Trend Research offloads more than 400K ETH amid growing liquidation concerns

The investment firm Trend Research has been decreasing its Ether holdings as the price of ETH approached the company's crucial liquidation thresholds situated below $1,700.

The Ethereum-focused investment entity Trend Research has persisted in lowering its exposure to Ether, driven by the recent market downturn that compelled the treasury firm to liquidate holdings in order to settle outstanding debts.

On Sunday, the company possessed approximately 651,170 Ether (ETH) in the format of Aave Ethereum wrapped Ether (AETHWETH). This figure declined by 404,090 units, reaching roughly 247,080 by Friday, as of the latest reporting.

Since the month began, Trend Research has moved 411,075 ETH to the Binance cryptocurrency exchange, based on information from Arkham, a blockchain data analytics platform.

These asset movements coincided with a nearly 30% decline in ETH price over the previous seven days, bottoming out at $1,748 on Friday, per CoinMarketCap data. At the moment of publication, it was changing hands at $1,967.

Trend Research continues risk management as ETH liquidation level approaches

The investment vehicle Trend Research has connections to Jack Yi, who established Liquid Capital, a Hong Kong-based cryptocurrency venture capital firm. Yi built up his Ethereum investment company's position through a strategy of buying ETH on exchanges, deploying it as collateral on the Aave platform to secure stablecoin loans, and then utilizing those borrowed funds to purchase additional ETH.

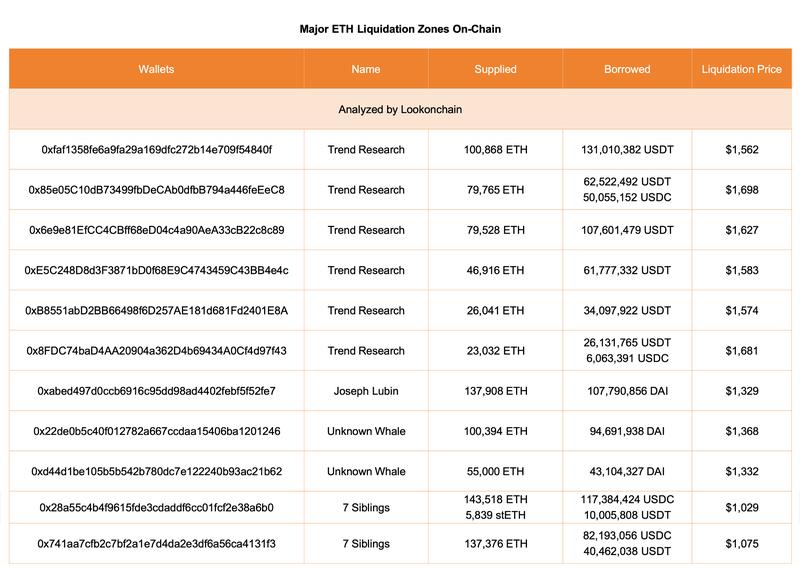

According to a Friday post on X from Lookonchain, a blockchain analytics platform, Trend Research is confronting several ETH liquidation price points ranging between $1,698 and $1,562.

In a Thursday post on X, Yi stated that he maintains an optimistic outlook despite acknowledging that he prematurely identified a floor in cryptocurrency valuations, and expressed his intention to continue awaiting a market rebound while "managing risk."

The spotlight turned to Trend Research in the days following the October 2025 liquidation event valued at $19 billion, a period when the investment company commenced its assertive Ether acquisition strategy.

By December, Trend Research's holdings would have positioned it as the third-largest holder of Ether, however, as a privately held company not listed publicly, it does not show up on the majority of crypto tracking platforms.

Meanwhile, Bitmine, which holds the title of the largest publicly traded corporate holder of Ether, was registering approximately $8 billion in paper gains on Friday.