Polymarket Traders Put 72% Probability on Bitcoin Dropping Under $65K

Prediction market data from Polymarket indicates heightened bearish sentiment for Bitcoin in 2026, with analysts citing negative market trends and constrained liquidity in the United States.

A wave of bearish sentiment has swept through prediction markets focused on Bitcoin following a weekend price decline that momentarily sent valuations beneath the $75,000 threshold on Monday.

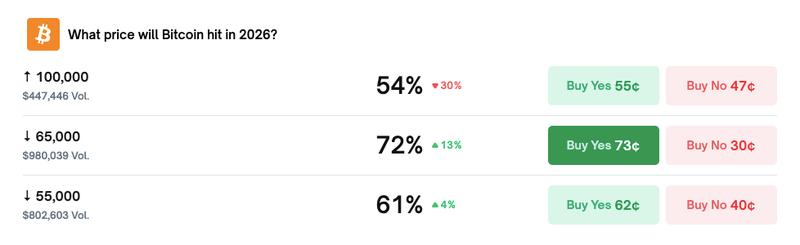

Data from Polymarket reveals that the probability of Bitcoin (BTC) declining beneath the $65,000 level at some point during 2026 has risen to 72% as of Monday, accompanied by trading volume approaching $1 million.

Additional significant wagers on the platform included predictions for BTC sliding below $55,000 and recovering to reach $100,000 before the year concludes, carrying implied probabilities of 61% and 54%, respectively.

The increased volume of bearish wagers indicates a shift in market sentiment. Recent gains accumulated following President Donald Trump's election victory in November 2024 have been completely wiped out.

The price drop also represented a significant milestone for Michael Saylor's Strategy, which holds the distinction of being the world's largest publicly traded Bitcoin holder, as the cryptocurrency's value dipped beneath its average acquisition price for the first time since the closing months of 2023.

Bear market, US liquidity squeeze cited as traders search for reasons behind sell-off

Various market analysts have connected the most recent cryptocurrency sell-off to a wider bearish trend affecting Bitcoin. CryptoQuant has maintained its position that a bear market commenced in November 2025, marking the point when Bitcoin dropped beneath its 365-day moving average.

"Don't try to find bottoms after a new leg down," CryptoQuant head of research, Julio Moreno, said in an X post on Saturday, adding: "Bear market bottoms take months to form."

Quantum Economics CEO Mati Greenspan stated that Bitcoin was not fundamentally designed with price appreciation as its primary objective, characterizing that as a secondary consequence rather than its fundamental function.

"Its main use case is to provide a form of money that is independent of governments and banks," Greenspan wrote on X on Monday.

In a separate analysis, Global Macro Investor founder Raoul Pal attributed the recent downturn to constrained liquidity conditions in the United States rather than issues specific to the cryptocurrency sector.

A potential drop of Bitcoin below $65,000 this year could run counter to forecasts from major investment firms and banks.

Toward the end of last year, Grayscale Investments issued a prediction that Bitcoin could exceed all-time high valuations of $126,000 by June 2026, pointing to institutional demand and improved regulatory clarity in the United States.

Standard Chartered and Bernstein projected Bitcoin would reach $150,000 in 2026, though both had revised earlier, higher targets amid slower inflows into exchange-traded funds (ETFs).

The news came amid Polymarket facing a Nevada court order blocking its event contracts as unlicensed wagering. Other states, including Tennessee, have also recently targeted the platform with enforcement actions.