Major Bitcoin Holders Acquire 40K BTC During Drop to $60K

Large Bitcoin holders and institutions signal renewed buying interest, though analysts warn of potential downside pressure with BTC potentially retesting the $66,000 level.

On Monday, Bitcoin (BTC) surged 17% to approach the $70,000 mark, recovering from its lowest point in 15 months below $60,000, driven by large holders capitalizing on reduced prices through strategic accumulation.

Key takeaways:

- Major holders capitalized on the decline to $60,000, accumulating a minimum of 40,000 BTC.

- Downside pressure persists for Bitcoin as purchasing momentum struggles to breach the $72,000 threshold.

Large Bitcoin holders accumulate 40,000 BTC amid price decline

Market observers have identified strategic positioning by major holders, with data indicating their significant contribution to the recent BTC price bounce.

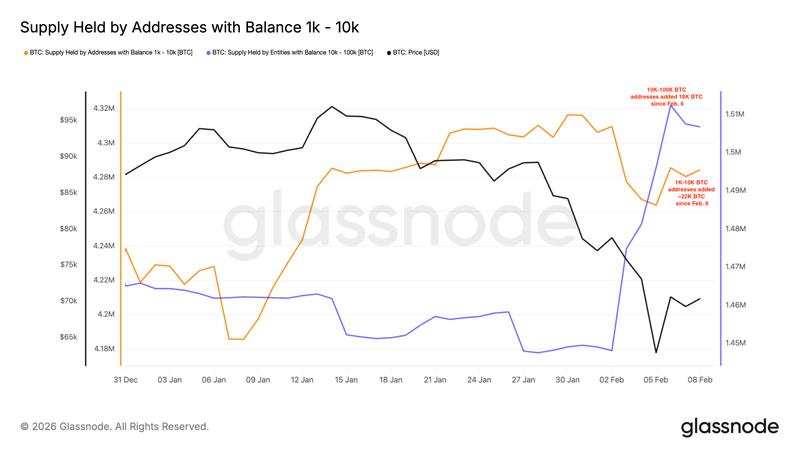

Large holders have been acquiring substantial quantities of Bitcoin throughout the recent decline, accumulating approximately 40,000 BTC, based on data from Glassnode.

Data visualization below demonstrates that wallets containing 1,000-10,000 BTC have increased their holdings by 22,000 BTC starting Friday, whereas wallets holding 10,000-100,000 BTC purchased approximately 18,000 BTC during the identical timeframe.

Following the accumulation by major holders, Bitcoin experienced a 20% surge to $72,000 from the 15-month bottom below $60,000 that occurred on Friday.

Additional buying pressure from Binance's Secure Asset Fund for Users (SAFU) contributed to Bitcoin's upward momentum, with the fund acquiring an additional 4,225 BTC valued at $300 million.

Currently, the SAFU BTC wallet contains 10,455 BTC valued at $731 million, with approximately $239 million remaining for conversion.

According to Cointelegraph's reporting, participants in US-based spot Bitcoin ETFs also purchased during the price reduction, with $331 million entering these investment vehicles on Friday.

Major holders unable to sustain BTC price beyond $72,000

During January, Cointelegraph documented comparable behavior when large Bitcoin holders accumulated 56,000 BTC after a price retreat to $84,000. This accumulation was followed by a 16% increase in Bitcoin's value to its year-to-date peak at $96,000.

Nevertheless, this accumulation proved insufficient for maintaining the upward movement as the BTC/USD trading pair plummeted more than 38% down to $60,000.

A comparable pattern may be emerging in the near term following price rejection at the resistance boundary of an ascending triangle formation at $72,000.

The technical analysis below indicates that the price faces the risk of breaking beneath the triangle's support trendline, which would suggest a potential continuation of the bearish trend.

The initial level to monitor is the $66,000-$68,000 support range, which aligns with the current position of the 200-week EMA.

However, while certain analysts maintain that Bitcoin has yet to establish a genuine bottom, Christopher Inks, founder of TexasWest Capital, stated that "the path of least resistance for Bitcoin at the moment is up or sideways, not new lows."

"We didn't get the Bitcoin weekly close back in the range at $75K or higher," Inks stated in a Monday publication on X, further adding:

"We want to see the low holding for the next 2-3 weeks with declining volumes on the pullbacks."

The analyst's commentary addressed the weekly support level at $66,000, which AlphaBTC suggests the price will probably revisit before any significant upward movement can occur.

According to Cointelegraph's coverage, Bitcoin may establish a "real bottom" near the $50,000 level in a scenario mirroring the 2022 bear market.