Quantum-Resistant Bitcoin Wallets: Genuine Protection or Fear-Driven Premium?

Bitcoin wallets marketed as quantum-resistant are now available for purchase, forcing crypto holders to determine if they're securing their assets or succumbing to fear-based pricing.

Companies producing cryptocurrency wallets alongside security firms are releasing post-quantum solutions despite the absence of powerful quantum computers that could compromise Bitcoin's security infrastructure.

In 2024, the US National Institute of Standards and Technology (NIST) completed its initial set of post-quantum cryptography standards and urged organizations to complete migrations prior to 2030.

While standards organizations are preparing for a measured cryptographic shift, certain segments of the wallet industry have already begun capitalizing on this anticipated future development.

"My assessment is that this represents somewhat of a fear tax. The reality is that quantum computers remain distant — approximately five to 15 years from being viable," Alexei Zamyatin, co-founder of Build on Bitcoin (BOB), shared with Cointelegraph.

The Bitcoin price currently sits approximately 50% beneath its all-time high achieved in October 2025. Among the various explanations attempting to account for cryptocurrency's recent downturn is an increasing worry that quantum computing threats may be discouraging institutional investment from flowing into Bitcoin.

Quantum threats are neither nonexistent nor imminent

The quantum security concern frequently mentioned involves Bitcoin's Elliptic Curve Digital Signature Algorithm, which validates transactions. Theoretically, a sufficiently advanced quantum computer could extract a private key from a revealed public key and appropriate the funds associated with that address.

Current quantum computing technology lacks the capacity to compromise elliptic curve cryptographic signatures. However, this reality doesn't suggest that malicious entities are idly awaiting a technological advancement.

"A common misconception among users is the expectation of a singular 'Q-Day' event when cryptographic systems abruptly collapse. The truth is that risk builds incrementally as cryptographic foundations deteriorate and vulnerability exposure expands," Kapil Dhiman, CEO and co-founder of Quranium, explained to Cointelegraph.

"Harvest now, decrypt-later tactics are currently operational, which means information and signatures revealed presently are being stockpiled in anticipation of future decryption capabilities," he stated.

For Bitcoin specifically, the primary concern centers on legacy exposed public keys. After a public key becomes visible on the blockchain, it remains permanently accessible. Contemporary address structures keep public keys hidden until funds are transferred.

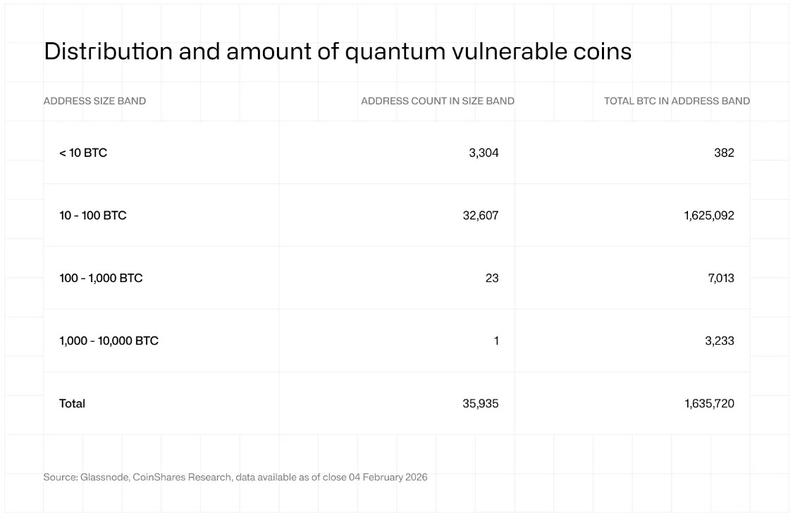

Christopher Bendiksen, a Bitcoin researcher at CoinShares, indicated that merely 10,230 Bitcoin (BTC) reside in addresses with publicly revealed public keys that would be susceptible to an adequately powerful quantum assault.

