VistaShares debuts new ETF combining US Treasuries with Bitcoin options strategy

BTYB, now trading on the NYSE, invests predominantly in United States Treasury securities while employing options-based strategies to generate weekly returns and exposure linked to Bitcoin.

An actively managed exchange-traded fund called BTYB has been introduced by VistaShares, with trading now available on the New York Stock Exchange. The fund directs the majority of its capital into United States Treasury securities while utilizing options-based approaches to deliver weekly returns and exposure connected to Bitcoin price performance.

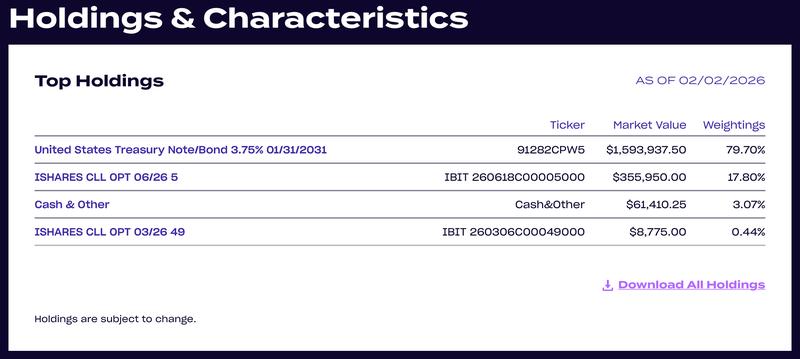

The Tuesday announcement revealed that approximately 80% of the fund's holdings consist of US Treasury securities and instruments related to them, while the other 20% maintains connection to Bitcoin (BTC) price fluctuations via a synthetic covered call approach. Data regarding the fund's holdings indicates that its Bitcoin-related exposure originates from call options on the iShares Bitcoin Trust (IBIT) managed by BlackRock.

Within this specific framework, a synthetic covered call approach utilizes derivative instruments to establish exposure to Bitcoin pricing while simultaneously selling call (buy) options against such exposure for the purpose of income generation, as opposed to maintaining direct Bitcoin holdings. Consequently, BTYB does not mirror spot Bitcoin pricing and caps potential upside gains in return for enhanced income derived from options premiums.

According to VistaShares, the ETF is designed to provide approximately twice the yield offered by the five-year Treasury, although distributions are not guaranteed and could fluctuate on a weekly basis based on prevailing options market conditions and movements in interest rates.

As a United States-based ETF issuer, VistaShares concentrates on actively managed funds that utilize options strategies and thematic investment exposures as opposed to conventional passive index tracking approaches.

Crypto ETF issuers expand beyond single-token products

Additional issuers have similarly introduced exchange-traded funds within the United States that combine Bitcoin with other assets or wider cryptocurrency collections, demonstrating increasing experimentation that extends beyond funds focused on single assets.

Two spot crypto index ETFs received approval from the United States Securities and Exchange Commission (SEC) on Dec. 19, 2024, authorizing Hashdex's Nasdaq Crypto Index US ETF for trading on Nasdaq alongside Franklin Templeton's Franklin Crypto Index ETF for listing on Cboe BZX Exchange. Each of these funds maintains holdings in spot Bitcoin and Ether (ETH) while tracking their corresponding crypto index benchmarks.

Bitwise Asset Management introduced the Bitwise Proficio Currency Debasement ETF in January, representing an actively managed fund that maintains positions in Bitcoin, precious metals and mining equities with the objective of counteracting the eroding purchasing power of fiat currencies.

Exchange-traded funds that track a more diverse array of cryptocurrencies are also experiencing increased interest. Hashdex expanded its Crypto Index US ETF in September to incorporate XRP (XRP), Solana (SOL) and Stellar (XLM). The fund, which is listed on Nasdaq, maintains holdings in five cryptocurrencies on a 1:1 basis, encompassing Bitcoin and Ether, as stated by the company.

Two US-regulated cryptocurrency index ETFs were introduced by 21Shares in November 2025: the 21Shares FTSE Crypto 10 Index ETF and the 21Shares FTSE Crypto 10 ex-BTC Index ETF. Each of these funds follows FTSE Russell crypto indexes and maintains portfolios consisting of large-capitalization digital assets.