2025 Witnessed Crypto Venture Capital Funding Surge to Double as Real-World Asset Tokenization Dominated

A comprehensive data-driven analysis from Cointelegraph Research examines cryptocurrency venture capital trends, focusing on investment patterns, sectoral shifts and evolving strategies among investors.

The most recent analysis from Cointelegraph Research delivers a comprehensive perspective on cryptocurrency market fundraising conditions and the primary venture capital trends that characterized 2025. Venture capital allocations to Web3 startups experienced a twofold increase in 2025 compared to the previous year, propelled by institutional participation, especially within the RWA sector, which accumulated over $2.5 billion in capital. Additionally, there was a notable rise in mergers and acquisitions (M&A) activity alongside other substantial corporate financing initiatives.

The state of crypto venture capital (VC) in 2026

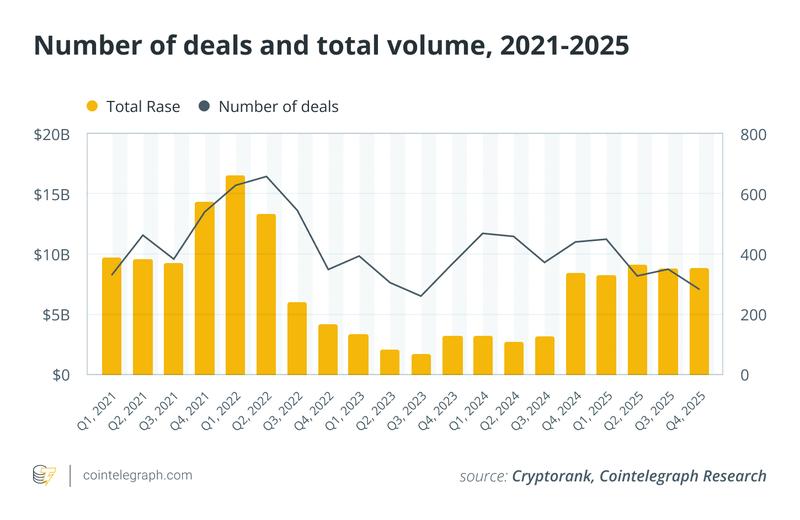

Throughout 2025, venture capital deployment into cryptocurrency startups surpassed $8 billion each quarter for the first time since 2022. Aggregate funding during 2025 climbed to over $34 billion, representing double the $17 billion figure documented in 2024. Despite this growth, 2025 can still be characterized as a risk-off year, given that investors showed preference for bonds and safe-haven instruments, including precious metals, which delivered outstanding returns that year, against a backdrop of geopolitical tensions and sustained elevated interest rates.

The diminished risk tolerance among venture capital investors also transformed perspectives on cryptocurrency business models. Throughout 2025, fund managers placed greater emphasis on sustainable revenue frameworks, genuine user engagement metrics and robust product market fit rather than projects demonstrating early momentum with constrained revenue prospects. This transformation was evidenced by the transition from pre-seed and seed funding rounds toward later-stage financing activities. Seed-stage capital decreased by 18%, whereas Series B funding grew by 90%. This pattern demonstrates more substantial investor commitment to projects and an enhanced concentration on ecosystem maturation rather than early-stage exploration.

The trending narrative: Real-world assets (RWA)

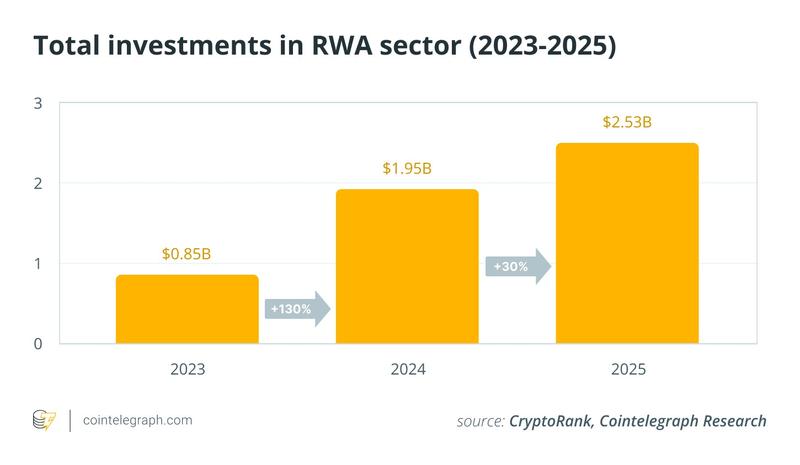

RWA tokenization has evolved from a conceptual narrative into an emerging sector throughout the last three years. Based on data from RWA.xyz, tokenized real-world assets have crossed a capitalization threshold of $38 billion, representing a 744% increase from $4.5 billion in 2022. RWAs have become one of the most rapidly expanding segments within the cryptocurrency market, trailing only stablecoins. Notwithstanding this expansion, the crypto RWA sector continues to be modest in comparison to $156 trillion in fixed-income and $146 trillion global equities markets. This reality points to considerable potential for additional growth.

From the investment perspective, the initial indicators of this transformation are evident in the evolution of annual funding data. Throughout 2025, VC funding directed toward RWA tokenization projects surpassed $2.5 billion.

Fading narrative for Ethereum layer 2s and modular infrastructure projects

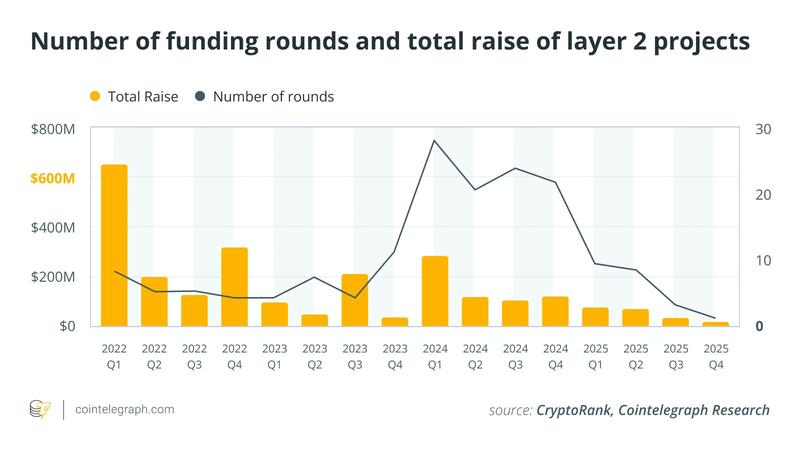

Although overall VC interest throughout the cryptocurrency market grew during the year, specific narratives demonstrated clear indications of deterioration. During 2022, Ethereum layer 2 projects secured over $1.2 billion, subsequently followed by $387 million in 2023 and $587 million in 2024. Throughout 2025, funding descended to a low point of $162 million, marking a 72% decline from 2024.

This decline was likely precipitated by the accelerated expansion of layer-2 blockchains, which has resulted in an increasingly congested landscape and a reduction in VC enthusiasm for this technology. Given that the quantity of L2 chains swiftly expanded beyond 50, the requirement for blockspace reached saturation levels.

We would like to thank Canton Foundation, CryptoRank, DWF Labs, Everest Ventures Group, Mercuryo, and RWA.xyz for contributing data, insights, and opinions to this report.