A New Kind of Crypto Winter? Industry Experts Reassess Bitcoin's Position

Institutional investors withdrawing from crypto markets may be fueling the current downturn, with digital assets still carrying excessive risk for traditional finance players.

Analysts tracking Bitcoin's performance suggest that the latest downward price movement could actually be evidence of the cryptocurrency's growing penetration into institutional portfolios, though these traditional players continue to view it as anything but a safe-haven investment.

Cryptocurrency markets have faced challenging conditions over the past several months. Following Bitcoin's October peak of more than $120,000, the leading digital currency has experienced a steady decline. The most recent weeks have witnessed a particularly steep drop, with monthly losses exceeding 25%.

As the market correction unfolds, industry watchers have sought to understand the underlying causes. Matt Hougan, who serves as Bitwise's chief investment officer, pointed to the well-known four-year market cycles that have historically characterized cryptocurrency price fluctuations as a potential explanation for the decline.

Alternative perspectives, including commentary from a governor at the United States Federal Reserve, suggest that recent market behavior demonstrates institutional risk aversion and that Bitcoin has not yet achieved its aspirational position as the digital equivalent of gold.

Bitcoin continues to be perceived as high-risk, "not digital gold"

The entry of institutional capital into Bitcoin and cryptocurrency markets may actually be contributing to the recent market downturn. Although large financial institutions possess substantial capital for crypto market deployment, their tolerance for risk falls well below that of individual retail participants, and Bitcoin continues to be widely categorized as a high-risk investment vehicle.

United States Federal Reserve Governor Chris Waller addressed this dynamic during remarks at a monetary policy conference held on Monday. According to Waller, much of the excitement surrounding cryptocurrency that emerged alongside President Donald Trump's new administration is now dissipating.

"I think there was a lot of sell-off just because firms that got into it from mainstream finance had to adjust their risk positions."

Galaxy Digital CEO Mike Novogratz voiced similar observations on Tuesday during a CNBC interview, noting that the cryptocurrency sector has attracted "institutions where people have a different risk tolerance."

"Retail people don't get into crypto because they want to make 11% annualized ... They get in because they want to make 30 to one, eight to one, 10 to one."

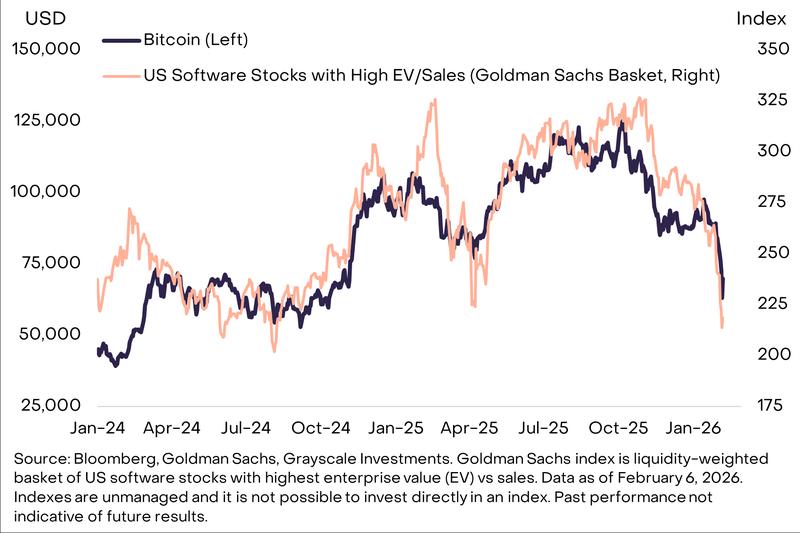

In a research publication, digital asset manager Grayscale observed that Bitcoin's recent price behavior shows stronger correlation to high enterprise value software equities than to traditionally stable stores of value such as gold. According to the investment firm, near-term price fluctuations have demonstrated weak correlation with gold and other precious metal commodities.

Mike McGlone, a commodity strategist at Bloomberg and well-known Bitcoin skeptic, maintained that Bitcoin remains fundamentally speculative in nature. "[Bitcoin] has proven it's neither digital gold nor leveraged beta," he said, adding, "It's a highly speculative [number]-on-the-screen tracking nothing with unlimited competition."

Despite these concerns, Grayscale expressed more positive sentiment regarding Bitcoin's future trajectory. "The network will likely continue operating well beyond our lifetimes and the asset may retain its value in real terms ... in a wide range of outcomes for the economy and society," it said.

The firm additionally emphasized the crucial role that institutional participants will play in determining the asset's future success, noting this depends heavily on achieving regulatory clarity, which remains elusive in the United States.

Stalled progress on CLARITY legislation creates uncertainty

The CLARITY Act, currently being deliberated in the US Senate, would fundamentally restructure cryptocurrency regulation throughout the nation, including which agencies hold authority over rules governing decentralized finance (DeFi) protocols.

Progress on the legislation has ground to a halt over recent weeks as cryptocurrency industry leaders such as Coinbase clash with banking sector lobbyists regarding stablecoin interest payments: a fundamental component of the exchange's revenue model that traditional banks worry could undermine financial system stability.

According to Waller, Congress's inability to swiftly enact crypto market structure legislation has contributed to market uncertainty. "The lack of passing of the CLARITY Act I think has kind of put people off on this," he said.

Novogratz similarly stressed the potential market impact of the legislation. He indicated that both Democratic and Republican lawmakers are committed to passing the bill and that "we need it for spirit back in the crypto market."

In its analysis, Grayscale highlighted the significance of both CLARITY and the GENIUS Act, with the latter having been enacted in July 2025. The firm noted that "improving regulatory clarity for the crypto industry is a structural trend much bigger than one piece of legislation."

Enhanced regulatory frameworks will catalyze expanded applications in "stablecoins, tokenized assets, and other applications of public blockchain technology," which will subsequently "drive value to blockchain networks and their native tokens."

Senior-level negotiations aimed at resolving the CLARITY impasse are presently ongoing. On Tuesday, representatives from both the cryptocurrency and banking sectors convened at the White House for another private discussion.

Stuart Alderoty, Ripple's legal chief, stated, "Compromise is in the air. Clear, bipartisan momentum remains behind sensible crypto market structure legislation."

At the same time, market analysts continue debating how far Bitcoin prices might fall during this bear market cycle. Kaiko Research provided Cointelegraph with a research memorandum suggesting that the $60,000 level could represent a "halfway point."

"Analysis of on-chain metrics and comparative performance across tokens reveals a market approaching critical technical support levels that will determine whether the four-year cycle framework remains intact," Kaiko said.

McGlone characterized $60,000 as merely a "speedbump on the way back down" to $10,000, citing multiple factors. Among these are a purported shift in cryptocurrency interest away from digital assets toward stablecoins and the probability that "cheer-leader and chief, President Trump, will be a lame duck this time next year."

A pro-cryptocurrency president operating under lame-duck status may encounter significant obstacles in implementing desired changes through Congressional channels. Whether the cryptocurrency industry will obtain the regulatory clarity necessary to fully engage institutional capital remains an open question.