Personal Customer Information Compromised in Figure Technology Cyberattack

Following a social-engineering scheme targeting a Figure employee, the ShinyHunters hacking group published customer data online after the blockchain firm declined to meet ransom demands.

A cybersecurity incident has struck Figure Technology, a lending platform built on blockchain infrastructure, following what the company describes as a social-engineering attack that compromised one of its workers.

According to a company representative speaking with TechCrunch, the breach enabled unauthorized parties to access "a limited number of files." Figure has initiated the process of informing impacted individuals and is providing complimentary credit-monitoring services to all those who are sent breach notifications.

The company has not publicly revealed specifics regarding the scale of the breach, such as the total number of affected customers or the timeline of when the security compromise was identified. A request for additional information was sent to Figure by Cointelegraph, though no response had been received at the time of this publication.

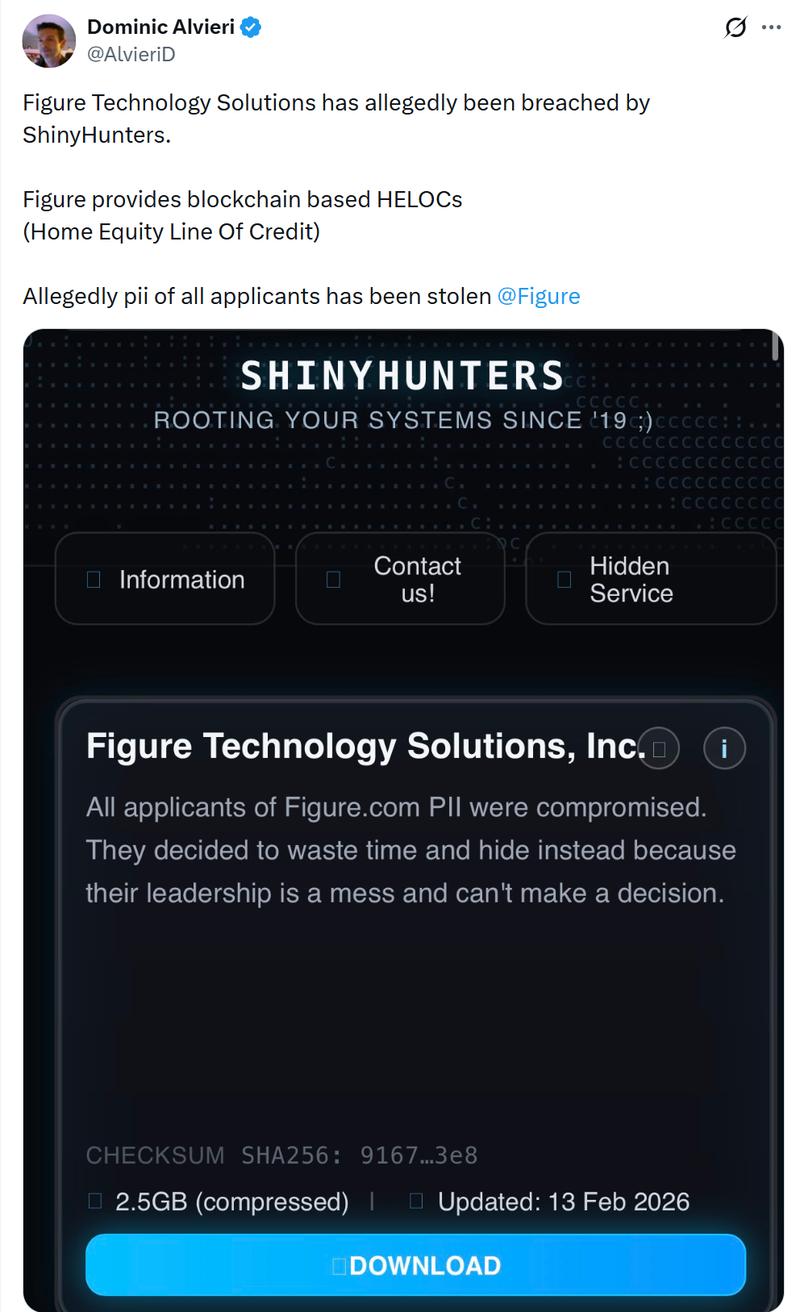

On its dark-web platform dedicated to data leaks, the notorious hacking group ShinyHunters took credit for the attack, stating that Figure refused to comply with ransom demands. The cybercriminal organization released approximately 2.5 gigabytes of information purportedly extracted from Figure's internal systems.

Leaked Figure data includes names, addresses

According to TechCrunch's examination of portions of the compromised information, the exposed data contained customers' complete names, residential addresses, birth dates and telephone numbers. Such personally identifiable information presents significant risks for identity theft schemes and targeted phishing campaigns.

According to previous Cointelegraph coverage, cryptocurrency-focused phishing operations connected to wallet-draining malware experienced a dramatic decline throughout 2025, with aggregate losses decreasing to $83.85 million, representing an 83% reduction compared to the nearly $494 million stolen in 2024, based on data from Scam Sniffer, a Web3 security research company. The victim count similarly decreased to approximately 106,000 individuals, marking a 68% year-over-year drop across blockchain networks compatible with the Ethereum Virtual Machine.

Security analysts emphasized that the reduction in figures should not be interpreted as the elimination of phishing threats. Loss patterns demonstrated strong correlation with cryptocurrency market dynamics, escalating during periods of intensive on-chain transaction activity and declining when trading volumes cooled. The third quarter of 2025, coinciding with Ethereum's most robust price rally, registered the peak losses at $31 million, while monthly figures fluctuated from a low of $2.04 million in December to a high of $12.17 million in August.

Figure Technology goes public

In September of last year, Figure Technology completed its transition to a publicly traded entity, securing a listing on the Nasdaq Stock Exchange. The financial technology company, recognized for its blockchain-powered lending services, set its initial public offering (IPO) share price at $25, successfully raising $787.5 million and establishing an initial market valuation ranging between approximately $5.3 billion and $7.6 billion.

In the previous month, Figure Technology introduced the On-Chain Public Equity Network (OPEN), an innovative platform operating on its proprietary Provenance blockchain that enables companies to distribute genuine equity shares and empowers investors to directly lend or collateralize those shares with other participants, eliminating the need for conventional brokers, custodial services or centralized trading platforms.