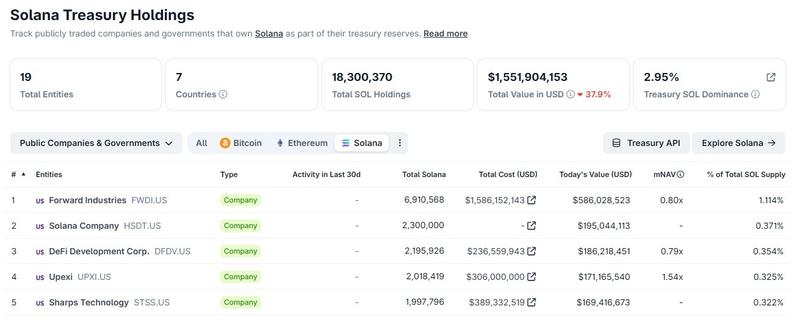

Corporate SOL Holdings Face Unrealized Losses Exceeding $1.5 Billion

Firms with substantial Solana token reserves accumulated during 2025 have halted further acquisitions while stock markets reassess valuations of SOL-laden corporate treasuries.

Corporations trading on public exchanges that maintain Solana within their treasury reserves are currently holding unrealized losses surpassing $1.5 billion, according to analysis of publicly disclosed purchase prices compared against present market valuations compiled by CoinGecko.

These losses are primarily held by a compact cohort of companies listed in the United States that together possess more than 12 million Solana (SOL) tokens, representing approximately 2% of the cryptocurrency's total circulating supply. Although these losses have not been realized through sales, stock markets have already adjusted valuations for these firms, with the majority now trading substantially beneath the current market worth of their digital asset holdings.

According to CoinGecko's data, Forward Industries, Sharps Technology, DeFi Development Corp and Upexi are collectively responsible for more than $1.4 billion in publicly reported unrealized losses. The actual aggregate figure may be higher, given that Solana Company has not provided complete transparency regarding its purchase costs.

These statistics underscore an expanding divide between losses on paper and actual liquidity concerns. Although none of these corporations have been compelled to liquidate their SOL positions, diminished net asset value (mNAV) multiples combined with declining stock valuations have limited their capacity to secure additional financing.

Accumulation stalls across Solana treasuries

Blockchain transaction records aggregated by CoinGecko reveal that the majority of SOL token purchases took place during the period spanning July through October 2025, when multiple corporations executed substantial, concentrated acquisitions.

Following that period, none of the five largest Solana treasury holders have announced significant additional purchases, with no blockchain-recorded disposals identified either.

Forward Industries, holding the largest position, amassed more than 6.9 million SOL tokens at an average acquisition price of approximately $230. With SOL currently trading near $84, Forward is experiencing unrealized losses exceeding $1 billion.

Sharps Technology executed a singular $389 million acquisition close to the cryptocurrency's price peak. The firm's SOL position currently holds a value of approximately $169 million, representing a decline of more than 56% relative to its initial purchase price.

DeFi Development Corp pursued a more incremental buying approach and has disclosed comparatively smaller losses, though its stock continues to trade beneath the market value of its SOL reserves.

Solana Company, which established a 2.3 million SOL treasury through multiple separate purchase transactions, has similarly suspended accumulation activities since October, based on CoinGecko's transaction records.

Equity markets signal a treasury winter

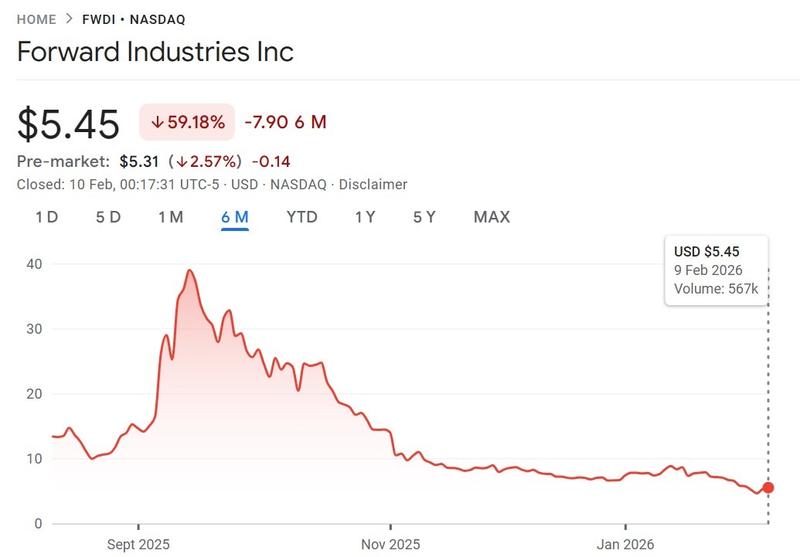

Stock price information sourced from Google Finance demonstrates that the five leading Solana treasury corporations have experienced significant declines over the past six months, substantially underperforming the price movement of SOL itself.

The share prices of Forward Industries, DeFi Development Corp, Sharps Technology and Solana Company have declined between 59% and 73% according to six-month performance charts.

Data from CoinGecko indicates that Upexi is carrying $130 million in unrealized losses across its SOL token holdings. Nevertheless, its equity value has experienced a steeper decline compared to other companies in this category.

Upexi's share price has dropped more than 80% throughout the preceding six-month period, per Google Finance data. Similar to other firms maintaining Solana treasury positions, Upexi has discontinued additional token purchases since September.