$55 Billion Drop in BTC Open Interest Over Past Month: Where Is Bitcoin Headed?

Bitcoin futures market participants have significantly scaled back their positions amid ongoing price weakness and consecutive year-to-date lows. Cointelegraph examines what traders anticipate for BTC's price trajectory.

Bitcoin's (BTC) continued difficulty maintaining levels above $70,000 persisted through Wednesday, sparking worries that a decline into the $60,000 territory might be the upcoming destination. The downturn was marked by liquidations in the futures marketplace, open interest (OI) for BTC declining by $55 billion throughout the last 30 days, and growing Bitcoin deposits flowing into exchanges.

The ongoing price deterioration has sparked debate among analysts regarding whether cryptocurrency-specific dynamics or broader macroeconomic challenges represent the primary catalyst behind the sell-off and its potential implications for BTC's near-term outlook.

Key takeaways:

- Approximately 744,000 BTC in open interest departed from major exchanges during a 30-day period, representing roughly $55 billion at prevailing prices.

- BTC futures cumulative volume delta (CVD) declined by $40 billion throughout the preceding 6-month timeframe.

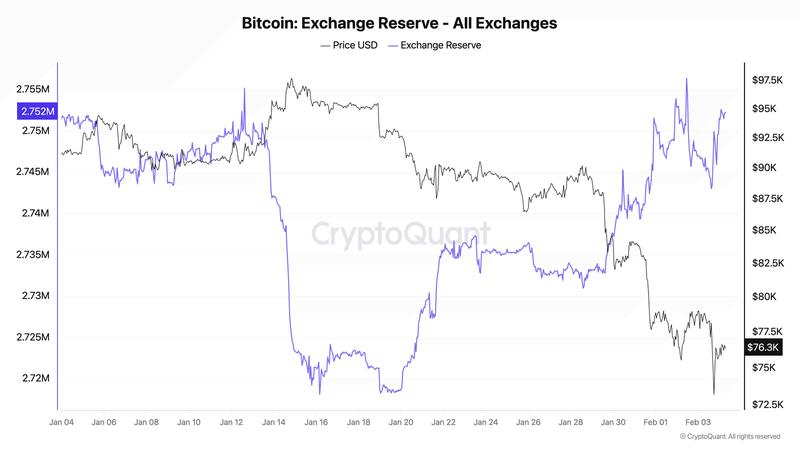

- Cryptocurrency exchange reserves have increased by 34,000 BTC starting from mid-January, elevating the short-term supply risk.

Dramatic decline in BTC open interest signals extensive deleveraging

Data from CryptoQuant revealed that Bitcoin's 30-day open interest transformation demonstrates a significant reduction across multiple exchanges, indicating widespread position unwinding, rather than merely newly established short positions.

At Binance, the net open interest decreased by 276,869 BTC during the previous month. Bybit experienced the most substantial drop at 330,828 BTC, whereas OKX witnessed a reduction of 136,732 BTC on Tuesday.

Collectively, approximately 744,000 BTC in open positions were unwound, corresponding to more than $55 billion at present prices. This reduction in open positions aligned with Bitcoin's descent beneath $75,000, suggesting deleveraging as a primary catalyst, rather than solely spot selling.

Onchain analyst Boris emphasized that the cumulative volume delta (CVD) data demonstrates market sell orders remain dominant, especially on Binance, where derivatives CVD hovers near -$38 billion throughout the past six months.

Additional exchanges display differing dynamics: Bybit's CVD leveled off near $100 million following a severe December liquidation event, while HTX reached stability at -$200 million in CVD as the price consolidates around $74,000.

Rising exchange flows intensify pressure while analysts monitor critical levels

Concurrently, Bitcoin deposits to exchanges experienced a surge in January, reaching approximately 756,000 BTC, with Binance and Coinbase leading the way. From early February onward, inflows have surpassed 137,000 BTC, highlighting traders' repositioning and not necessarily leaving the market.

Regarding the supply perspective, analyst Axel Adler Jr. observed that exchange reserves have climbed from 2.718 million BTC to 2.752 million BTC since Jan. 19. The analyst cautioned that persistent growth exceeding 2.76 million BTC could amplify selling pressure. The analyst believed that a complete capitulation is yet to take place, which may happen at lower price levels.

Market analyst Scient stated Bitcoin is improbable to establish a bottom in a single day or week. Sustainable market bottoms may emerge through two to three months of consolidation near the major support zones, with higher time frame indicators. Scient noted that whether this structure forms in the high $60,000 range or the low $50,000 level remains unclear.

Bitcoin Trader Mark Cullen maintains his view of potential downside toward $50,000 in a broader macro scenario, but expects a short-term reversion toward the local point of control ($89,000 to $86,000) after BTC swept weekly lows below $74,000 on Tuesday.