Hyperliquid's HYPE surges 20% following prediction markets approval

The development team HyperCore backing the Hyperliquid decentralized exchange has announced backing for proposal HIP-4, which aims to bring prediction markets to the network.

On Monday, HYPE experienced a double-digit percentage increase following an announcement from HyperCore, the foundational infrastructure team responsible for operating Hyperliquid's layer-1 blockchain, confirming their backing of the HIP-4 initiative aimed at introducing prediction market capabilities to the platform.

The proposed integration would enable completely collateralized contract trading on Hyperliquid, which currently stands as the leading decentralized platform for perpetual futures trading in cryptocurrency, giving users the ability to place bets on outcomes ranging from political electoral contests to sporting events and additional market categories.

Through a statement shared on X during Monday, Hyperliquid indicated that their decision to back the proposal stemmed from "extensive user demand" for access to prediction market features and bounded instruments resembling options, further noting that implementing HIP-4 has the potential to facilitate the development of other innovative applications utilizing the Hyperliquid infrastructure.

Outcomes under the HIP-4 framework would operate similarly to a traditional betting slip featuring a maximum payout limit, with settlement occurring within predetermined boundaries and without incorporating leverage mechanisms, liquidation events, or margin call requirements.

According to Hyperliquid, the outcomes trading functionality remains a "work in progress" at this stage and is presently undergoing testing exclusively within the testnet environment. The primary markets utilizing this feature would be priced in Hyperliquid USDH (USDH), which serves as Hyperliquid's proprietary stablecoin.

Following the announcement, Hyperliquid (HYPE) experienced a 19.5% price increase, reaching $37.14, building upon its impressive 46.9% growth trajectory observed throughout the preceding month even as the wider cryptocurrency market experienced declining values, according to information from CoinGecko.

This planned integration would merge two of the cryptocurrency industry's most popular applications from the past 24 months, as both decentralized perpetual futures trading and blockchain-based prediction market platforms are now regularly processing daily trading volumes measured in hundreds of millions of dollars.

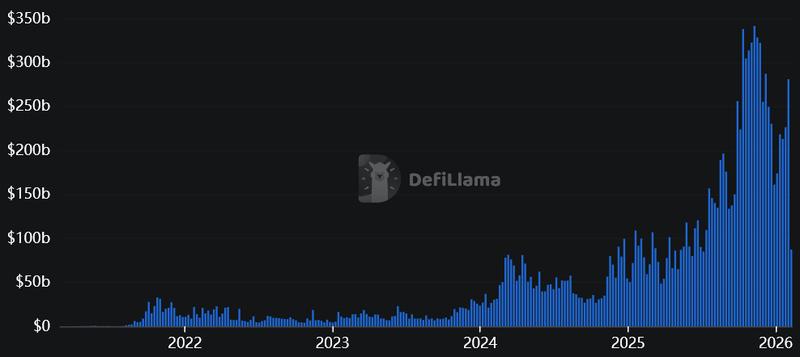

Perps trading volume still over $200 billion weekly

Trading volume for perpetual futures has experienced a decline from its peak levels observed in early November following the achievement of a record-breaking $341.7 billion during the period spanning Nov. 3 through Nov. 9, however weekly trading activity has maintained levels exceeding $200 billion throughout each of the previous four complete weeks, based on statistics provided by DeFiLlama.

The weekly volume figures recorded throughout the most recent month continue to represent volumes approximately three to four times greater than the trading activity levels documented during January 2025.