Monetizing quantum anxiety

As the Bitcoin ecosystem continues debating the timeline for quantum computing threats, cryptocurrency wallet manufacturers are following their independent schedules.

The Safe 7 from Trezor carries "quantum-ready" branding as a hardware wallet solution. In a separate development, qLabs recently unveiled the Quantum-Sig wallet, which purportedly incorporates post-quantum signatures natively into its transaction signing mechanism.

Zamyatin from BOB contended that protections implemented at the wallet layer wouldn't address Bitcoin's fundamental quantum vulnerability. Bitcoin transaction authorization relies on a signature algorithm embedded within the protocol architecture itself. Should that cryptographic system become compromised, remediation would necessitate modifications at the protocol foundation.

"My personal stance is that I wouldn't allocate significant capital toward a quantum wallet at this time because I'm uncertain about the actual protection it provides for Bitcoin. In my view, it cannot truly offer meaningful protection since Bitcoin currently lacks a quantum-resistant signature mechanism."

Ada Jonušė, executive director at qLabs, concurred that comprehensive quantum resistance demands protocol-level implementation. Nevertheless, dismissing contemporary infrastructure developments as merely a fear tax ignores the transitional characteristics of security enhancement processes.

"Quantum threats aren't binary in nature. Even prior to a protocol-level migration taking place, there exists a genuine 'harvest now, decrypt later' danger," she conveyed to Cointelegraph, asserting that qLabs' methodology minimizes the exposed cryptographic key attack surface.

"Achieving quantum readiness involves proactive infrastructure preparation, not exploiting fear for profit," Jonušė emphasized.

Trezor similarly acknowledged that blockchain networks themselves must modify their cryptographic foundations and protocols. But Tomáš Sušánka, the company's chief technology officer, informed Cointelegraph that wallet solutions can deploy protective measures immediately rather than awaiting prolonged blockchain modification processes.

"After blockchains complete their upgrades, wallet software must equally support identical algorithms to maintain compatibility," Sušánka explained. He noted that Trezor Safe 7 employs a post-quantum cryptographic algorithm to defend against future quantum computers fabricating digital signatures and authorizing malicious firmware modifications.

Commercial motivations and Bitcoin's governance challenge

In contrast to iPhones, which see nearly annual releases, hardware wallet devices and comparable security products generally operate on multi-year development and release cycles. Incorporating post-quantum capabilities into a new product provides justification for consumers to purchase an updated device, regardless of how distant the actual threat remains.

"Certainly, segments of the cryptocurrency sector possess incentives to magnify quantum dangers, but that motivation is progressively influenced by regulatory and institutional considerations rather than immediate revenue generation alone," said Dhiman, whose Quranium technology underlies the Qsafe wallet.

"For the majority of users, quantum-secure wallet solutions currently serve as forward-looking insurance. The prudent strategy is to recognize the coming transition, resist urgency manufactured by fear campaigns, and select systems engineered to adapt without necessitating sudden complete replacements."

Multiple blockchain networks are progressing with post-quantum implementation strategies, yet Bitcoin has demonstrated comparatively greater reluctance. Some of the network's most prominent thought leaders have downplayed the threat as a concern for future generations.

In contrast to Bitcoin, Ethereum possesses a broadly acknowledged figurehead. Co-founder Vitalik Buterin has championed post-quantum preparedness initiatives, and the network has been moving progressively in that strategic direction.

For Bitcoin, the central challenge involves achieving social consensus, coordinating stakeholders, and cultivating the collective determination to act, according to Zamyatin.

"The situation differs from having a single individual whose leadership everyone follows. Achieving this will demand extensive social consensus building, which presents considerable difficulty," he explained.

Wallet manufacturers acknowledge that comprehensive quantum defense must originate from protocol-level implementation. However, even if the threat remains years distant, these products can function as insurance helping investors achieve greater peace of mind, though skeptics maintain they constitute a fear-driven premium.