Technical Analysis Points to $50 SOL: Three Charts Reveal Classic Bearish Formation

Multiple timeframe analysis reveals Solana has confirmed a traditional head-and-shoulders formation, suggesting a potential decline toward the $50 price level.

The native token of the Solana network, SOL, has experienced a significant 38% decline throughout the past month, reaching a two-year bottom of $67 on Friday. Several market analysts are convinced that the selling pressure hasn't concluded for this seventh-ranked digital asset, with bearish price projections ranging down to $30.

Key takeaways:

- Solana's head-and-shoulders pattern targets a SOL price of $50 or lower.

- MVRV bands point to a potential bottom, but support at $75 must hold.

Bearish confirmation sends Solana toward $42 target

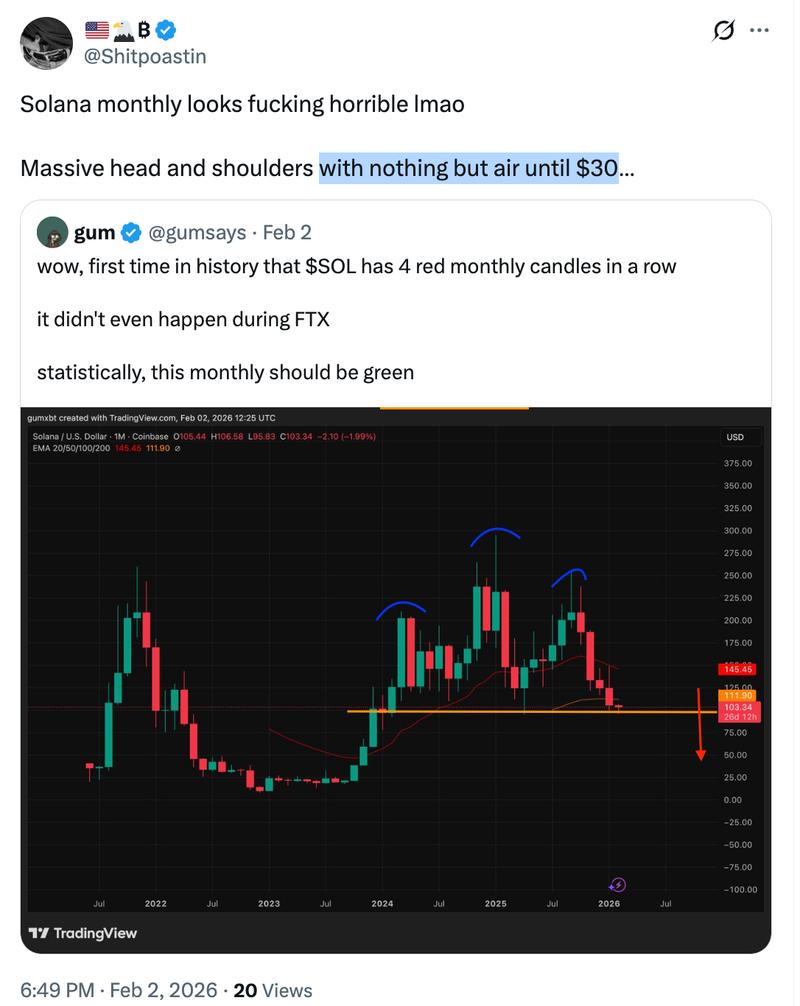

The value of SOL has already declined by more than 72% from its cycle peak of approximately $295 reached in January 2025. Throughout this descent, its price action has validated a head-and-shoulders (H&S) formation across several different timeframes.

Market analyst Bitcoinsensus published a technical chart demonstrating SOL's confirmation of a H&S structure, suggesting additional downward movement lies ahead.

"Solana has confirmed a breakdown from this macro Head & Shoulders pattern," Bitcoinsensus stated in a Monday post on X, adding:

"The target could be as low as $50 per $SOL."

"This is a classic head and shoulders pattern with a measured move to $45," analyst Nextiscrypto said about SOL's two-week chart. However, additional market analysts have indicated the price could descend to even lower levels.

A pseudonymous market observer known as "Shitpoastin" indicated that Solana's price action has also developed a "massive head and shoulders" formation on the monthly timeframe spanning two years, "with nothing but air until $30."

Analysis of the two-day candle chart, in the meantime, demonstrates that SOL's price had breached below the H&S neckline positioned at $120 on Jan. 30.

The projected target derived from the H&S formation, determined by measuring the head's height from the neckline breakdown level, stands at $57, which would represent a 32% decline from the present price level.

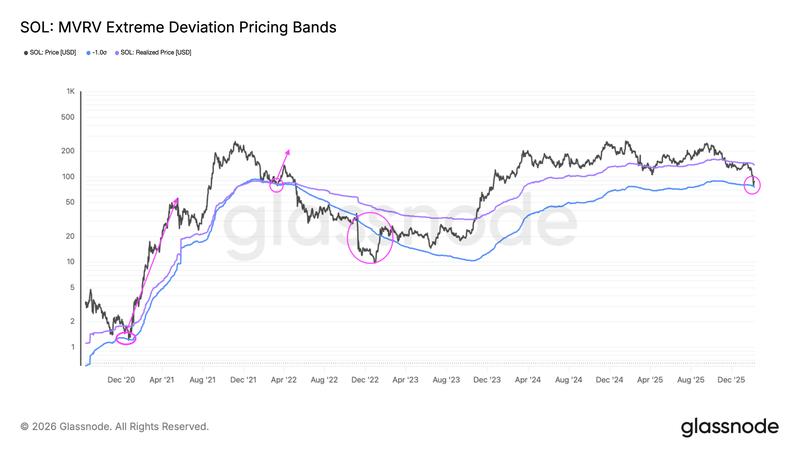

MVRV bands suggest potential Solana bottom formation at $75

The dramatic price decline SOL experienced last week found support at the lower boundary of its MVRV extreme deviation pricing bands, which currently sits at $75.

These technical bands illustrate when SOL is trading below or above the mean price at which market participants most recently transferred their tokens.

According to historical patterns, SOL's price tends to decline toward or sometimes even beneath the lower MVRV band before establishing a market bottom.

This pattern includes the March 2022 recovery, during which the SOL price surged 87% over a three-week period to reach $140 following a test of the lowest MVRV deviation band in the vicinity of $75. A comparable price rebound took place previously in December 2020.

The connection between Solana and the FTX collapse in November 2022, on the other hand, resulted in a substantial deviation beneath this technical band, with the token's price plummeting an additional 70% and forming a bottom near $7 in December that year.

Consequently, SOL's decline beneath $75 could trigger the subsequent phase of the correction similar to what was observed in 2022, potentially corresponding with the H&S price target.