AI Infrastructure Emerges as True 'Supercycle,' Not Cryptocurrency: Industry Expert

Investment in artificial intelligence data centers is overshadowing the anticipated crypto supercycle, with Bitcoin mining operations redirecting funds toward high-performance computing facilities.

Following extensive discussion within certain segments of the cryptocurrency sector, Bitcoin and other digital currencies are approaching a much-anticipated "supercycle" — a term commonly understood to describe a prolonged, fundamentally-powered expansion that extends well past a conventional market period.

As the renowned Magnificent Seven technology behemoths are expected to allocate over $600 billion collectively toward artificial intelligence initiatives throughout the current year, Bitcoin (BTC) mining operations with involvement in AI and high-performance computing are similarly increasing their capital expenditures.

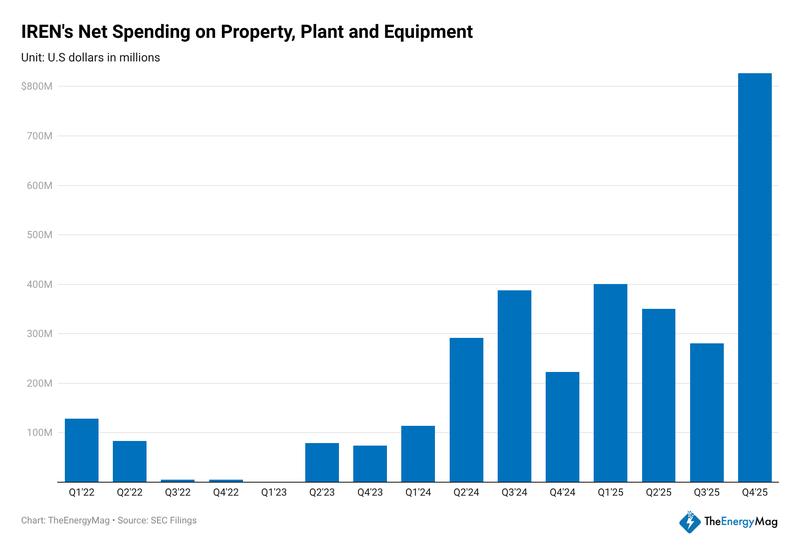

A notable case is IREN, previously operating under the name Iris Energy, a publicly-traded Bitcoin mining company on Nasdaq that has broadened its operations to include AI data center facilities.

During its latest quarterly report, IREN disclosed approximately $800 million in net expenditures on property, plants and equipment. Based on TheEnergyMag's evaluation, the enterprise "allocated more capital within a twelve-month period, constructing AI data center infrastructure and acquiring GPU hardware than it invested over three years building out its Bitcoin mining operations following its initial public offering."

Bitcoin mining: An industry in transition

IREN represents just one among multiple established Bitcoin mining firms that have pivoted dramatically toward AI and high-performance computing, partially to broaden their revenue streams amid progressively tightening mining profit margins. Additional companies implementing comparable approaches include MARA Holdings, Riot Platforms, HIVE Digital Technologies and Bitdeer Technologies.

The previous year likely represented one of the most difficult stretches for the Bitcoin mining sector, as plummeting revenue streams converged with mounting debt obligations. This downturn came after a significant decline in Bitcoin's market value that commenced in October 2025. Following a peak that exceeded $126,000, Bitcoin experienced a consistent decline and temporarily dropped beneath the $60,000 threshold in February.

Bitdeer, having published its fourth quarter 2025 financial performance on Thursday, stated the timeframe "represented a strategic inflection point as we accelerated our transition toward high-performance compute infrastructure and colocation services."

Chief business officer Matt Kong indicated that the company's energy portfolio will serve as a strategic advantage as "We expect the global AI infrastructure supply / demand imbalance to widen," as stated in a company announcement.

Frank Holmes, CEO of HIVE Digital Technologies, has recently explained why the current environment may represent a critical juncture for mining companies to diversify into AI.

Bitcoin miners are winning the AI data center arms race

He stated in a Forbes editorial, contending that large-scale artificial intelligence facilities require multiple years to construct, whereas mining operations already possess power resources, land assets and data center infrastructure that can be converted for high-performance computing applications.