Aave Labs requests $50M in funding to channel product revenues toward DAO treasury

In a new proposal, Aave Labs suggests channeling product revenues to the DAO treasury while seeking approval for Aave V4 through an updated revenue structure.

A funding proposal worth approximately $50 million has been submitted to Aave tokenholders by Aave Labs, with the company offering to channel all revenues generated from Aave-branded products directly into the Aave DAO treasury in exchange for approval.

The funding package encompasses as much as $42.5 million in stablecoin allocations — with $25 million designated as an upfront grant and an additional $17.5 million conditional upon achieving product milestones. Additionally, the proposal incorporates 75,000 Aave (AAVE) tokens, valued at approximately $8 million based on current market prices. Subject to approval, the stablecoin allocations would be distributed gradually over time, with milestone-based payments unlocking as products are successfully launched.

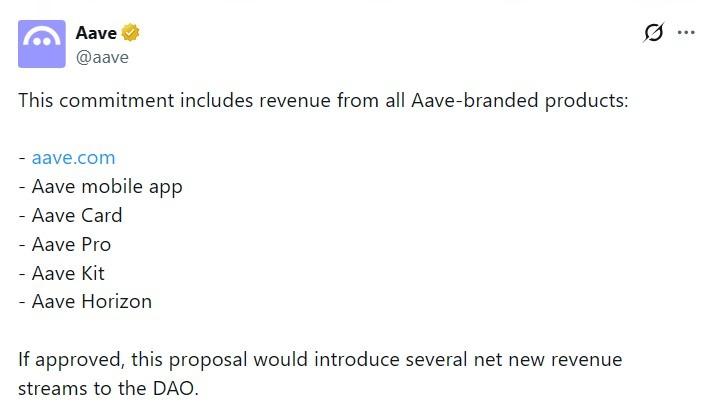

As consideration for this funding, Aave Labs has committed to directing 100% of product-generated revenue toward the DAO. This encompasses revenue streams from aave.com, the forthcoming Aave App and Aave Card, Aave Pro, Aave Kit and Aave Horizon. Beyond revenue redirection, the framework seeks tokenholder approval to establish Aave V4 as the protocol's permanent technical infrastructure and includes provisions for establishing a foundation entity responsible for holding and managing the Aave brand.

This proposal represents a fundamental transformation in Aave's value capture and distribution mechanisms. The plan would centralize both protocol and product revenues under DAO governance while transitioning Aave Labs toward a DAO-supported operational structure following several months of governance-related friction.

Governance concerns over voting power

Several community participants have raised questions about the funding proposal. Marc Zeller, who founded the Aave Chan Initiative, noted that the approximately $50 million package constitutes a substantial allocation from the DAO treasury.

Zeller advocated for separating the vote into distinct proposals addressing revenue alignment, V4 ratification, foundation establishment and funding independently.

Additionally, Zeller requested more precise definitions of what constitutes "revenue" and called for independent auditing of product income directed to the DAO. He expressed particular concern regarding the 75,000 Aave token allocation, emphasizing that governance tokens confer voting rights. According to Zeller, any entities receiving DAO tokens should publicly disclose their wallet holdings.

Separately, cryptocurrency analyst DefiIgnas characterized the proposal as a "big compromise" that AAVE token holders "should like," while acknowledging that enhanced transparency regarding governance voting power associated with the 75,000 AAVE grant would be beneficial.

According to Aave Labs, the proposal represents a transition toward a "token-centric" framework that synchronizes value accumulation with the DAO. Stani Kulechov, founder of Aave, stated on X that channeling product revenue to the DAO would enhance its ability to support growth and additional initiatives.

This would position the DAO to fund growth, increase buybacks, and pursue other opportunities as it sees fit.

Stani Kulechov

Proposal follows rejected IP vote

This proposal emerges on the heels of another contentious governance matter that occurred recently. On Dec. 26, a proposal seeking to transfer ownership of the protocol's brand assets to a DAO-controlled entity was defeated by Aave tokenholders, with the majority casting votes in opposition to the measure.

On Jan. 3, Kulechov presented a comprehensive strategy focused on expanding beyond decentralized finance (DeFi) lending operations and reexamining how revenue generated outside the protocol flows to token holders.

The present proposal codifies key components of that strategic vision, bundling revenue consolidation, V4 ratification and the creation of a new foundation structure into a unified strategic framework.

The Temp Check serves as a mechanism to assess community sentiment prior to advancing to a formal binding vote. Should it receive sufficient support, the proposal would progress through subsequent governance phases before any capital is disbursed.