BTC rebounds to $76K level, yet indicators point to continued price weakness

Market indicators and price data build a compelling case for Bitcoin's fragile market foundation, pointing toward the possibility of further downside movement.

On Wednesday, Bitcoin (BTC) climbed to $76,900, representing a 4.5% increase from the 15-month bottom of $72,860 that was established on Tuesday. Despite this recovery, mounting evidence suggests the digital asset may face a more substantial price decline in the coming weeks or months.

Key takeaways:

- Multiple time frame analysis reveals Bitcoin's confirmation of bearish technical formations, creating risk of further decline to the $60,000 level.

- The Puell Multiple indicator for Bitcoin may remain within discount territory for an extended period, signaling potential downtrend continuation.

- Significant BTC deposits flowing into Binance might give bearish traders ammunition for additional price weakness.

Technical chart analysis points to prices below $60,000

On its weekly timeframe, the BTC/USD trading pair has validated a head-and-shoulders (H&S) formation, serving as a warning signal for additional downside movement.

Saturday saw the price decline beneath the H&S formation's neckline positioned at $82,000, setting the stage for continued bearish momentum with a calculated objective of $52,650.

Should this scenario unfold, it would result in total depreciation of 31% from present levels, while the drawdown from the record peak of $126,000 would reach 58%.

According to cryptocurrency analyst BitcoinHabebe, the descent of Bitcoin toward the H&S formation's objective at $60,000 appeared "obvious," given numerous macroeconomic challenges.

Meanwhile, other market observers have projected even more bearish targets. Analyst 0xLanister described the H&S configuration as a "very scary picture" in a Wednesday X platform post, stating:

"Bitcoin price will drop to $40,000."

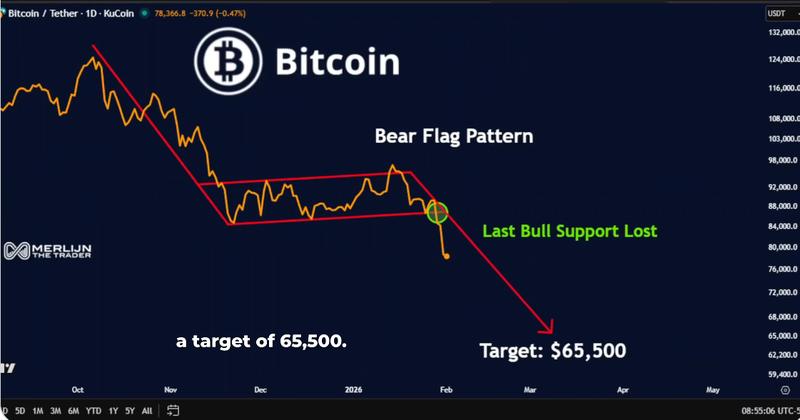

Market participants have additionally identified the validation of a bear flag formation on the daily timeframe following the loss of critical price support zones.

Analyst Merlijn Trader noted in a recent X post that "Bear flag confirmed on Bitcoin," after the final support level at $78,000 was breached, further commenting:

"Next liquidity magnet is $65,500."

According to Cointelegraph's previous coverage, Bitcoin's downward trajectory could extend to levels as low as $58,000 given the current absence of catalysts capable of reversing the prevailing trend.

On-chain metric signals "continuation of bearish trend"

Based on the Puell Multiple indicator, which measures miners' daily revenue relative to their yearly average, Bitcoin appears to have entered "accumulation" phase. The metric has continued its descent into discount territory after Bitcoin's most recent plunge to 15-month lows beneath the $73,000 mark.

CryptoQuant analyst Gaah noted in a Tuesday QuickTake analysis that "The indicator has been in this range for at least three months, since November 2025."

According to Gaah, the typical duration for the indicator to stay within the discount zone spans approximately 200 days, with the analyst noting:

"We are halfway through the period, indicating a continuation of the bearish trend in price BTC."

Depressed price levels also indicate that Bitcoin mining operations continue facing challenges with diminished revenue streams. This situation could serve as the "perfect fuel for small entrepreneurs in the sector to shut down machines and capitulate to cover expenses," according to Gaah's further analysis.

