Mastermind behind $73M cryptocurrency fraud receives two-decade prison term

Daren Li has been handed a 20-year prison sentence by a United States court for his role as ringleader in a $73 million cryptocurrency pig butchering fraud scheme that victimized American investors.

A citizen holding dual nationality from China and St. Kitts and Nevis has received a 20-year sentence in a United States federal penitentiary for his role in directing a worldwide cryptocurrency fraud operation that siphoned over $73 million from its victims, with a significant portion being American investors.

Daren Li, age 42, was handed the maximum penalty allowed by statute in California's Central District, with an additional three-year period of supervised release to follow, based on a Tuesday announcement from the United States Department of Justice (DOJ).

According to prosecutors, Li worked alongside a minimum of eight additional co-conspirators to create counterfeit domains and websites that mimicked authentic trading platforms, using these to advertise bogus crypto investment opportunities after first winning the confidence of their targets, in what is commonly referred to as pig butchering or phishing fraud schemes.

Documentation submitted to the court reveals that the criminal group frequently made initial contact via social media networks and online dating applications, building what appeared to be professional or romantic connections before convincing their targets to move funds into financial accounts under the group's control.

"The Court's sentence reflects the gravity of Li's conduct, which caused devastating losses to victims throughout our country,"

Assistant Attorney General A. Tysen Duva

Duva further stated that authorities would "work with our law enforcement partners around the world to ensure that Li is returned to the United States to serve his full sentence."

Li represents the initial defendant to receive sentencing in this case. Eight additional co-conspirators have already entered guilty pleas and are currently awaiting their sentencing hearings.

Li confessed that he along with his fellow conspirators deceived victims into moving no less than $73.6 million in assets to banking accounts linked to the defendants, which included $59.8 million flowing through United States shell corporations that served to launder the victims' money.

The sentencing decision arrives over a year following Li's guilty plea to charges of conspiring with others to launder assets obtained from victims via cryptocurrency scams and fraudulent activities, as Cointelegraph documented in November 2024.

The criminal investigation continues to progress and is currently under the direction of the United States Secret Service Global Investigative Operations Center, receiving support from Homeland Security Investigations' El Camino Real Financial Crimes Task Force along with the United States Marshals Service, in addition to several other federal agencies.

Cryptocurrency fraud schemes experience revival as 2026 begins

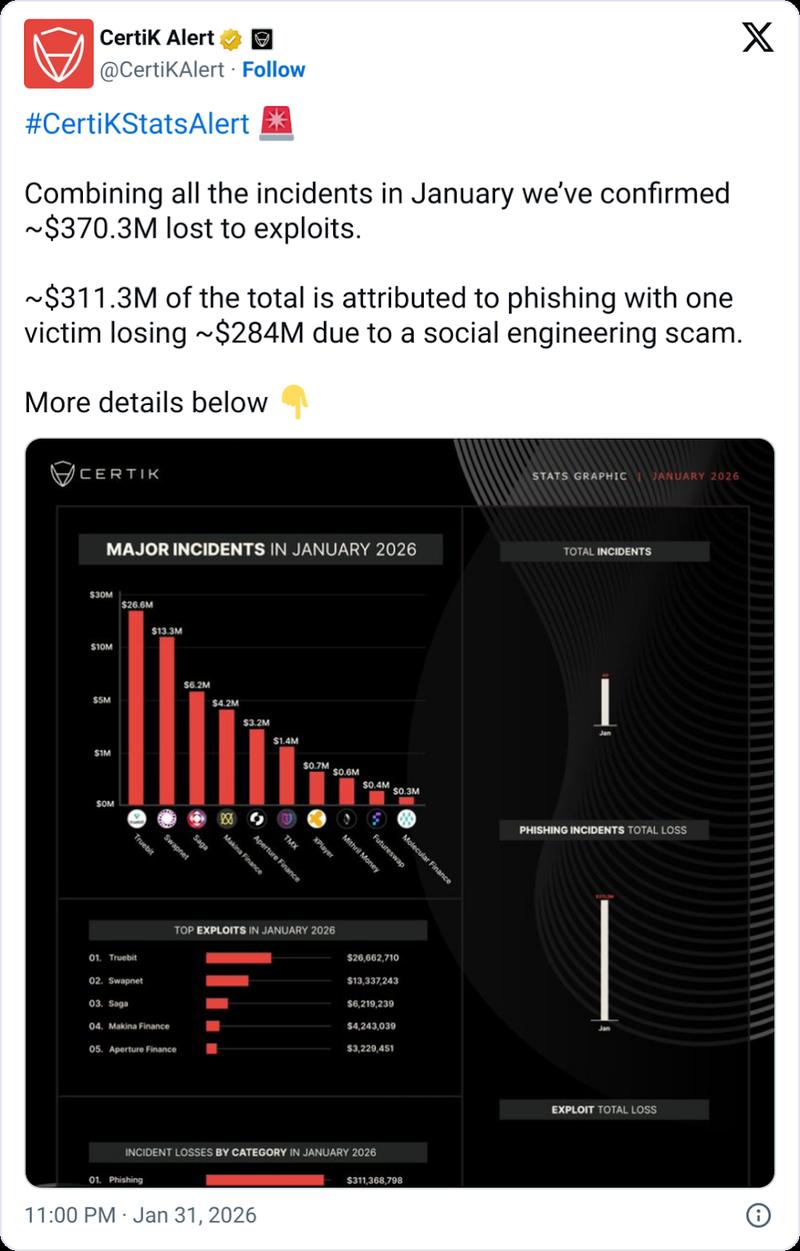

Cryptocurrency fraud and phishing attacks experienced a notable surge during January, with fraudsters successfully stealing $370 million, representing the highest monthly total recorded in 11 months, based on data from crypto security firm CertiK.

Significantly, $311 million of that overall amount was linked to phishing fraud operations, following an incident where a single victim suffered losses of approximately $284 million as a result of an especially destructive social engineering fraud attack.

The $370 million figure represented the most substantial monthly loss recorded since February 2025, during which attackers successfully obtained approximately $1.5 billion in overall value stolen, with the vast majority stemming from the $1.4 billion Bybit exchange security breach.