Spot Bitcoin ETF holdings drop beneath $100B mark amid $272M withdrawal wave

Total assets under management for spot Bitcoin ETFs dropped beneath the $100 billion mark following $272 million in withdrawals, bringing total year-to-date losses near $1.3 billion.

Exchange-traded funds focused on Bitcoin (ETFs) have reached their lowest point in assets under management (AUM) for the year following a succession of substantial outflows.

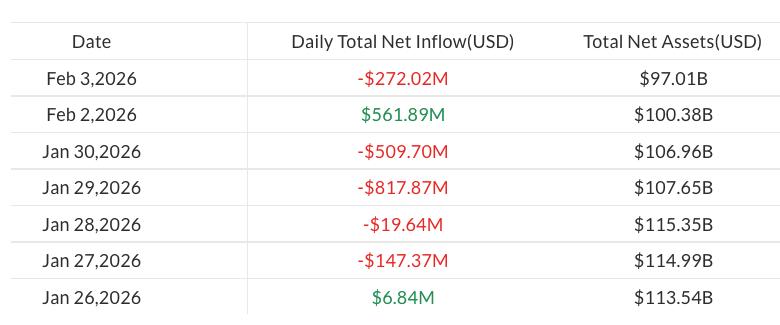

Total holdings in spot Bitcoin (BTC) ETFs dipped beneath the $100 billion mark on Tuesday after experiencing another $272 million in withdrawals, based on statistics from SoSoValue.

This represented the initial occasion that spot Bitcoin ETF AUM had fallen beneath the $100 billion mark since April 2025, following a high point of approximately $168 billion in October.

The decline occurred during a wider cryptocurrency market downturn, with Bitcoin dropping beneath $74,000 on Tuesday. The worldwide cryptocurrency market capitalization declined from $3.11 trillion to $2.64 trillion during the previous week, based on CoinGecko data.

Altcoin funds secure modest inflows

The most recent withdrawals from spot Bitcoin ETFs came after a short-lived recovery in flows on Monday, during which the products drew $562 million in net inflows.

Nevertheless, Bitcoin funds returned to losses on Tuesday, driving year-to-date outflows to nearly $1.3 billion, aligning with persistent market volatility.

In contrast, ETFs monitoring altcoins including Ether (ETH), XRP (XRP) and Solana (SOL) registered modest inflows totaling $14 million, $19.6 million and $1.2 million, respectively.

Is institutional adoption moving beyond ETFs?

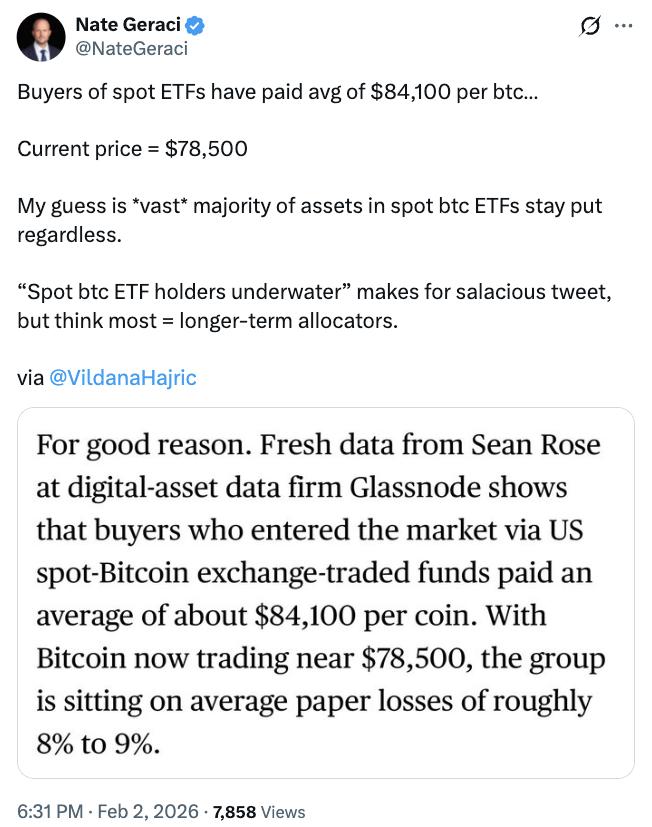

The continuing decline in Bitcoin ETFs arrives as BTC is trading beneath the ETF creation cost basis of $84,000, indicating new ETF shares are being created at a loss and exerting pressure on fund flows.

Market analysts suggest that the downturn is not likely to spark additional mass sell-offs in ETFs.

"My guess is vast majority of assets in spot BTC ETFs stay put regardless," ETF analyst Nate Geraci wrote on X on Monday.

Thomas Restout, CEO of institutional liquidity provider B2C2, shared a similar perspective, observing that institutional ETF investors tend to be resilient. However, he suggested that a transition toward onchain trading could be emerging.

"The benefit of institutions coming in and buying ETFs is they're far more resilient. They will sit on their views and positions for longer," Restout said in a Rulematch Spot On podcast on Monday.

"I think the next level of transformation is institutions actually trading crypto, rather than just using securitized ETFs. We're expecting the next wave of institutions to be the ones trading the underlying assets directly," he noted.