Bitcoin's Lightning Network Tested With Historic $1M Institutional Payment

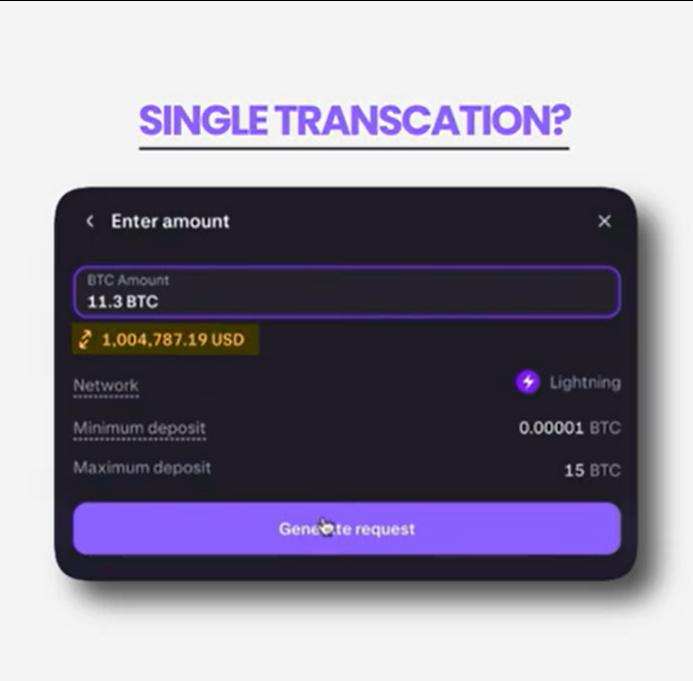

SDM and Kraken executed a groundbreaking $1 million transfer via the Lightning Network to evaluate if Bitcoin's primary scaling solution can support institutional-level, seven-figure transactions.

Secure Digital Markets (SDM), an institutional-grade trading and lending platform, announced that it successfully transmitted a payment worth $1 million to the cryptocurrency exchange Kraken through the Lightning Network on Jan. 28.

In a statement provided to Cointelegraph on Thursday, SDM asserted that this represents the highest publicly disclosed Lightning transaction on record and serves as a demonstration of feasibility for moving seven-figure sums between regulated financial entities.

The transaction was completed in just 0.43 seconds and traveled through Voltage's managed Lightning infrastructure platform, which offers node management services, liquidity that's pre-provisioned, and uptime guarantees specifically designed for cryptocurrency exchanges and institutional trading desks.

The prior publicly announced "record" for a single payment milestone stood at approximately 1.24 Bitcoin (BTC), valued at around $140,000 during that period, which underscores how uncommon six-figure Lightning payments are, not to mention a clean seven-figure transfer executed in a single transaction.

Graham Krizek, CEO of Voltage, characterized the transaction as an "important moment for Lightning and for institutional Bitcoin payments," explaining that a Lightning transfer of $1 million demonstrated the "its ability to meet enterprise requirements."

Lightning metrics remain small, but growing

This transfer occurs amid a landscape of fluctuating Lightning metrics. The capacity held in public Lightning channels declined from more than 5,400 BTC in the final months of 2023 to approximately 4,200 BTC by the middle of 2025, only to recover and reach a new all-time high capacity exceeding 5,600 BTC by December.

This remains a relatively modest pool of capital when measured against Bitcoin's overall market value, and the majority of documented activity has been weighted toward smaller-value payments.

Cryptocurrency exchange Bitfinex, to cite one example, had for an extended period capped Lightning deposits at 0.04 BTC prior to recently raising those limits to 0.5 BTC per individual payment and 2 BTC per channel.

Fidelity and Blockstream see institutional potential

Fidelity Digital Assets, which released a 2025 report on Lightning that utilized data from Voltage, made the case that the Lightning Network not only strengthened Bitcoin's practical utility but simultaneously reinforced its value proposition as an investment.

According to Fidelity's findings, average Lightning capacity had grown by 384% since 2020, with the firm adding that the network represented a "transformative opportunity for both new and existing financial institutions."

Blockstream, an infrastructure company centered on Bitcoin development, advanced a comparable narrative in its quarterly update for Q4 2025.

The firm spotlighted Core Lightning releases that prioritized latency reduction and Lightning Service Provider (LSP) support, and promoted its Greenlight platform as a solution enabling apps, exchanges and services to integrate trust-minimized Lightning functionality while bearing minimal infrastructure burden, accompanied by an explicit roadmap targeting enterprise-focused Lightning deployments.