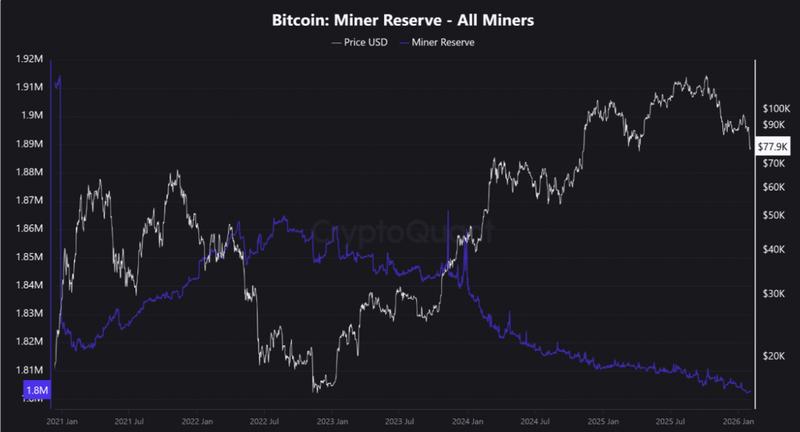

Declining miner reserves provide evidence of this trend, having decreased continuously over the previous four years to reach 1.8 million BTC at current measurement.

"If price continues to decline, this effect intensifies, increasing pressure to sell miners' reserves."

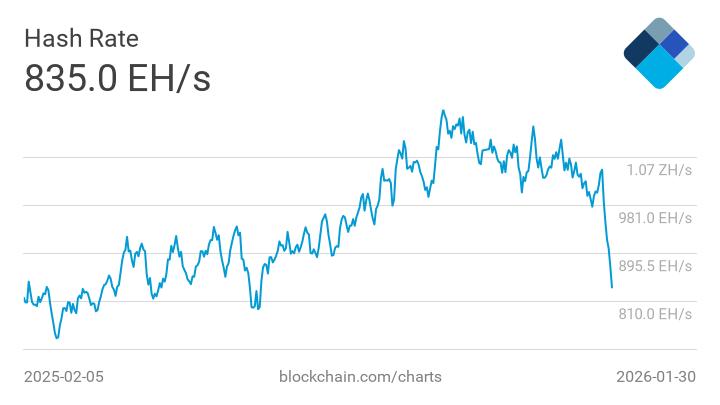

Furthermore, the total network hash rate for Bitcoin has experienced a 12% reduction from its November 2025 peak levels, marking the most significant drop observed since 2021, which indicates potential miner capitulation may be occurring at present price levels.

Substantial BTC deposits to Binance trigger concerns

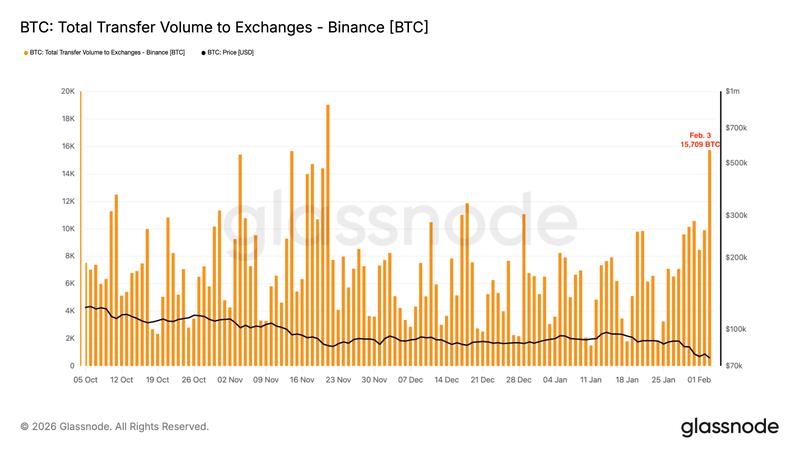

According to on-chain tracking data, daily BTC transfers to Binance reached 15,709 coins on Tuesday, marking the highest level observed since Nov. 21, 2025. Historical patterns show that comparable inflow spikes, including the one documented in November, have typically preceded significant downward price movements.

This dramatic increase indicates that cryptocurrency holders are actively positioning to reduce risk exposure, or capitulate entirely, in the aftermath of Bitcoin's breach below crucial support thresholds.

CryptoQuant analyst Darkfost stated in a Wednesday X platform post that "BTC inflows trigger FUD as selling pressure builds on Binance," referencing the substantial volume of Bitcoin transfers to the exchange during Monday and Tuesday's trading sessions.

Darkfost elaborated that "Over those two days, between 56,000 and 59,000 BTC were sent to Binance, representing a real selling pressure on the spot market," before adding:

"This suggests that we are entering a phase of capitulation and panic as BTC becomes oversold, a context that has historically often allowed for the formation of a bottom, both in the short term and over longer horizons."

As the market works to establish price support above the $74,000 level, the expanding inventory accumulating on Binance presents a concerning factor for bullish traders. The current recovery attempt may prove fleeting until this surplus supply finds adequate absorption.