The Collision of Digital Assets and Politics at Davos: Key Insights

The 2026 Davos forum highlighted cryptocurrency's movement into mainstream finance, even as officials from central banks warned about risks to monetary control.

Despite the World Economic Forum's 2026 gathering being dominated by geopolitical conflicts and the developing Greenland situation, cryptocurrency emerged as an important secondary storyline with significant implications.

During his appearance at Davos, US President Donald Trump dedicated a portion of his remarks to reinforcing his vision of making the United States the global hub for cryptocurrency and expressing backing for legislative measures favorable to the industry.

The president's perspective stood in sharp contrast to positions taken by central banking institutions. During a discussion featuring prominent crypto industry leaders, France's central bank chief offered criticism of privately-issued currencies and stablecoins that generate yield, while advocating for central bank digital currencies (CBDC) instead.

The forum didn't produce unified agreement on cryptocurrency matters, but it clearly exposed a fundamental divide. American political leaders positioned digital assets as strategic geopolitical tools, while a prominent European central banking official cautioned that privately controlled money systems pose dangers to financial stability and national sovereignty.

The following represents the key cryptocurrency-related insights from the 2026 Davos gathering.

Trump positions crypto oversight as competitive international challenge

In his Wednesday address at Davos, Donald Trump expressed optimism about signing legislation establishing crypto market structure "very soon."

The legislation, commonly referred to as the CLARITY Act, had been scheduled for markup proceedings in the US Senate the previous week but faced postponement following withdrawal of endorsement from major cryptocurrency firms including Coinbase.

The president characterized regulatory action on cryptocurrency in the United States as an issue of pressing geopolitical significance.

"It is politically popular but much more importantly, we have to make it so that China doesn't have a hold of it, and once they get that hold, we won't be able to get it back. So I'm honored to have done it," Trump said, referring to his signing of the GENIUS Act. He linked the bill to the importance of the pending market structure legislation.

The current administration views establishing the United States as the world's cryptocurrency center as a priority and treats regulatory frameworks as instruments of global competition. While Trump recognized that final congressional action remains pending, his comments suggested passage was simply a question of when.

BlackRock's Larry Fink, who leads the planet's largest asset management firm, provided the introduction for the US president's special remarks. Trump delivered remarks exceeding an hour in duration; cryptocurrency represented just a minor portion of his overall address.

Coinbase chief executive and French monetary official disagree on sovereignty questions

Among the most widely circulated cryptocurrency-related exchanges at Davos occurred when the head of France's central banking system challenged the crypto industry's positions, despite expressing support for tokenization during a Wednesday panel conversation.

François Villeroy de Galhau, who serves as Governor of the Banque de France, predicted that tokenization and stablecoins will likely represent "the name of the game" throughout 2026, noting their potential to upgrade financial infrastructure. He recognized tokenization as a significant advancement in finance, especially within wholesale market applications, and highlighted Europe's CBDC initiatives as leading worldwide efforts.

His positive tone shifted substantially when the conversation moved to questions of monetary sovereignty. Brian Armstrong, serving as CEO of Coinbase, characterized Bitcoin (BTC) as a contemporary alternative to historical gold-based monetary systems and described it as a constraint on democratic governments' deficit spending tendencies.

In response, Villeroy de Galhau argued forcefully that monetary systems and sovereignty cannot be separated. Transferring monetary authority to privately-controlled frameworks would represent an abandonment of democratic functions, according to his view.

Armstrong countered by highlighting Bitcoin's decentralized architecture to argue that it operates with even greater independence than traditional fiat currency systems, describing the disagreement as a "healthy competition," a characterization that elicited laughter from Villeroy de Galhau.

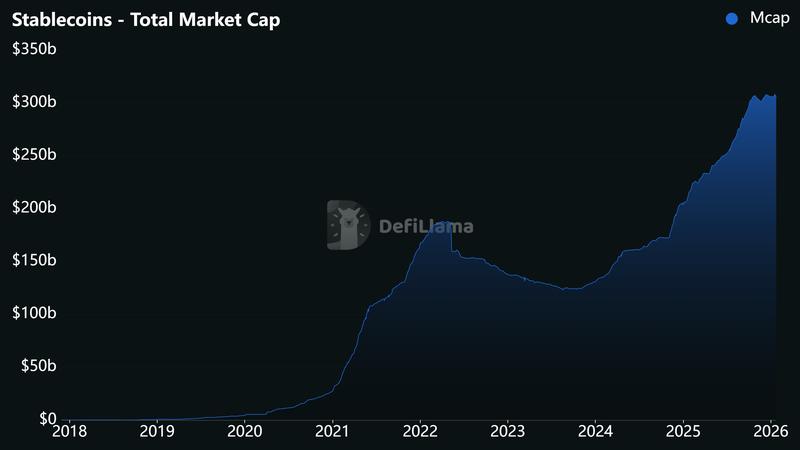

The French central banker also expressed opposition to stablecoins that pay interest to holders, arguing that such instruments could undermine stability in current financial systems. American crypto industry executives countered that offering rewards remains essential for stablecoins to maintain competitiveness against China's CBDC initiatives.

