Stellar Network Powers Rails' New Institutional Derivatives Vault Infrastructure

Institutional crypto derivatives platform Rails leverages Stellar's blockchain infrastructure with smart contract vaults, transparent onchain verification, and isolated collateral management to attract institutional participation in high-frequency perpetual futures markets.

On Tuesday, Rails, a provider of crypto derivatives services for institutional clients, revealed the introduction of "Institutional-Grade Vaults" built on Stellar's blockchain infrastructure, enabling brokers, financial technology companies and various intermediaries to access cryptocurrency perpetual futures through a unified backend system. The platform has set its sights on introducing options trading capabilities by the second quarter of 2026.

In an interview with Cointelegraph, Satraj Bambra, the chief executive officer of Rails, explained that the fundamental concept behind the system was creating a separation between order matching and capital custody. "The critical difference is custody and verifiability," he stated.

The Rails platform operates a centralized order matching engine, whereas customer funds will be held within audited smart contract vaults deployed on the Stellar blockchain. Every half minute, profit and loss calculations (PnL), transaction fees and outstanding liabilities are recorded onchain in the form of Merkle roots, enabling institutional clients to perform independent reconciliation against their internal accounting records.

Reducing counterparty risk

A fundamental design principle underlying the system is the assertion that vault-based custody reduces both counterparty exposure and operational risks by creating a firewall between client collateral, market-making capital reserves and Rails' operational treasury.

Bambra positioned this architectural choice as a deliberate response to previous cryptocurrency exchange failures, in which customer assets were commingled in omnibus accounts, forcing clients to rely solely on the platform's internal bookkeeping.

"If they fail, you become an unsecured creditor in bankruptcy," he explained. "This is exactly what happened to FTX customers."

He emphasized that the industry takeaway was unmistakable: "Separate execution from custody," underlining that client funds are maintained within onchain smart contracts instead of appearing on Rails' corporate balance sheet.

Bambra explained that the company selected the Stellar network based on its rapid settlement finality characteristics and its extensive ten-year track record of collaboration with banking institutions, cross-border remittance providers and tokenized asset infrastructure platforms.

"When you are asking institutions to trust smart contracts holding tens of millions in capital, that heritage matters," he remarked.

Per the official announcement provided to Cointelegraph, the platform has facilitated over $3.4 billion in cumulative trading volume since inception. The company operates under registration with the Cayman Islands Monetary Authority (CIMA), though Bambra informed Cointelegraph that Rails had "begun its registration process" with the National Futures Association in the United States.

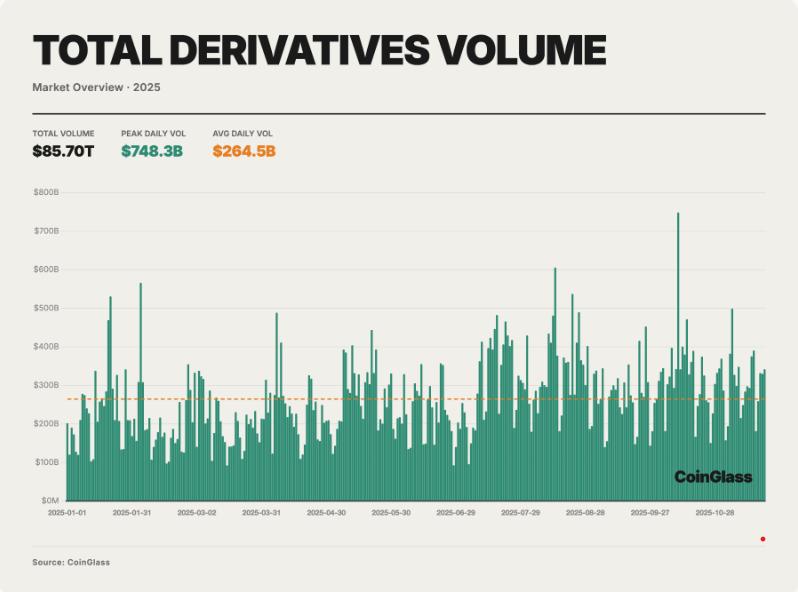

Crypto derivatives hit $85.7T in annual volume

Derivatives markets have rapidly emerged as the dominant arena within cryptocurrency for price discovery mechanisms and risk transfer operations. According to CoinGlass' annual report for 2025, derivatives trading volume reached approximately $85.7 trillion over the year, translating to an average daily trading turnover of approximately $264.5 billion.

These numbers represented unprecedented volume levels and increased open interest depth as institutional market participants increasingly relied on futures and options instruments as their preferred mechanisms for price discovery and risk hedging strategies.

The identical report cautions that increased complexity and extended leverage chains have "elevated systemic tail risks," noting that the deleveraging event in October 2025 demonstrated how vulnerable liquidation mechanisms, auto-deleveraging (ADL) systems and highly concentrated trading venues remain capable of transforming overcrowded trading positions into disproportionate losses that ripple across the entire marketplace.