, offering institutional clients a comprehensive suite of services including custody solutions, settlement operations, staking capabilities and stablecoin issuance.

The equity investment was executed through Tether Investments, the investment division of the stablecoin company that operates out of El Salvador, and follows recent reports indicating that Anchorage Digital is currently pursuing a capital raise ranging between $200 million and $400 million in anticipation of a possible initial public offering scheduled for next year.

As the entity behind USDt (USDT), Tether operates the world's most dominant stablecoin measured by market capitalization, with approximately $185 billion currently in circulation, representing roughly 60% of the entire stablecoin market, based on data from DefiLlama.

Tether invests on the back of huge profit margins

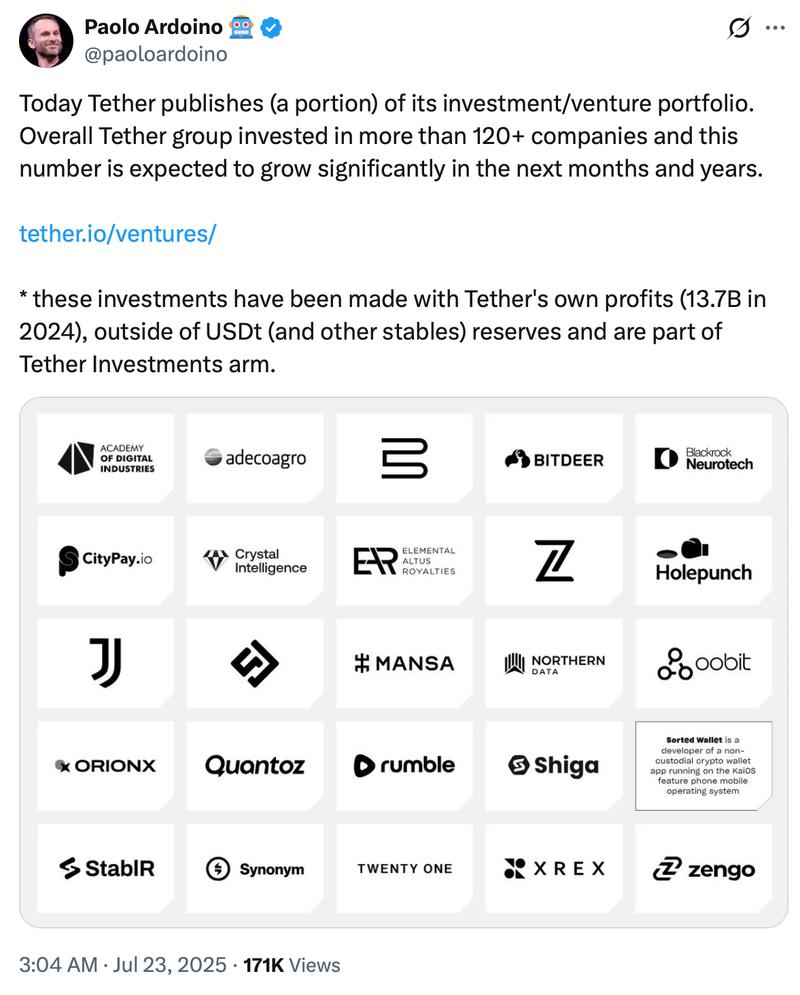

The stablecoin giant disclosed net profits exceeding $10 billion throughout 2025 and excess reserves totaling $6.3 billion, as detailed in its fourth-quarter attestation published in January. These financial results underscore the enormous scale of Tether's financial resources and provide context for its recent string of acquisitions and strategic investments.

During a July statement, CEO Paolo Ardoino revealed that Tether had deployed capital into more than 120 different companies utilizing its own profit reserves, noting that the investment portfolio was anticipated to expand considerably throughout the coming months and years.

During November, Tether allocated funds to Ledn, a financial services platform specializing in consumer lending products secured by Bitcoin (BTC). This investment came on the heels of news reports suggesting that Tether was also considering a substantial $1.15 billion stake in Neura, a German company specializing in robotics technology.

One month following that transaction, the company spearheaded an $8 million funding round for Speed, a Bitcoin-focused payments enterprise dedicated to facilitating enterprise-level stablecoin transactions through the Lightning Network infrastructure.

Beyond equity investments, Tether has been actively expanding its Bitcoin treasury holdings. On Jan. 1, the company revealed it had purchased 8,888 Bitcoin during the final days of 2025, increasing its aggregate holdings to exceed 96,000 BTC, as confirmed by Ardoino.

Despite Tether's status as a privately owned entity, its Bitcoin holdings would position it as the second-largest corporate Bitcoin holder among publicly traded companies, based on information compiled by BitcoinTreasuries.NET.