Bitcoin's Risk-Adjusted Returns Plunge to Historic Bear Market Territory

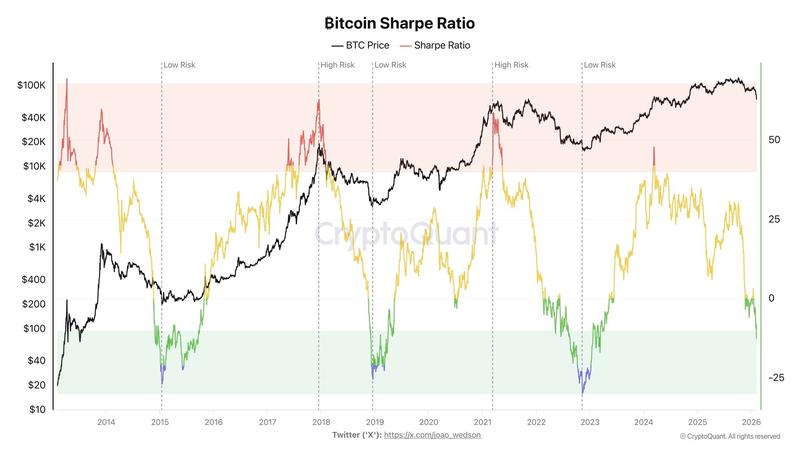

The cryptocurrency's Sharpe ratio has plummeted to -10, mirroring the depths witnessed during 2018 and 2022 bear cycles, indicating that risk-adjusted returns have reached historically extreme territory.

According to CryptoQuant analyst Darkfost, the Sharpe ratio for Bitcoin, a key metric for evaluating risk-adjusted performance, has descended into negative levels typically correlated with the concluding stages of bear market cycles.

In a Saturday post on X, the analyst noted that "The Sharpe ratio has just entered a particularly interesting zone, one that has historically aligned with the final phases of bear markets."

The analyst clarified, though, that this development does not necessarily indicate the bear market has concluded, "but rather that we are approaching a point where the risk-to-reward profile is becoming extreme."

Data from CryptoQuant reveals that the Sharpe ratio has declined to -10, marking its most depressed reading since March 2023.

This metric evaluates Bitcoin (BTC) returns in relation to the associated risk, demonstrating the potential return an investor might anticipate for every unit of risk undertaken.

Negative ratio signals market turning point

The metric registered even lower readings during the late 2022 to early 2023 timeframe, as well as from late 2018 to early 2019 — both intervals representing the lowest points of their respective bear market cycles. In November 2025, when BTC reached a local bottom at $82,000, the metric dropped to zero.

According to the analyst, from a practical standpoint, "the risk associated with investing in BTC remains high relative to the returns recently observed."

"The ratio is still deteriorating, showing that BTC's performance is not yet attractive compared to the risk being taken," the analyst elaborated.

Nevertheless, they noted that a negative Sharpe ratio typically indicates potential market inflection points.

"But this type of dynamic is precisely what tends to appear near market turning zones. We are gradually approaching an area where this trend has historically reversed."

True reversal could be months away

The analyst warned that this current phase "may last several more months, and BTC could continue correcting before a true reversal takes place."

In a Monday market analysis, analysts from 10x Research also conveyed a cautious outlook, noting:

"While sentiment and technical indicators are approaching extreme levels, the broader downtrend remains intact. In the absence of a clear catalyst, there is little urgency to step in."

Bitcoin plummeted to $60,000 on Friday before staging a recovery to $71,000 by Monday. Despite this rebound, the cryptocurrency remains down 44% from its October peak of $126,000, with sentiment continuing to reflect bear market conditions, according to analysts.