Bitcoin and US Dollar Liquidity Face Uncertain Outlook Following Trump's Federal Reserve Pick: Analysis

Market experts suggest Kevin Warsh's appointment to lead the Federal Reserve presents both challenges and opportunities for digital assets, with potential liquidity constraints balanced against favorable rate policies.

President Donald Trump's selection of Kevin Warsh to head the Federal Reserve has created an ambiguous outlook for digital currency markets and US dollar liquidity, potentially prolonging the ongoing market consolidation phase.

The nomination of the Bitcoin-supportive Warsh was announced by Trump on Friday, with the appointee poised to take over from Jerome Powell upon the conclusion of his term in May, pending Senate confirmation.

The appointment of Warsh may indicate the Federal Reserve's continuation of its current path toward reducing interest rates. However, as noted by Thomas Perfumo, who serves as global economist at the Kraken cryptocurrency exchange, the nomination also suggests that overall market liquidity is likely to "stabilize rather than meaningfully expand."

In his statement to Cointelegraph:

"This sustains the mixed macro backdrop for Bitcoin and crypto, which are sensitive to overall liquidity conditions, perhaps moreso than changes to the Fed Funds Rate."

Market participants might find themselves let down by Warsh's "skeptical posture on balance sheet expansion," Perfumo elaborated, referring to tools such as quantitative easing — a monetary policy approach that encompasses purchasing bonds to reduce the cost of borrowing and encourage economic growth.

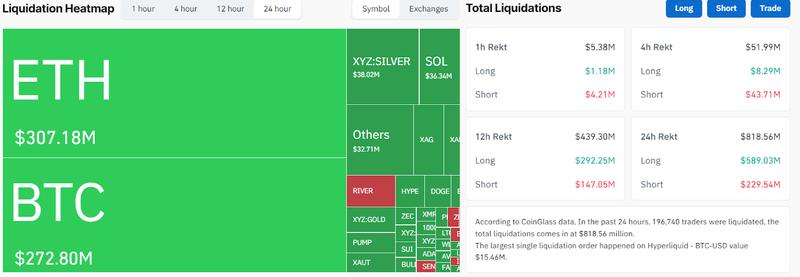

These observations follow closely on the heels of digital asset markets experiencing a $250 billion reduction in total market capitalization throughout the weekend, occurring as part of a broader market downturn that also affected equity markets and precious metal valuations.

Well-known market commentator Raoul Pal identified the shortage of US liquidity as the primary catalyst driving the cryptocurrency and stock market downturn, as opposed to developments specific to the crypto sector, as Cointelegraph previously reported on Monday.

Warsh's appointment and liquidity worries triggered market downturn: Puckrin

The nomination of Warsh sparked anxiety among market participants regarding liquidity availability, serving as the principal driver behind the decline across cryptocurrency, equity, and precious metal markets, according to Nic Puckrin, who serves as investment analyst and co-founder of the Coin Bureau educational platform.

"Markets are digesting Warsh's views on future Fed policy – most notably the central bank's balance sheet, which he says is 'trillions larger' than it needs to be," the analyst told Cointelegraph, adding:

"If he does indeed adopt policies to shrink the balance sheet, markets will have to reckon with a lower-liquidity environment – a backdrop that isn't supportive of either risk assets or precious metals."

Nevertheless, uncertainty persists regarding Warsh's approach to interest rate management and the degree to which he is "willing to align himself" with Trump's advocacy for reduced interest rates, Puckrin noted.

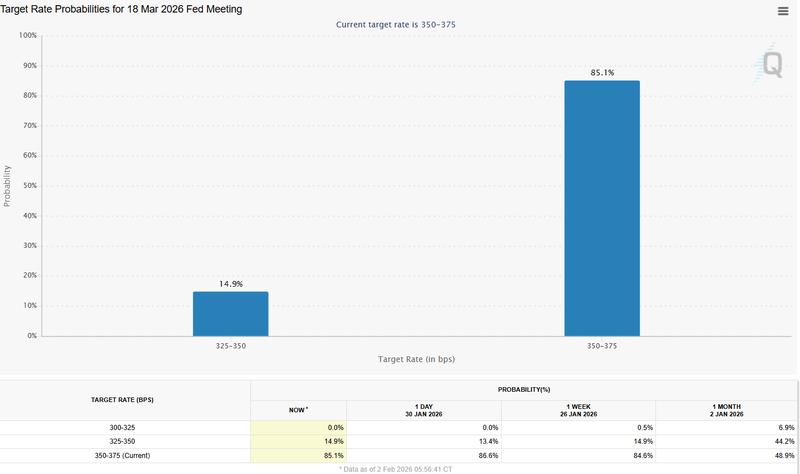

Market projections regarding interest rate movements have shown minimal variation following Warsh's nomination announcement, with 85% of market observers anticipating rates will hold steady during the upcoming March 18 meeting, based on information from the CMEGroup's FedWatch tool.

Forecasts for interest rate policy decisions also show consistency looking ahead to the June 17 meeting, where 49% of participants expect a 25 basis-point reduction in interest rates, representing an increase from the 46% recorded during the previous week. This date would represent the first Federal Open Market Committee gathering following the expiration of Powell's term in May.