Binance keeps possibility of US market re-entry open

Richard Teng, serving as Binance co-CEO, declined to eliminate the possibility of re-establishing operations in the United States. During a CNBC interview conducted on the margins of the Davos gathering, he indicated the exchange is adopting a "wait-and-see" strategy.

While Teng refrained from making specific commitments while keeping options available, Ripple CEO Brad Garlinghouse offered more direct predictions in his own interview with the network. Garlinghouse forecasted that Binance would ultimately return to what he described as a "very large" marketplace.

The company introduced Binance.US during 2019 as a structurally separate organization designed to accommodate American customers. However, according to accusations from US regulatory authorities, Binance maintained service for select "VIP" customers through its international platform, culminating in a 2023 settlement with the Department of Justice. Company founder Changpeng Zhao entered a guilty plea to charges of failing to maintain an effective Anti-Money Laundering program, completed a prison sentence and subsequently received a presidential pardon from President Trump.

Zhao attended the Davos forum as well and participated in a Thursday panel conversation, where he asserted that cryptocurrency has demonstrated its permanence.

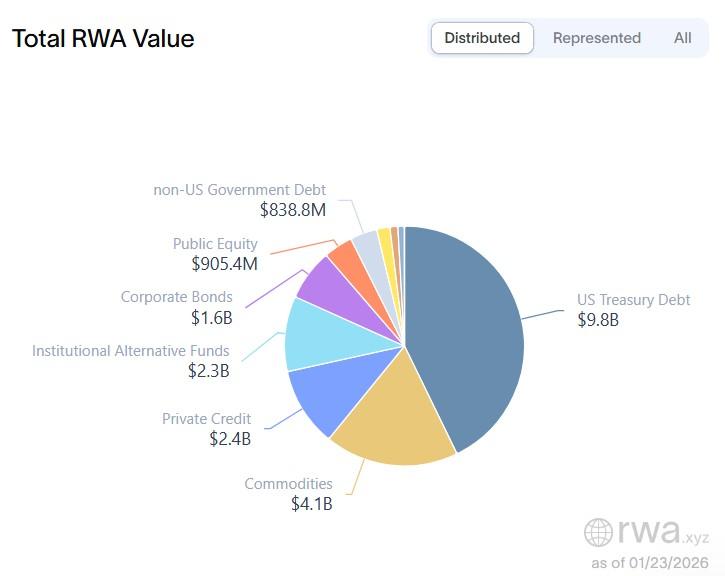

Despite appearing on different panels, Zhao's views on tokenization aligned with those of the Bank of France's Villeroy de Galhau, identifying it as representing the industry's upcoming phase, alongside artificial intelligence applications and payment systems.

According to Zhao, he is engaged in conversations with numerous government entities about tokenizing state-controlled assets as a mechanism to release value and channel it toward economic development initiatives.

Circle's Allaire rejects banking system instability concerns

During a Thursday panel at Davos, Jeremy Allaire, who serves as CEO of Circle, rejected concerns that stablecoins offering interest payments could create instability within the banking sector.

Characterizing worries about bank runs as "totally absurd," Allaire contended that the financial incentives at play are insufficient in scale to pose threats to monetary policy effectiveness or trigger mass deposit withdrawals.

According to his analysis, interest payment mechanisms serve predominantly as tools for retaining customers rather than forces capable of creating systemic disruption.

Allaire proceeded to reference government-sponsored money market funds as a relevant historical precedent. Notwithstanding recurring warnings throughout multiple years, approximately $11 trillion in capital has moved into money market fund vehicles without producing a collapse in bank lending activity, according to his account.

Lending activity, he maintained, is already undergoing a transition away from traditional banking institutions toward private credit markets and capital market mechanisms, a shift occurring independently of stablecoin development.

Davos insights reveal cryptocurrency sector's current priorities

The reputation of stablecoins among the general public suffered severe damage during 2022, following the Terra ecosystem's collapse involving losses totaling billions of dollars. The catastrophic failure originated with TerraUSD (UST), an algorithmic stablecoin design supported by the network's native token, LUNA.

Since that period, stablecoins have successfully reversed the prevailing narrative. The topic now commands attention at the yearly assembly of the globe's most influential figures in geopolitics and economic policy. Even central banking officials who typically maintain skeptical positions toward the cryptocurrency sector recognize stablecoins as central themes deserving observation alongside tokenization developments.

The 2026 Davos gathering confirmed that stablecoins and tokenization have secured their place within this year's policy discourse. The United States executive branch and European banking authorities continue to hold fundamentally different philosophical positions regarding appropriate approaches, and regulatory progress remains limited by domestic political constraints.